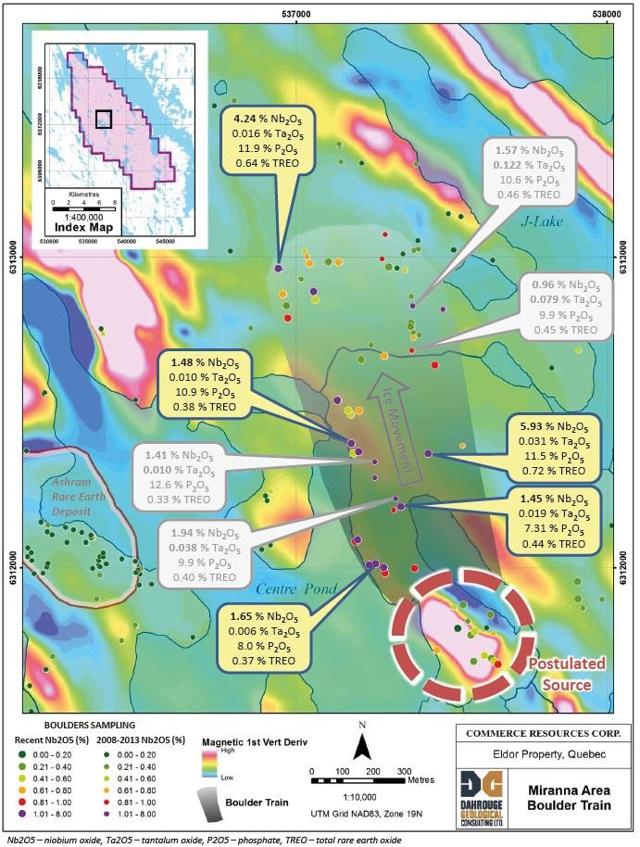

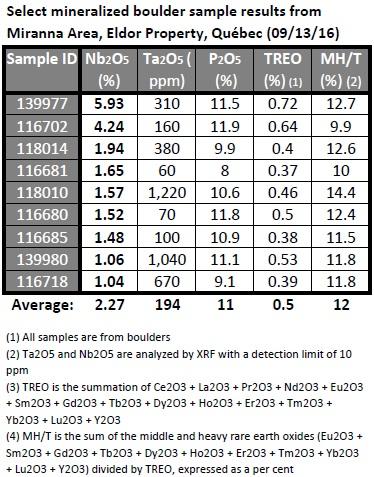

Last week, Commerce Resources Corp. (TSX.V: CCE) (OTCQX:CMRZF) reported sampling assays from the Miranna Area, located only 1 km east of its Ashram REE Deposit in Québec. The best results include 5.9% and 4.2% niobium pentoxide (Nb2O5). The 9 selected samples reported by Commerce averaged 2.3% Nb2O5. Of all 64 samples, 40 assayed >0.5% Nb2O5, with 16 surpassing 1%. Sampling also found significant grades of tantalum, phosphate and rare earth oxides (2 samples each graded >1,000 ppm Ta2O5 and 1% Nb2O5, while several samples revealed >10% P2O5).

When comparing these niobium grades with the range of global average mining grades of about 0.5 to 1.5% Nb2O5, and the average grades of niobium exploration projects, Commerce Resources indeed has every reason for being enthusiastic.

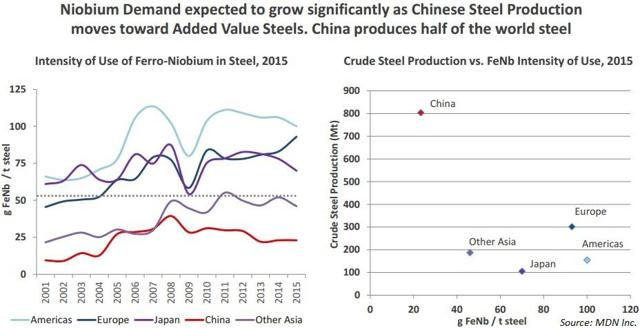

Niobium focused juniors seem to be enjoying a recent lift in share prices and market valuations potentially due to positive demand growth for niobium for structural steel for infrastructure projects, as well as for the current lighter and stronger chassis for cars. MDN Inc. (MDNNF) has recently seen its' share price appreciate by almost 400% following the announcement of their acquisition of the James Bay Niobium Project, called the Argor Project, which has an historic indicated resource with a grade of 0.52% Nb2O5.

