CS. With Las Bambas deal secured in Chinese hands and Pascua Lama and CITIC rumours still circling in the industry, another industrial group from China is searching the Globe for the best Copper projects left. We have discussed before, that M&A activity in this case signifies the very important bottom in the mining cycle.Barrick Gold talks with Newmont Mining in Gold and Las Bambas purchase by Minmetals Group in Copper.

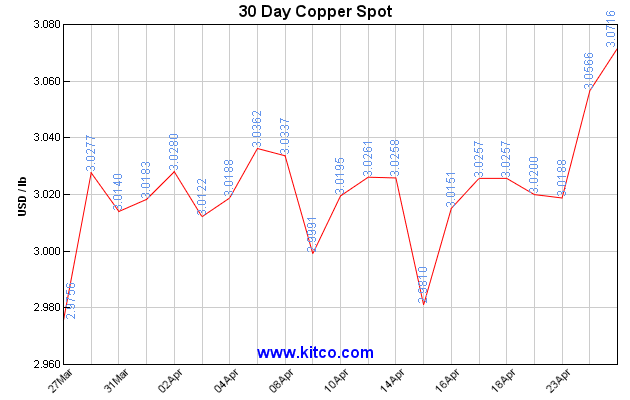

Western Central Banks are anxious with "the lack of Inflation" - all "official" Inflation measures in US (if you are not eating, paying insurance or rent) are dangerously low, if you consider the unprecedented amount of the freshly printed money in the system. ECB is talking about the new "whatever-it-takes" war on Deflation and Copper is sensing the upcoming change already. Prices of Copper are up last week.

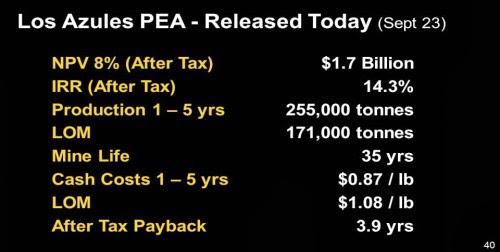

With this report from China Los Azules Copper is very well positioned to bring the Catalyst to TNR Gold and McEwen Mining. Rob McEwen is talking about it as "One of the best Copper projects in the world" and industry's M&A activity will bring it on the investors radar screens again.

Las Bambas Purchase Shows China Is Still in the Hunt for Copper MUX TNR.v LCC.v CU

"We have narrowed it down from the Wall Street headline: the best Copper projects are going to those who can think about the economic development with the long term view. We have been discussing Las Bambas Sale for quite a while here and other our stories could be coming to fruition now as well. Security of supply is the major issue during the next stage of the Rising Power and Chinese companies are scooping the Globe for the best projects available."

Copper M&A: Glencore Xstrata Close to Sale of Its Las Bambas Peruvian Copper Project MUX TNR.v LCC.v

"According to the report China is closing the next mega deal in the resource sector in order to secure the supply of strategic commodities. This time it is copper. Another Chinese company - China National Gold is reported to be in talks with Ivanhoe on DRC Copper mine. We guess that the end of the world will be postponed again and China is using any opportunity to buy the real assets at the cheapest price possible. China is executing the state-level plan to diversify its reserves out of US Dollar and is buying assets in Gold, Copper and Lithium. We have mentioned before the rumours about Barrick Gold being in talks over its huge Pascua Lama with CITIC from China and are monitoring the sector for the conformation.

Rumour Mill: "CITIC Buying Into Pascua Lama" - Can Argentina Mining Really Make Its Come Back? TNR.v MUX ABX LCC.v

"Is this rumour too good to be true for the proud people of Argentina? Can Argentina ever make its come back in mining? On the one hand we have still the very strong perception of the high political risk and on another hand we have reports from the ground about the changing environment in the country:

"Situation in Argentina is changing for the better with recent developments on Repsol compensation. Goldcorp was talking about "Argentina issues easing" and Pan American Silver CEO has recently sated:"Meanwhile, when asked by an analyst to comment on the future of the Navidad project, PanAm CEO Geoff Burns said he sees signs of noted improvement "in our operating environment and in the attractiveness of making investments" in Argentina.Rob has mentioned as well that Argentina is changing for the better now: "Profits are coming out of the country now and political change will happen within next one and a half years. We have very large Los Azules Copper project in Argentina. Last year large projects went out of favour, we are sitting on it now. Copper prices are above 3 dollars now and we had the new PEA last Fall. It is our source of liquidity in the future.""There was a new chief of cabinet installed…now a couple of months ago," he observed. "And he certainly seems to be driving a more business-friendly environment, or at least, pushing for a more business-friendly environment."

