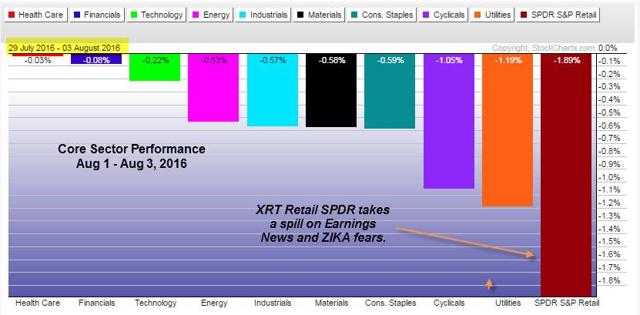

The following chart is the three-day relative performance for the sector SDPR ETF's as of Wednesday's close (the chart covers Friday's close, July 29th, through Wednesday's close):

The S&P 500 was down 0.45% for this three day period. Healthcare, Financials and Technology were the relative strength leaders as they all outperformed the S&P. Technology appears to be poised to continue its uptrend in August and it was constructive to see Financials, one of the four economically-sensitive sectors, outperform on a relative basis as well.

On an absolute basis it was a bit of a rocky start to August for all of the core sectors (see next chart). I included the XRT Retail SPDR, which was discussed in Monday's post, to help highlight the weakness we saw in Consumer Discretionary as the new month started.

Some of the weakness in Retail was earnings related (Apparel and Broadline Retailers), and some was a result of Zika virus cases being reported in Miami on Monday (Travel related stocks took a hit). Priceline (PCLN), Expedia (EXPE) and TripAdvisor (TRIP) are all part of the Retail SPDR (XRT), which is essentially an equal-weight ETF.

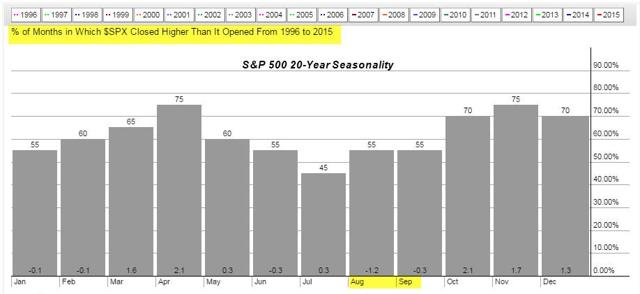

August historically is one of the two poorer performing months for the market, with September being the other. Another trader also pointed out to me that the first two-days of a new month are also historically negative for the market. So perhaps August got a bit of a "double-whammy" out of the starting gate.

The following is a 20-year seasonal chart for the S&P 500 from StockCharts.com. It helps to statistically highlight the seasonal weak period we are entering. Keep in mind though this does not guarantee this month's weakness is an absolute. In some cases - 45% of the time - the S&P closed higher than it opened for August.

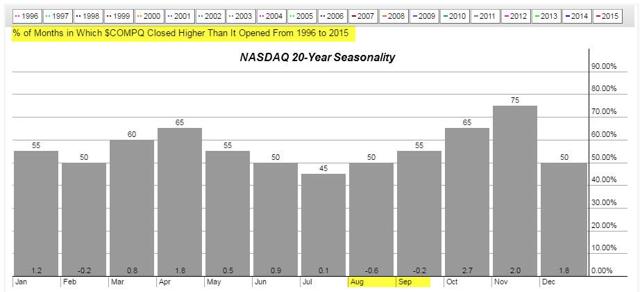

The NASDAQ has a similar track record, but somewhat better (see next chart).

The name of the game is to stay vigilant and nimble. How the market handles this coming Friday's Non-Farm Payroll report could set the tone for the rest of the month.

Thanks for stopping by and reading.