Last year, NioCorp Developments Ltd. (NIOBF) (originally structured by Zimtu Capital Corp.) (OTCPK:ZTMUF) reported an average indicated resource grade of 0.71% Nb2O5 assuming a 0.3% cut-off grade at its Elk Creek Niobium Deposit in Nebraska, USA. Today, NioCorp enjoys a market valuation exceeding $150 million CAD.

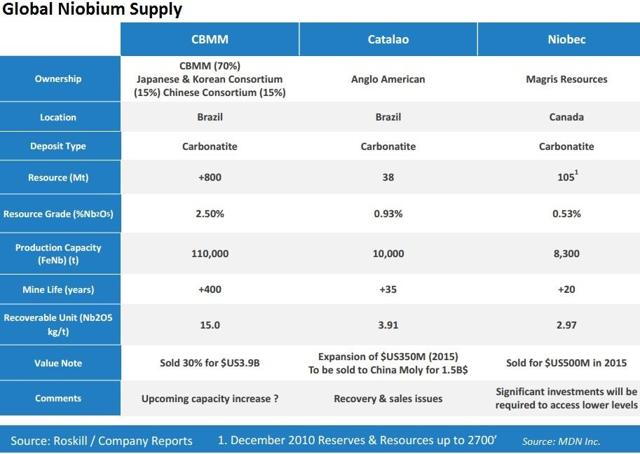

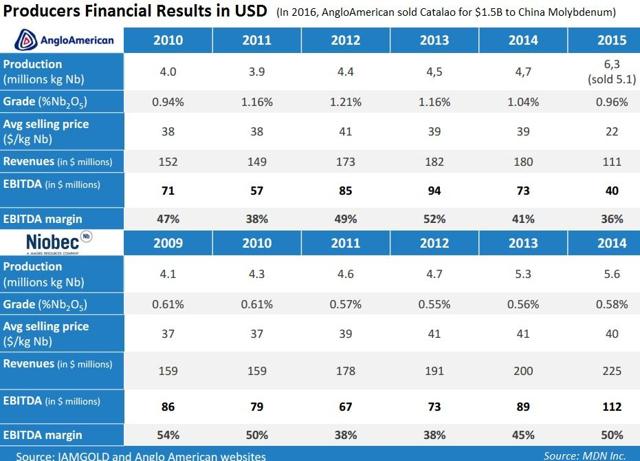

With a market share of about 90%, Brazil is the world's largest producer of niobium, followed by Canada. Brazil has the world's largest niobium reserves (98.5%), followed by Canada (1%) and Australia (0.5%). Brazilian niobium reserves total about 840 million t of Nb2O5, with an average grade of 0.73%. The 2 Brazilian niobium mines are Araxá (owned by private company CBMM) producing about 85% of the world's niobium with resource grades of about 2.5% Nb2O5 and Catalão (owned by China Molybdenum) producing about 7% of the world's niobium with reserve grades of about 1.2% Nb2O5 (resources at 0.93% Nb2O5).