"I was down there [in Argentina] just a couple of weeks ago, and I would say I am more optimistic than I have been in the last couple of years about the future of Argentina and the future of mining investment in Argentina," Burns advised."

The reports provided on the links below are suggesting that this particular move by Barrick Gold could not be so far fetched: company has confirmed that it is working on strategic partnerships on Pascua Lama and that partners from China are of a particular interest for the company. Argentinean government has even organised negotiations with Chile in order to bring Pascua Lama project back to life. We will not rush ahead to the conclusions and will wait for the official confirmations about these talks, but the trend is quite apparent for the industry insiders and we had discussed it before.

After the bidding war for Las Bambas Copper in Peru there are not so many world class copper assets left. M&A activity in Copper sector is heating up with ongoing deals on Glencore's Las Bambas, Hudbay's acquisition and OZ Minerals talks with potential partners. Now the projects like Los Azules copper will get more industry attention. We are following McEwen Mining and TNR Gold involved in this project, please read carefully all our disclaimers and do your own DD, as usual.

"TNR Gold is still the sleeping beauty: company holds shares in McEwen Mining after the settlement on Los Azules and Back-In right into Los Azules Copper project in Argentina. Among other assets TNR Gold holds 100% of Shotgun Gold project in Alaska with first resources announced last year and strategic stake in International Lithium."

TNR Gold Insiders report: CEO And CFO Buying Shares.

Among other beneficiaries of improved investment climate in Argentina we should name Lumina Copper with its Taca Taca copper deposit and International Lithium developing Mariana Lithium brine project with its strategic partner Ganfeng Lithium.

We will closely monitor the situation with these developments around Pascua Lama and you can find additional information for your research on the links below.

More."

South China Morning Post:

Chinalco Mining Sets Sights On Copper Projects in Latin America

Metal unit keen on copper projects in Peru with its huge potential and friendly environment

Peng Huaisheng shrugs off the impact from Peru's suspension order on the output of Chinalco Mining's Toromocho project. Photo: Nora Tam

Chinalco Mining, the non-ferrous and non-aluminium metals unit of aluminium giant Chinalco, is seeking acquisition opportunities in Latin America for copper projects with long-term return rates of more than 10 per cent.

Chief executive Peng Huaisheng said the region presented more development potential, especially Peru, where the company has been developing the Toromocho copper project since 2007.

Peru has a strategy to catch up with Chile in mining development

PENG HUAISHENG, CHINALCO MINING

"Our understanding is that Peru offers greater potential within Latin America," he said. "Peru has a strategy to catch up with Chile in metals and mining development, so it provides an overseas-investor-friendly investment environment."

Chile is the world's largest producer and resource holder of copper, which is used widely in the power distribution and construction sectors. China imports about 70 per cent of its raw copper ore needs.

Hong Kong-listed Chinalco Mining's US$3.5 billion Toromocho project, about 140 kilometres from Lima, started trial commercial production in December.

But power shortages, caused by a three-month delay in power connection, meant the company had to first process ore with lower copper content than originally planned. This caused the firm to slash in December its output target for this year to between 120,000 and 150,000 tonnes from 190,500 tonnes.

In March, heavy rainfall resulted in muddy water being discharged from the project's quarry mine to a lake. Peru's Ministry of Environment ordered on March 28 the project to stop operation for alleged non-compliance with environmental laws relating to water discharge. After building a water tank to collect rainfall and a draining system, the ministry allowed production to resume on April 11.

Peng said the suspension would not hinder the project from achieving the revised output target since it was not expected to reach full capacity utilisation until the third quarter.

He said his firm was "surprised" by the suspension order, but he would not comment when asked if he thought foreign and domestic firms had been treated differently on similar issues.

In July last year, Chinalco Mining decided to use US$120 million from its initial public offering proceeds, originally for acquisitions, towards phase two expansion of Toromocho.

The US$1.32 billion expansion will be 80 per cent-financed by bank loans and will raise annual output capacity by 45 per cent to 310,000 tonnes when completed in the first half of 2016."

Please Note our Legal Disclaimer on the Blog, including, but Not limited to:

There are NO Qualified Persons among the authors of this blog as it is defined by NI 43-101, we were NOT able to verify and check any provided information in the articles, news releases or on the links embedded on this blog; you must NOT rely in any sense on any of this information in order to make any resource or value calculation, or attribute any particular value or Price Target to any discussed securities.

We Do Not own any content in the third parties' articles, news releases, videos or on the links embedded on this blog; any opinions - including, but not limited to the resource estimations, valuations, target prices and particular recommendations on any securities expressed there - are subject to the disclosure provided by those third parties and are NOT verified, approved or endorsed by the authors of this blog in any way.

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advice on this blog and there is no solicitation to buy or sell any particular company.