Historically, low volatility is common around stock market highs. The CBOE Volatility Index (VIX) has moved higher from levels consistent with peaks in the S&P 500, but how should investors (balanced, opportunistic and equity-only alike) position their overall portfolios? Simply put, volatility is a real-time market proxy for sentiment and risk appetite. Generally speaking, higher volatility typically corresponds with the under-performance of riskier asset classes. Economic and financial market volatility increases against a weakening macro backdrop, which is also the time when investors tend to become less risk tolerant. In this article, we demonstrate that rising volatility has broad implications for currencies, commodities, fixed income, credit and equities, including the size cycle (large caps versus small caps) and sector positioning (defensives versus cyclicals).

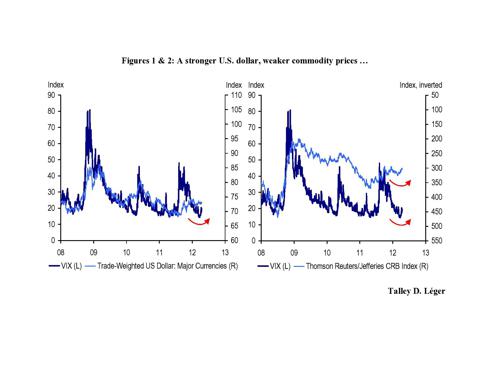

Consider the relationship between the VIX and the Fed's Trade-Weighted U.S. Dollar Index: Major Currencies. Clearly, flight-to-safety flows typically benefit the U.S. dollar at the expense of other major currencies, which also takes some of the shine off the broad commodity complex as measured by the Thomson Reuters / Jefferies CRB Index.

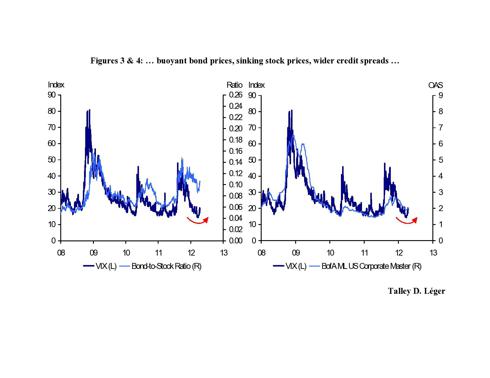

Meanwhile, 10-year U.S. Treasury bonds generally outperform the S&P 500 during such risk-shedding events. At the same time, these trends usually correspond with wider credit spreads as expressed by BofA Merrill Lynch U.S. Corporate Master Option-Adjusted Spreads. In other words, flight-to-safety flows typically favor Treasuries over investment-grade corporate bonds (i.e., those rated BBB or better).

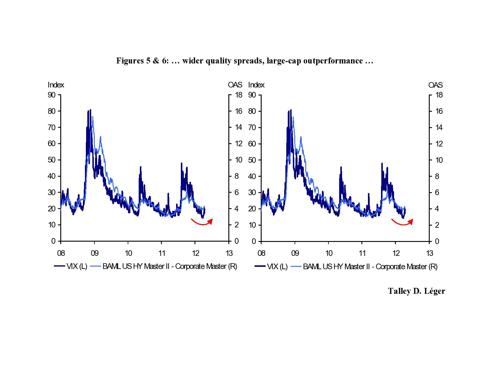

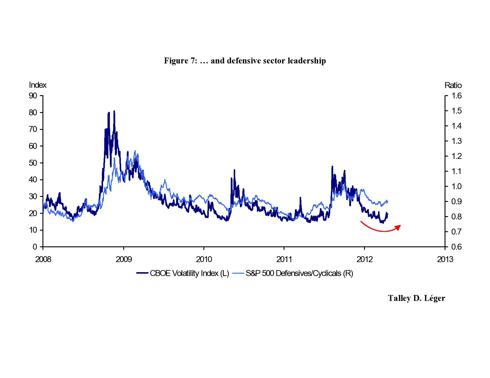

Volatility trends are inversely correlated with the relative performance of several other higher-beta asset categories, including high-yield corporate bonds, small-capitalization stocks and economy-sensitive sectors of the equity market (i.e., Financials, Consumer Discretionary, Technology, Industrials, Energy and Materials). Widening quality spreads (i.e., the difference between high-yield corporate bond spreads and their investment-grade counterparts), the outperformance of the S&P 500 versus the Russell 2000, and the leadership of large-cap defensive sectors (i.e., Health Care, Consumer Staples, Utilities and Telecom) makes sense in the context of heightened market turbulence because investors' appetite for risk (or lack thereof) is a key driver of their overall risk posture.

Another way to think about these relationships is economic beta: Higher-quality, larger, defensive companies are more insulated from an eroding economic outlook than their lower-quality, smaller, cyclical brethren. From our lens, the trajectories of C&I loan growth, the 2s10s Treasury yield curve and the VIX suggest the recent outperformance of lower-beta assets is just beginning. Stay sharp.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.