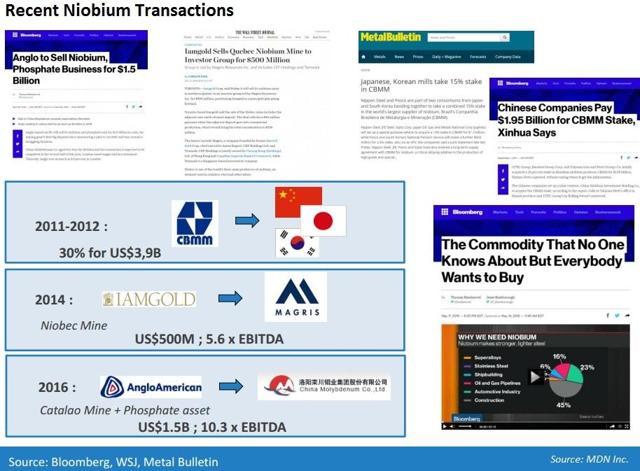

The third largest producer is the Niobec Mine in Québec (owned by private company Magris Resources) accounting for about 7% of global niobium mine output, with resource grades at 0.53% Nb2O5. Magris purchased Niobec from IamGold (IAG) for $500 million CAD in January 2015. Market insiders believed this was a signal that infrastructure building was back on the horizon and that niobium demand would be positively affected.

Most of the current exploration, development, and operating mines for niobium have gradesbetween 0.3% and 1.2% Nb2O5, apart from the world's largest and highest grade niobium mine, Araxá in Brazil, with resource grades of 2.5% Nb2O5. With an average of 2.3% Nb2O5 in the 9 samples reported from the Miranna Area, Commerce Resources may be close to the discovery of a high grade niobium deposit comparable to the leading global producer. Miranna has the right host rock and ore mineral for standard, highly efficient metallurgical processing, that being carbonatite rock and pyrochlore mineralogy hosting the niobium.

As Miranna is located only 1 km east of the Ashram Rare Earth Deposit, there could be significant potential for development synergies in the event a deposit of merit is defined at Miranna.

Having 2 strategic metals deposits right at surface would greatly facilitate the infrastructure development on the Eldor Property, as well as the entire region.

Developing 2 separate deposits on the Eldor Property would allow for significant synergies in CAPEX and OPEX, thereby bringing the overall costs down considerably in the event both assets were developed. The Plan Nord initiative, which has a focus on fostering the development of Quebec's northern mineral resources, could soon have another good reason to consider Commerce Resources in its infrastructure development plans.

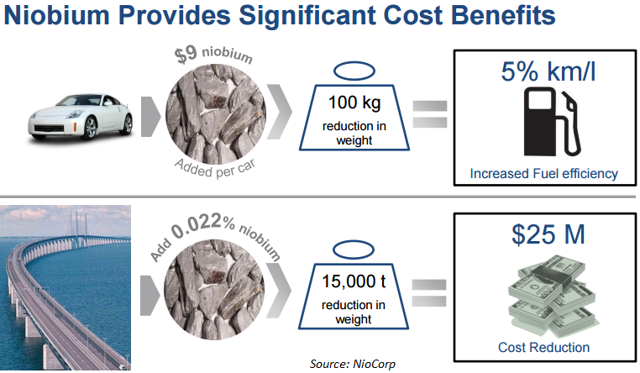

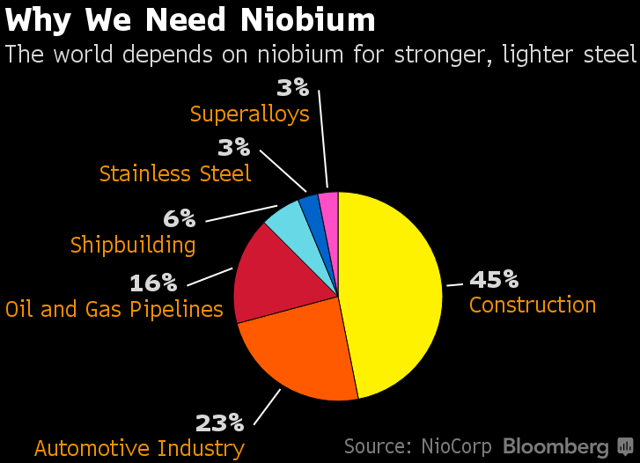

Niobium can deliver powerful economic and environmental benefits in applications where it is used. For example, according to the World Steel Association, approximately $9 USD of niobium added to a mid-sized automobile can reduce its weight by 100 kg. That helps increase its fuel efficiency by 5%. And that's a huge return to consumers and our environment. As a commodity, niobium enjoys relatively stable pricing at attractive levels. It also is characterized by robust and diverse global markets, solid forecast growth rates, relatively limited substitution risk, and multiple applications across environmentally preferred technologies.

