GROWTHACES.COM Trading Positions:

USD/JPY: long at 104.90, target 108.00, stop-loss 106.50

GBP/USD: long at 1.6220, target 1.6400, stop-loss 1.6130

EUR/USD: long at 1.2920, target 1.3100, stop-loss 1.2830

USD/CAD: long at 1.1040, target 1.1160, stop-loss 1.0980

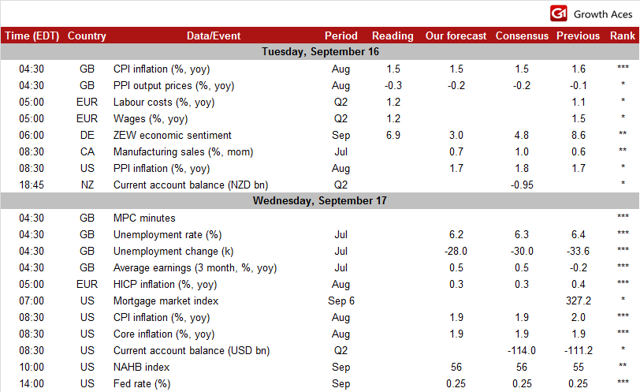

ECONOMIC CALENDAR

EUR/USD: German investor morale lowest since December 2012

(bullish in the medium term, target 1.3100)

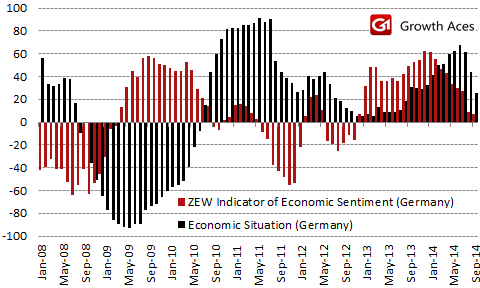

- ZEW's monthly survey of economic sentiment dropped in September for a ninth straight month to 6.9 from 8.6 in August, the lowest level since December 2012. The data were better than the market consensus of 4.8 and our forecast. The continued depreciation of the EUR and accommodative policy of the ECB might have tempered investors' pessimism. On the other hand, a separate gauge of current conditions plunged to 25.4 from 44.3 in August, strongly undershooting the consensus forecast and perhaps reflecting ongoing fears about the effects of the Ukraine crisis.

- The market looks ahead to the FOMC decision on Wednesday. The market has largely priced in a more hawkish Fed statement suggesting shorter period between the end of quantitative easing and the start of tightening cycle. That is why GrowthAces.com sees only little room for further fall of the EUR/USD and keeps bullish outlook for this currency pair in the medium term.

Significant technical analysis' levels:

Resistance: 1.2980 (high Sep 15), 1.2990 (high Sep 5), 1.3030 (recovery high Sep 4)

Support: 1.2908 (low Sep 15), 1.2897 (low Sep 11), 1.2883 (low Sep 10)

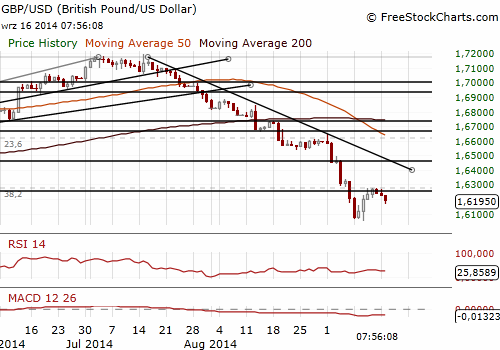

GBP/USD dips as referendum nears

(still bullish assuming "No" for independence on Thursday)

- The GBP/USD fell back towards recent lows on Tuesday as nervousness intensified before Scotland's vote on independence on Thursday. British Prime Minister David Cameron used his last visit to Scotland before a historic independence referendum this week to implore Scots to remain part of the United Kingdom, warning on Monday that a breakaway vote would be irreversible.

