With new wealth demands better standard of living. And new wealth created by the Chinese economy has given the locals a better choice in all sorts of things in their lives. One of these things is their way of travelling. It has been for so long that they have been using their bicycle. However, because new markets are created but are farther away, the Chinese local needs to replace that old two wheeler.

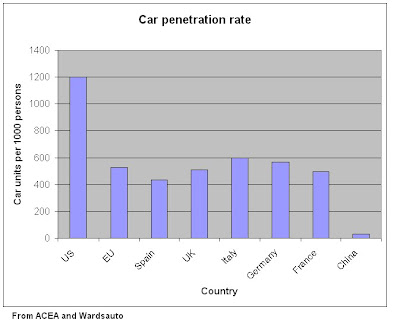

With new wealth demands better standard of living. And new wealth created by the Chinese economy has given the locals a better choice in all sorts of things in their lives. One of these things is their way of travelling. It has been for so long that they have been using their bicycle. However, because new markets are created but are farther away, the Chinese local needs to replace that old two wheeler.The graph tells us that only 3% of the people in China have a car. From a billion population, that is still a whopping 3 million cars now running the newly paved highways.

Supporting this glaring opportunity in the Chinese auto sector is the fact that the government has enacted policies to subsidize vehicle acquisition.

Some of the implemented policies are:

1) Consumers who agree to scrap their old cars before their usage life will be given a replacement subsidy of an average of at least Rmb 4000

2) Farmers who replace their agricultural vehicles for minivans and pick up trucks will get an upgrade subsidy.

3) Subsidies will be given to those who will buy energy efficient vehicles.

Aside from the subsidies, the government itself is a big consumer of vehicles. It is estimated that the government accounts for 8% of total vehicle sales. To support the local auto industry, the government buys half of their yearly purchase from local car makers.

Local players are:

1) Dongfeng Motor Group (hkg: 489)- manufactures and sells passenger vehicles, SUVs, and auto parts

2) Brilliance China Automotive (hkg: 1114) - manufactures and sells minibuses and auto components; among several brands they are popular with are Zhonghua sedans and rights to manufacture and sell BMW sedans

3) Geely Automobile Holdings (hkg: 175) - manufactures and trades automobiles and auto parts

4) Great Wall Motor (hkg: 2333) - prinicipal products are pick-up trucks, SUVs and sedans

5) Qingling Motors (hkg: 1122) - produces and sells light-duty trucks, multi-purposes vehicles, pick-up trucks, medium and heavy-duty trucks, other vehicles, and automobile parts and accessories; known for selling Isuzu trucks

6) Denway Motors (hkg: 203) - engaged in a range of activities relating to the manufacturing, assembly and trading of motor vehicles; the manufacturing and trading of automotive equipments and parts in the People’s Republic of China, and the manufacturing and trading of audio equipment in Hong Kong

7) Weichai Power (hkg: 2338) - provides engines for passenger vehicles, engines for trucks, engines for electric power generation, engines for ships, engines for engineering machines, as well as engines for agricultural machines; also involved in manufacture and sale of heavy-duty vehicles, axles for heavy-duty vehicles, gear boxes and other automobile components

8) Byd Co (hkg: 1211) - sells advanced batteries and also will manufacture and sell their F3DM model which is supposed to be a "new energy" clean vehicle

Leaders have to determined but popular brands of 2008 in China are Dongfeng Motors and Geely Automobile. Foreign brands like the Audi, Mercede Benz, and BMW are among the brands that the government are allowed to purchase.

To conclude, here is a summary of why any investor should take a look at the China auto sector.

1) The penetration rate of cars is only 3%

2) Government is supporting the sector by enacting policies that give subsidies to new purchasers

3) New wealth from China's economic growth allows more Chinese to purchase their first vehicle

4) Estimates say that 92% of cars purchased last year was paid in cash therefore car financing will enable that possible extra demand in the future

Bryan S. Gomez does not own any of stocks mentioned in this article.