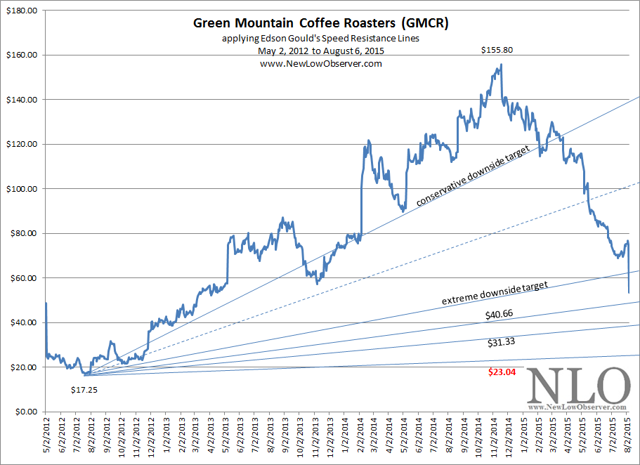

On May 19, 2015, we did a downside target review of Green Mountain Coffee Roasters (GMCR) based on the work of Edson Gould. At the time, GMCR was trading at $88.69. Our downside assessment was as follows:

"As can be seen above, the price of GMCR has declined below the conservative and mid-range downside targets of $110.08 and $81.40. The acceleration of the current decline seems to indicate that achieving the $52.71 extreme downside target is very likely."

On August 6, 2015, GMCR declined as low as $52.40. This falls well within the indications that were provided by Gould's Speed Resistance Lines [SRL] at $52.71. We closed our downside assessment of GMCR with the following comment:

"The fact that GMCR is prone to extreme moves up and down suggests that the extreme downside target is the point at which to start assessing risk and accumulating shares."

Now that GMCR has fallen below the extreme downside target of $52.71, we think now is the time to review GMCR as a going concern for a potential transaction.

The Setup

Assuming that an investor is willing to accept total loss of funds, now is a great time to review the fundamentals of GMCR and determine if it will survive on its own or ultimately get acquired. Below is the updated SRL based on the work of Edson Gould.

Our best guess is that buying GMCR in three stages on the way down is the most "prudent" approach. For those interested in the stock but don't like the prospect of catching a falling knife, we've outlined three potential starting points for investment at $40.66, $31.33 and $23.04. We'd suggest investments of 50%, 25% and 25% of allotted funds.

Again, this recommendation is not for the faint of heart. Additionally, it is safest to assume all money put to this stock is a total loss and requires a significant amount of due diligence before any commitment is made. From a historical standpoint, a retest of the prior low ($17.25) is not unusual.