Overview:

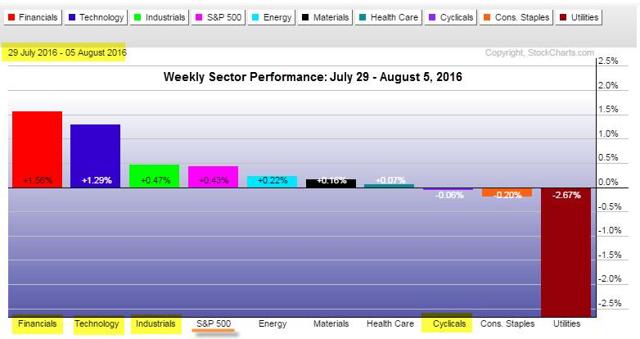

As I mentioned in my mid-week update on Wednesday the market got off to a shaky start. Some of this weakness being seasonal tendencies and perhaps some of it was caution ahead of Friday's Non-Farm Payroll (aka NFP) report. The first chart is the weekly performance on an absolute basis for the nine-sector SPDR ETF's. Money continued to exit the Utilities space. This has been a trend I have highlighted over the last two weeks.

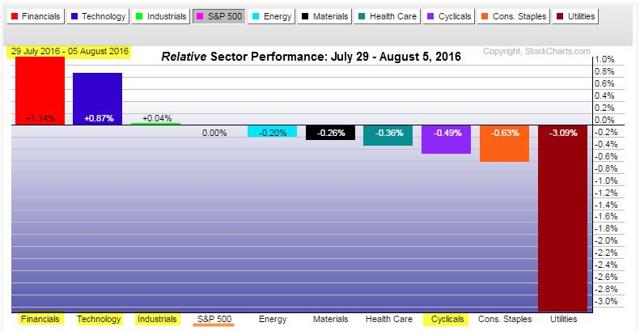

The next chart is the performance for the same nine core sectors on a relative basis using the S&P 500 as the benchmark. The relative performance helps to highlight the significant underperformance of Utilities. This weakening trend in Utilities has been a clear warning to lighten up holdings in this space.

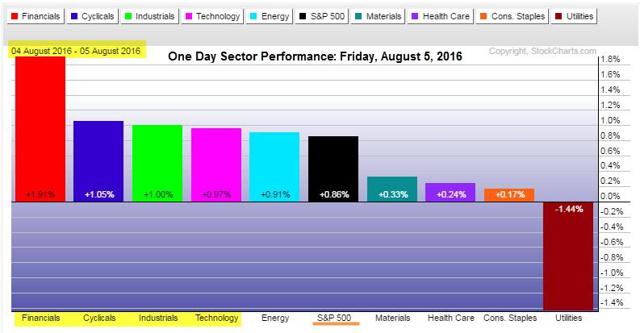

Technology continues to be a leader on both an absolute and a relative basis. Financials had the biggest gains for the week. Most of the gains in Financials came in the latter part of the week as a result of the positive NFP report for July (180K forecast, 255K actual) and the upward revision to June's report. To get a perspective on how the NFP report positively impacted Financials, take a look at the following one-day chart. Essentially all the gains for the week for the Financial sector were realized on Friday.

Insights:

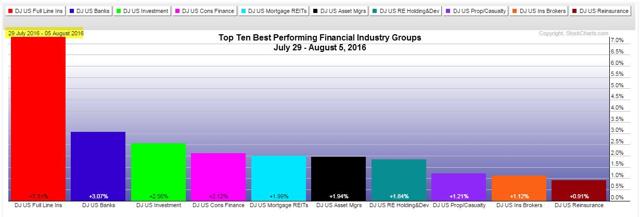

Friday's positive jobs report, plus the upward revisions for June, sparked a rally in Financials. The strong job data potentially puts a possible rate hike on the table for the September FOMC meeting. Just the anticipation of higher rates will be a boost to many of the Financial sector industry groups, especially the banking sector. The following chart is the one-week performance for the top-ten Financial industry groups.

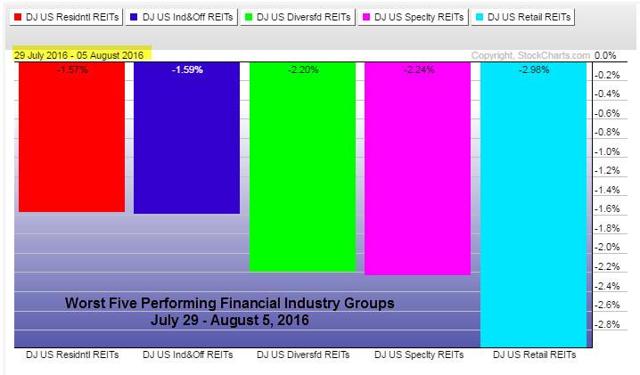

Higher rates mean better margins for the banks as well as insurance companies and investment services companies. On the flip side, potentially higher rates took the air out of the sails of many of the REIT groups. The following chart is for the five worst performing Financial industry groups for last week.

As you can see all five are REIT's. Higher interest rates have the same affect on many REIT's just as it does on bonds (bond prices and bond yields are inversely correlated). Just keep in mind that not all REIT's will be impacted negatively with higher interest rates. Going back to the chart above for the top ten Financial industry groups you will see that Mortgage REIT's actually got a boost (+1.99% for the week). They are typically impacted the fastest with higher rates and hence able to also realize gains sooner.

Summary:

Friday's strong NFP report lit a fire under the Financial sector with the specter of higher interest rates. Keep in mind there is no guarantee that the FOMC will raise rates in September or even this year. The rally in Financials is certainly at best being driven by speculation at this early stage. However, if the employment trend continues (August NFP) then obviously the odds are going to increase for a rise in rates in September or later in the year.

August can be a volatile month, primarily due to lower trading volumes (as was the case for volume in last week's rally). The S&P 500 made a new all-time closing high Friday. Technology continues its march higher. Can this rally be trusted? There is an old adage that goes "The trend is your friend until it bends and ends." Keep in mind that market tops typically form much slower than bottoms. The name of the game is to stay flexible and nimble.

Thanks for the read…