The commodity no one knows about but everybody wants to buy

By Thomas Biesheuvel & Jesse Riseborough for Bloomberg on May 18, 2016

The world's mines and steel plants got so devalued during the commodity slump that some were just given away by owners struggling to cut losses or debt. But there's at least one metal that's been attracting a lot of attention.

Niobium -- named for a Greek goddess who became a symbol of the tragic mourning mother -- is used to produce stronger, lighter steel for industrial pipes and aircraft parts. It is mined in only three places on Earth, and the price of every kilogram is seven times higher than copper.

China Molybdenum Co. outmaneuvered at least 15 companies last month to purchase Anglo American Plc's niobium and phosphate unit in Brazil, agreeing to pay $1.5 billion, or 50 percent more than the valuation by some analysts. The buying frenzy that included Vale SA, Apollo Global Management LLC and X2 Resources showcased the growing appeal of a market that may be worth $4 billion for a soft, silvery metal many experts don't know much about.

"I didn't know what niobium was, and I had been in the minerals industry for 20 years before this opportunity came across my desk," said Craig Burton, the chairman of Cradle Resources Ltd., which is seeking to develop the $200 million Panda Hill niobium project in Tanzania.

"I had to actually open up the periodic table just to double-check that it was an element. It definitely is a boutique space."

Niobium is hard to find and hard to value. More than 80 percent of global supply comes from one company -- Cia. Brasileira de Metalurgia & Mineracao in Brazil. Metal Bulletin Ltd., which publishes prices for metals as obscure as bismuth and germanium, says there's not enough liquidity to report one for niobium.

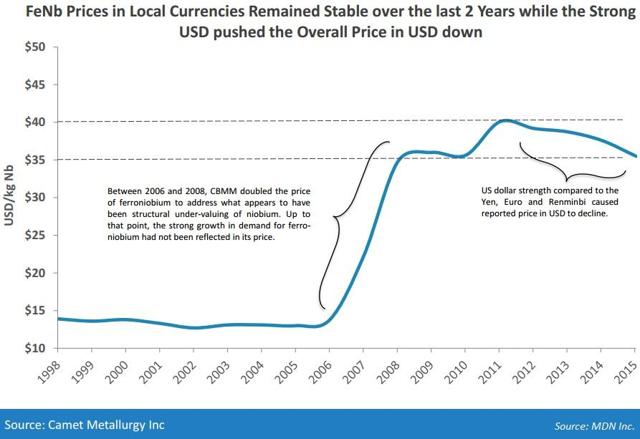

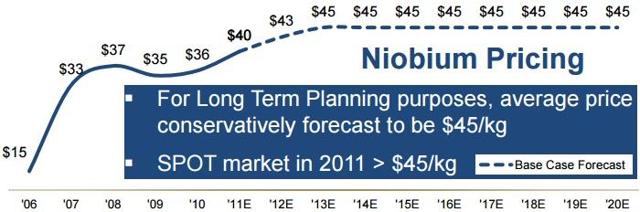

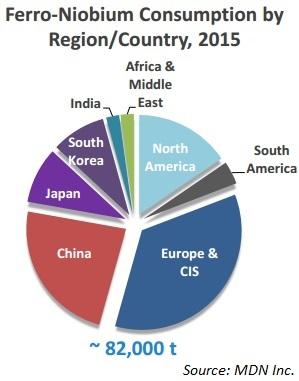

The metal averaged about $40 a kilogram last year, according to Cradle Resources, which is based in Perth, Australia. An equivalent amount of copper on the London Metal Exchange fetched about $5.49. Global demand for niobium is about 90,000 to 100,000 metric tons annually.

