World Market Media highlighted CYCC in previous articles identifying the comany as an undervalued pick at .84 and a 25M(MarketCap) they also reside in our NanoCap Index. We receive no compensation from the company and own no shares. The biopharmaceutical company weighs in on earnings, an FDA approval request, and releases revisions in past earnings.

Cyclacel Pharmaceuticals, Inc., a developmental stage biopharmaceutical company developing oral therapies that target the various phases of cell cycle control for the treatment of cancer and other serious disorders, reported first quarter financial results that included an announcement the company has submitted a request for what’s called a Special Protocol Assessment (SPA) to the FDA that grants permission to conduct a randomized Phase 3 study of sapacitabine in elderly patients with acute myeloid leukemia, or AML. Sapacitabine, the company’s lead product candidate, has been the primary focus of Cyclacel’s resources and capital. The Company expects the request to be followed by consultations with the FDA, at which point more information will be released to shareholders.

In response to other products in the pipeline, Spiro Rombotis, President and Chief Executive Officer of Cyclacel said, “we are also continuing to evaluate the broad therapeutic utility of our cyclin-dependent kinase (CDK) inhibitor drug candidates in treating cancers that are resistant to available therapies."

Released financial highlights for the first quarter of 2010 include:

- Revenues for the quarter were $0.3 million, compared to $0.2 million for the same period in 2009, and the operating loss for the quarter was $4.5 million compared to $5.2 million for the same period in 2009. The net loss for the first quarter was $5.1 million, or $0.18 per basic and diluted share. This compared to a net loss of $5.1 million, or $0.26 per basic and diluted share, for the same period in 2009.

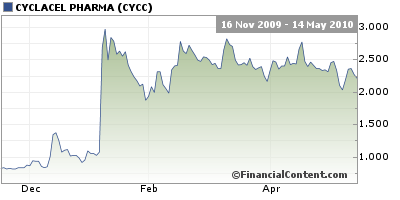

- Cash and cash equivalents were $24.2 million compared to $11.5 million as of December 31, 2009. The Company raised $18.5 million through registered offerings and warrant exercises in this first quarter and expects its existing capital resources should be adequate to fund operations and commitments into 2012.

- Regained compliance with the minimum $50 million market value of listed securities requirement for continued listing on The NASDAQ Global Market.

Disclosure: no positions