Performance Review

Our December 2013 watch list contained 14 companies. The 1-year performance is listed below.

| Symbol | Name | 2013 | 2014 | % change | ||

| D-UN.TO | Dundee REIT | 28.22 | 24.89 | -11.80% | ||

| CUF-UN.TO | Cominar REIT | 17.92 | 18.39 | 2.62% | ||

| FTS.TO | Fortis Inc. | 30.31 | 37.96 | 25.24% | ||

| CWT-UN.TO | Calloway REIT | 24.72 | 27.25 | 10.23% | ||

| CAR-UN.TO | Canadian Apartment Properties REIT | 20.84 | 24.41 | 17.13% | ||

| TA.TO | TransAlta Corp. | 13.38 | 10.71 | -19.96% | ||

| REI-UN.TO | Riocan Real Estate Investment Trust | 24.54 | 26.91 | 9.66% | ||

| SAP.TO | Saputo, Inc. | 24.12 | 33.96 | 40.80% | ||

| CU.TO | Canadian Utilities Ltd. | 35.26 | 39.01 | 10.64% | ||

| FCR.TO | First Capital Realty Inc. | 17.5 | 18.65 | 6.57% | ||

| EMA.TO | Emera Incorporated | 30.63 | 38.10 | 24.39% | ||

| REF-UN.TO | Canadian REIT | 42.08 | 46.16 | 9.70% | ||

| AX-UN.TO | Artis Real Estate Investment Trust | 14.65 | 14.32 | -2.25% | ||

| ESI.TO | Ensign Energy Services Inc. | 16.42 | 10.91 | -33.56% |

At the time, our analysis of the list was summed up in the following commentary:

"As we've indicated in the past, companies that are typically expected to experience the most decline under the lowest earnings scenario are often the ones that outperform in the following year. We will see if TransAlta, Fortis, Emera, First Capital Realty and Saputo manage to exceed the performance of the stocks currently expected to be in the positive one year from now. Because of our bias on this matter, we favor the stocks expected to decline in price based on analyst low estimates."

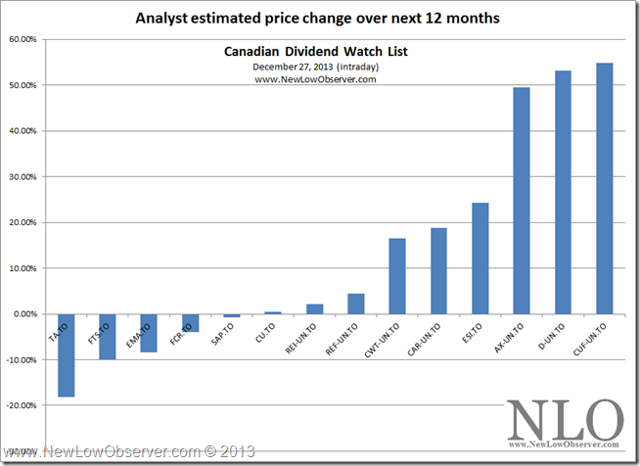

Our commentary was based on estimates of price change using analyst earnings projections for the coming year (2014) as seen below:

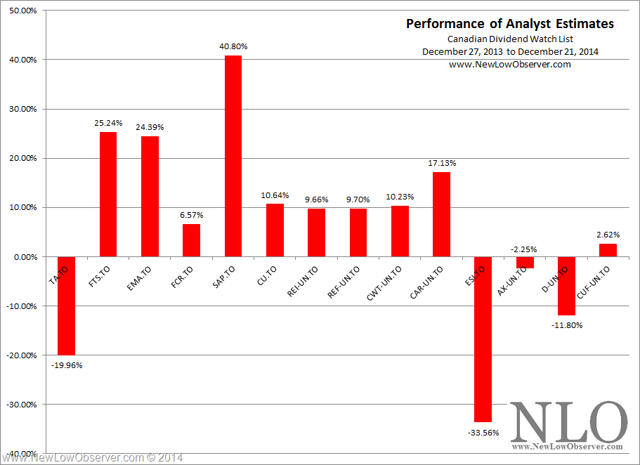

Below is a graphical representation of the change that has occurred in the last year:

As has been the case time and again, the stocks that were expected to do the worst actually outperformed the stocks that were anticipated to do the best. Of the five companies (TransAlta, Fortis, Emera, First Capital Realty and Saputo) that were expected to decline in value averaged a gain of +15.41%. Of the remaining stocks that were expected to increase, the average gain was +0.22%. The entire list gained +6.39% while the Toronto Stock Exchange gained +6.48%.

Of interest to all investors is the performance of TransAlta (TA.TO) down -19.96% and Canadian Apartment Properties (CAR-UN.TO) up +17.13%. The analyst low expectations of these stocks were extremely accurate. We're hoping that the analysts tracking these stocks could achieve a repeat performance.

Our latest watch list and estimates for the coming year can be found at our website (NewLowObserver.com).