Three MinesStill, prices fell last year because of the weak demand for steel, as slumping oil and gas markets led to fewer metal pipe purchases, according to Anglo American, which wants to raise cash to cut debt after a collapse in commodity prices. Almost all the metal comes from just three mines in Brazil and Canada, allowing dominant producer CBMM to match supply to demand and influence prices.

Among the companies outbid by China Molybdenum were Mosaic Co., the world's largest producer of phosphate fertilizer, South32 Ltd. and Eurochem Group AG, people familiar with the process said.

The sale was highly competitive, said two people involved, who asked not to be identified because the matter was private.

The winning offer exceeded the estimates of analysts at Bank of America Corp. and Investec Plc. RBC Capital Markets said the assets were among the best that London-based Anglo has offered.

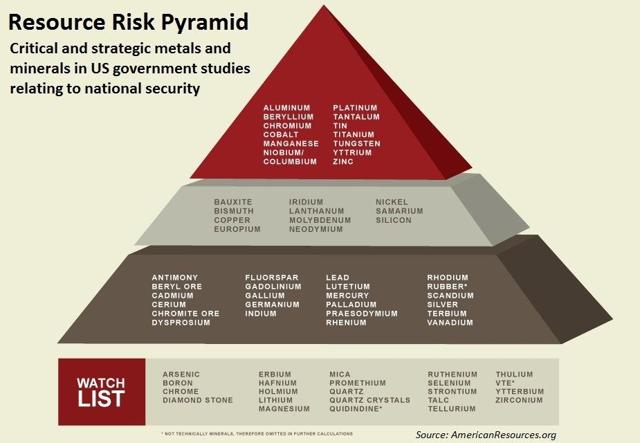

Very UniqueWhat makes the business so attractive is that there are only a few operating mines. Anglo and Niobec account for about 9 percent of production, and Brazil's CBMM supplies the rest, according to Argonaut Securities Pty. Both the U.S. and Europe list niobium as a strategically important mineral.

"Niobium is a very unique business," said Kalidas Madhavpeddi, who heads the CMOC International unit of Luoyang, China-based China Molybdenum. "We typically want to buy from people who regret selling it. We've been very carefully assembling a war chest in anticipation of a downturn in the industry."

CBMM, controlled by the billionaire Moreira Salles family, has mostly dominated supply since starting operations five decades ago.

It sold a 30 percent stake to a group of Asian steelmakers in two transactions valued at $3.9 billion in 2011.

In another deal, Magris Resources Inc., founded by former Barrick Gold Corp. Chief Executive Officer Aaron Regent, agreed to pay $530 million for the Niobec mine in Canada in 2014.

Unsuccessful bidders in Anglo's sale may turn their interest to Cradle's Panda Hill project in Tanzania, Argonaut said in a research report. Pending financing, it's expected to start producing in mid-2018. Cradle shares jumped 8.6 percent in Australian trading, reaching the highest since 2011.

The sales "have brought a lot of participants in," Cradle's Burton said. "There was only one winner. That leaves lots of parties that might be interested in talking to us because we do need to raise some capital to bring this project on."

Commerce Resources samples high-grade niobium outside its Ashram rare earths deposit

By Greg Klein for ResourceClips on September 13, 2016

A serene-looking camp contrasts with activity elsewhere on Commerce Resources' Eldor property.

A serene-looking camp contrasts with activity elsewhere on Commerce Resources' Eldor property.

A "spectacular" niobium assay has Commerce Resources TSXV:CCE enthused about an exploration target one kilometre from its Ashram rare earths deposit. A sampling program on the northern Quebec Eldor property strengthens the Miranna area's niobium-tantalum-phosphate potential, with results up to 5.9% niobium pentoxide. But excited as the company is, work continues to focus on Ashram's pre-feasibility studies.