- Consumer prices rose 1.5% yoy in August, the lowest increase since May, compared with 1.6 percent in July. The ONS said the biggest negative contributions to inflation in August were motor fuels, food and non-alcoholic beverages and furniture. Food and non-alcoholic drinks prices fell by 1.1% yoy. The largest, partially offsetting, upward effects came from clothing, transport services and alcohol. The CPI data were, however, in line with expectations and did little to divert attention from the possible break up of the United Kingdom. Core inflation, excluding energy, food, alcohol and tobacco, amounted to 1.9% yoy in August.

- Producer output prices fell in August by 0.1% mom and 0.3% yoy vs. a fall by 0.1% yoy in July. Input prices (material and fuels) went down by 0.6% mom and 7.2% yoy vs. a fall by 7.2% yoy in the previous month.

- Separate data from the ONS showed house prices in Britain rose 11.7% in the year to July. In London, which led house surging house price growth earlier this year, property prices rose 19.1% yoy, down slightly from 19.3% yoy in June.

- The Bank of England will release its minutes tomorrow. It is widely expected that minutes show 2 members had voted for a rate hike, unchanged from the prior meeting. Investors will be eyeing also jobs and earnings data.

- The GBP/USD fell to 1.6160 today but then recovered after CPI reading (in line with expectations). GrowthAces.com keeps its long position on the GBP/USD assuming "No" for Scottish independence on Thursday.

Significant technical analysis' levels:

Resistance: 1.6250 (hourly high Sep 16), 1.6279 (38.2% of 1.6645-1.6052), 1.6340 (high Sep 5),

Support: 1.6160 (hourly low Sep 16), 1.6052 (low Sep 10), 1.6003 (50% of 1.4814-1.7192)

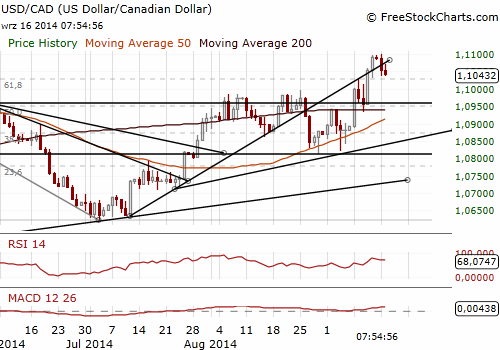

USD/CAD: Get long at 1.1040

(we went long at 1.1040, target 1.1160)

- The CAD firmed against the USD on Monday, recovering from a more than five-month low hit overnight as the currency pairing backed away from resistance at 1.1100. The loonie shrugged off a number of weak economic figures from China that came out over the weekend.

- The USD/CAD is in a wait-and-see attitude now. We have three important events this week - a speech about the role of floating exchange rate from the head of the Bank of Canada Stephen Poloz today (16.30 GMT), a policy statement by the Fed on Wednesday, Scotland's referendum on whether to leave the United Kingdom.

- The release of manufacturing sales data are also scheduled for today - they will be revealed at 12.30 GMT.

- GrowthAces.com is bullish on the USD/CAD in the short term. We went long today at 1.1040 with the target of 1.1160.

Significant technical analysis' levels:

Resistance: 1.1100 (high Sep 15), 1.1106 (high Mar 27), 1.1123 (76.4% of 1.1279-1.0620)

Support: 1.1027 (low Sep 12), 1.0978 (10-dma), 1.0940 (30-dma)

GrowthAces.com is an independent macroeconomic research consultancy for traders. We offer you daily forex analysis with forex trading signals. The service covers forex forecasts and signals for following currencies: EUR, USD, GBP, JPY, CAD, CHF, AUD, NZD as well as emerging markets. Our subscribers should expect to receive: forex trading strategies, latest price changes, support and resistance levels, buy and sell forex signals and early heads-up about the potential fx trading opportunities. GrowthAces.com offers also daily macroeconomic fundamental analysis that enables you to see fundamental changes on forex market. We provide in-depth analysis of economic indicators resulting from knowledge, experience, advanced statistics and cutting-edge quantitative tools.

We encourage you to subscribe to our daily forex newsletter on http://growthaces.com to get daily analysis for forex traders. We intend that our consultancy should help you make better decisions. At GrowthAces.com we give our best to you - always greatest quality, usefulness and profitability.