Duke Energy (DUK) made significant news recently with the resigning of new CEO right at the closing of the merger with Progress Energy. The news was mind blowing considering the deal with shareholders, regulators, and consumers was that Bill Johnson from Progress Energy would run both companies with former Duke Energy CEO Jim Rodgers moving up to Chairman.

How does this impact the stock? Outside of political and regulatory noise, it shouldn't honestly have a huge impact. Utilities are complex businesses, but it only takes a solid operator to run them. Jim Rodgers will have no problem running the merged entity. In fact, Jim Cramer remained bullish on the stock especially considering the stock price drop.

2012 Post Merger Earnings Guidance

The bigger concern should be the lack of earnings growth and limited growth in the future. The combination created the country's largest utility as measured by enterprise value, market capitalization, generation assets, customers and numerous other criteria.

If that doesn't speak of industry low growth, not sure what else would.

The combined companies should be able to wring out overlapping costs, but the stock already trades at a rich valuation to the 2012 guidance of $4.20 to $4.35. At $66, Duke trades close to 15x the expected numbers for 2013.

Dividend Yield

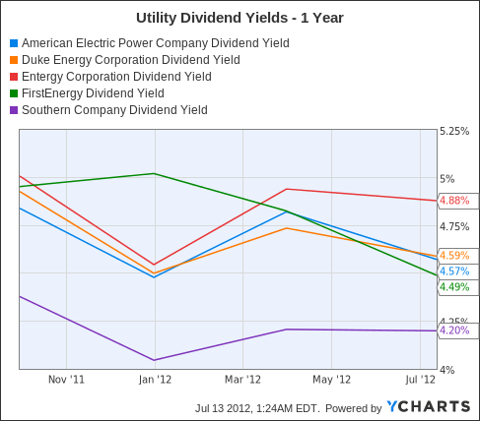

In general the stock isn't that appealing as the 4.6% dividend yield is relatively low for a company expecting limited 4 to 6% earnings growth mostly coming from cost savings.

The sector as well isn't that exciting though several stocks offer either higher dividend yields or faster growth that would be more attractive over Duke. The below figure has a list of dividend yields over the last year.

AEP Dividend Yield data by YCharts

Worth noting is that the typical yield in the sector has trended down over the last year from closer to 5% to the current 4.5%.

Conclusion

While investors are getting a better yield on these utility stocks than Treasuries, the general populace has become too complacent on the sector after strong total returns recently. These aren't risk free investments after all.

Considering the extra risks and scrutiny in Duke Energy right now and the inevitable slower growth of being the largest utility, investors will be better served in American Electric Power (AEP), Entergy (ETR), FirstEnergy (FE), or Southern Company (SO).

Disclosure: I am long ETR.

Additional disclosure: Please consult your financial advisor before making any investment decisions.