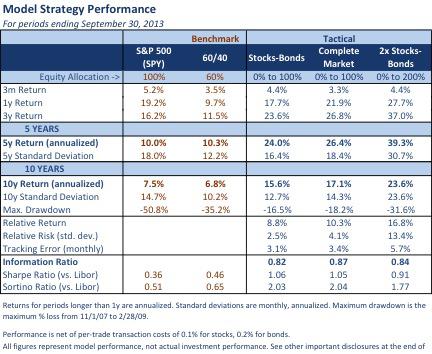

- In Q3-2013, our two Stocks-Bonds strategies achieved 4.4% return, outperforming their 60/40 benchmark by 0.9%. The Complete Market strategy underperformed somewhat, with 3.3% return.

- In the past 12 months, relative performance over the 60/40 benchmark ranged from 8.0% (for Stocks-Bonds) to 18% (for 2xStocks-Bonds).

- Over a ten-year simulation period, the strategies outperformed by a minimum of 8.8% (for Stocks-Bonds), while reducing downside risk - by half in the case of the two un-levered strategies.

All Model Capital Management's tactical strategies started Q3-2013 with 100% equity allocation to the S&P 500 (SPY). The allocation moved to all-bonds in mid-July, then back to all-equities in September. This was based on the return forecasts for the S&P 500 by our PAR Model™ turning negative to -1.0% in mid-July. By forecasting 6-month return for equities, the model is designed to help avoid major market declines. However, the August drop in U.S. equities proved to be short-lived. The PAR Model™ correctly identified that as well, and turned back to positive 2.4% forecast on August 31st based on continued strong real estate market factors, and improved valuation ratios. So far, this bullish turn by the model proved to be accurate as the S&P 500 rose by 3.2% in September.

Figures represent model performance, not performance for any client portfolio or account. Actual performance may vary depending on timing of account transactions, fees, expenses and other factors.

Q3 ended up being challenging for tactical investing as bonds, typically a safe investment, were hurt by rising interest rates. During the 1.5 months that our portfolios were allocated to 7-10 year corporate bonds (LQD), their price dropped by 2.0% (see chart below). This contributed to Q3 performance being respectable at 4.4%, but not as high as we would have expected based on the precise forecasting by our equity model. The Complete Market strategy underperformed the other portfolios, with 3.3% return. While the allocation to Mid-Cap equities (IJH) helped its performance, the substantial allocation to the Mortgage REIT index ETF (REM) hurt. REM ended roughly flat for the quarter after the 3.5% quarterly dividend.

Q3-2013 Price Returns

12-month performance continues to be exceptional for all strategies. The period started with the PAR Model's™ 10.1% 6-month return forecast for the S&P 500 at the end of September 2012, which continued to increase, culminating in a 19.2% 6-month forecast in November. This was hard to believe at the time but proved to be incredibly accurate - the S&P returned 16.3% over the following six months.

All strategies were fully invested in stocks from the beginning of the 12-month period, and the 2xStocks-Bonds strategy was invested in 2x-levered (SSO) position for as long as the model's forecast stayed above 5%. The all-stock allocations lasted until our March 15, 2013 report, when we changed to the 60/40 benchmark allocation.

Disclosure: I am long SPY.