"That's the highest grade niobium sample I have ever seen on the planet," says president Chris Grove. "I've never seen anything higher. This is spectacular."

Of 64 samples, 40 assayed above 0.5% Nb2O5, with 16 surpassing 1%. The program also found significant grades of tantalum, phosphate and rare earth oxides. Two samples each graded above 1,000 ppm Ta2O5 and 1% Nb2O5, while several samples revealed more than 10% P2O5.

The samples also showed appreciable REE mineralization associated with the niobium, Commerce added.

The finding brings to mind the origin of Commerce, which was created around the Upper Fir project in southeastern British Columbia. The property's Blue River tantalum-niobium deposit reached PEA in 2011 and a resource update in 2013.

Niobium's price explosion in late 2006 sent Commerce looking for additional deposits, Grove says. That led the company to Eldor. But Ashram's initial drill results switched the focus to rare earths.

And while Miranna now presents additional multi-commodity potential, work will continue to focus on Ashram's pre-feas, Grove emphasizes.

The Miranna samples come from a glacial train of niobium-tantalum-phosphate mineralized boulders believed to be near their source. Some mineralized samples hold magnetite, suggesting a magnetic signature to the source. The company says a magnetic high immediately south, which appears to coincide with the train's apex, could mark the bedrock source.

Previous mineralogical work indicates that Miranna's niobium and tantalum mineralization is hosted by pyrochlore, the world's dominant mineral source of niobium, Commerce stated. The pyrochlore's coarse grains would also benefit recovery.

Meanwhile work continues at Ashram, where a near-surface program of 14 holes totalling 1,600 metres began last month. Metallurgical studies at a mini-pilot plant have simplified the project's flowsheet.

Busy on a number of fronts, a company priority remains producing samples to send to potential JV or offtake partners, who might then take part in the pre-feas.

"It would make sense to have a potential partner offer input on what our production scenario would be," Grove points out.

"We have a huge deposit and we can go bigger, go smaller or stay the same. So advice from a potential partner does make sense before we actually complete the pre-feas."

Using a 1.25% cutoff, Ashram's 2012 resource shows 1.59 million tonnes averaging 1.77% total rare earth oxides measured, 27.67 million tonnes averaging 1.9% indicated and 219.8 million tonnes averaging 1.88% inferred. The near-surface deposit remains open to the north and south, and at depth.

Ashram hosts REEs largely in monazite and to a lesser extent bastnasite and xenotime, minerals that dominate commercial extraction.

Ashram's distribution shows enrichment in the critical and magnet feed elements neodymium, praseodymium, europium, terbium, dysprosium and yttrium.

Read more about Commerce Resources.

Company Details

Commerce Resources Corp.

#1450 - 789 West Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 484 2700

Email: cgrove@commerceresources.com

www.commerceresources.com

Shares Issued & Outstanding: 259,508,950

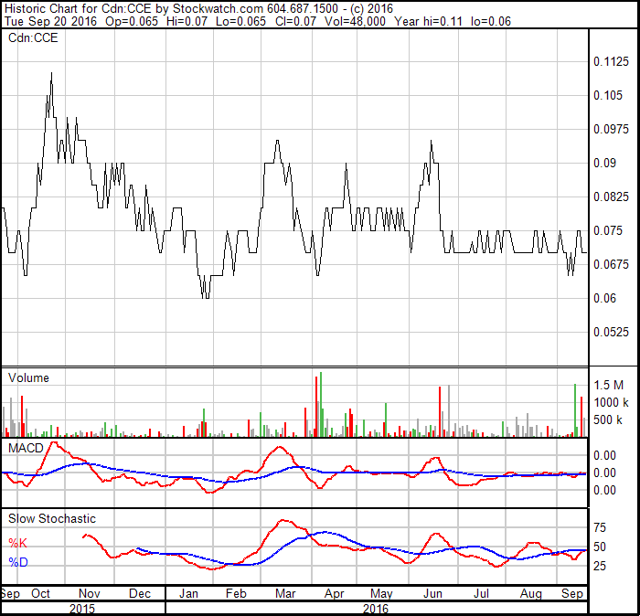

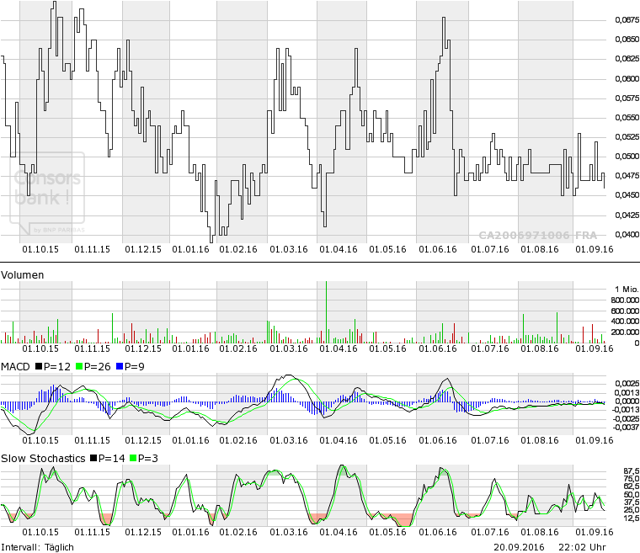

Canadian Symbol (TSX.V): CCE

Current Price: $0.07 CAD (09/20/2016)

Market Capitalization: $18 million CAD

German Symbol / WKN (Frankfurt): D7H / A0J2Q3

Current Price: €0.045 EUR (09/20/2016)

Market Capitalization: €12 million EUR

Previous Coverage

Research #19 "Carbonatites: The Cornerstones of the Rare Earth Space"

Research #18 "REE Boom 2.0 in the making?"

Research #17 "Quebec Government starts working with Commerce"

Research #16 "Glencore to trade with Commerce Resources"

Research #15 "First Come First Serve"

Research #14 "Q&A Session About My Most Recent Article Shedding Light onto the REE Playing Field"

Research #13 "Shedding Light onto the Rare Earth Playing Field"

Research #12 "Key Milestone Achieved from Ashram's Pilot Plant Operations"

Research #11 "Rumble in the REE Jungle: Molycorp vs. Commerce Resources - The Mountain Pass Bubble and the Ashram Advantage"

Research #10 "Interview with Darren L. Smith and Chris Grove while the Graveyard of REE Projects Gets Crowded"

Research #9 "The REE Basket Price Deception & the Clarity of OPEX"

Research #8 "A Fundamental Economic Factor in the Rare Earth Space: ACID"

Research #7 "The Rare Earth Mine-to-Market Strategy & the Underlying Motives"

Research #6 "What Does the REE Market Urgently Need? (Besides Economic Sense)"

Research #5 "Putting in Last Pieces Brings Fortunate Surprises"

Research #4 "Ashram - The Next Battle in the REE Space between China & ROW?"

Research #3 "Rare Earth Deposits: A Simple Means of Comparative Evaluation"

Research #2 "Knocking Out Misleading Statements in the Rare Earth Space"

Research #1 "The Knock-Out Criteria for Rare Earth Element Deposits: Cutting the Wheat from the Chaff"

For smartphones, an APP from Rockstone Research is available in the AppStore for Apple devices and in the GooglePlayStore for Android devices.

Recently, Zimtu Capital Corp. launched the Beta Version of its Advantage APP, in which all interlisted stocks (i.e. all public companies listed in Canada and Germany) can be tracked. After a cost-free registration, the full features of the APP are unlocked, e.g. sorting all stocks with the biggest daily trading volumes on all German or Canadian exchanges (see instructions in the section "How To Use"): http://app.zimtu.com

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist.