It's confounding how certain Seeking Alpha authors can put a floor on NQ's valuation at $425 million based on what NQ management thinks FL Mobile should be worth - I wish I could say the same thing about the house I bought in 2007.

Well, on May 30, 2014, NQ put out a press release announcing a strategic investment: "Specifically, NQ Mobile has signed a definitive agreement to sell up to 5.88% of FL Mobile, or up to a total of $25 million, consisting of $15 million to Bison Mobile Limited, a division of Bison Capital Co Ltd and $10 million from other investors, at a pre-money valuation of $400 million dollars or post-money valuation of $425 million. The funds will be used to further expand and enhance the FL Mobile business, brand and content. The investment has a redemption right if FL Mobile does not complete a qualified IPO within 12 months after the investment is completed."

Kinda Dumb for NQ mgt to assign 5% for $25 milion. They should've assigned 1% for $25 milion to value FL Mobile at $2.5 billion. Why not just go all - the - way?

But wait, if memory serves me correctly, NQ bought FL Mobile for about $20 million in cash and stock, creating a 21X return on their original investment in only a two year period. So it appears NQ Mobile has an incredible acumen for investment returns to land them a place as a top PE firm or hedge fund, should NQ Mobile's competency rot out from the core.

I also question the investor, Bison Capital Management Co Ltd, of Bejing China, not to be confused "in Chinese style" with Bison Capital headquartered in Los Angeles and New York. The only other holding of Mr Xu's company seems to be penny stock called AirMedia (AMCN) trading for around two bucks. But regardless of the formula NQ and Bison used to manufacture $425 mil in intrinsic value from a company with a reported $20mil in revenues, I find it difficult to reconcile.Take note of the back-out clause: if FL Mobile fails to IPO within 12 months, investors pull their money. How convenient.

Now why shouldn't FL Mobile be worth $425 million? After all, FL Mobile claims to be the #1 top publisher of iOS games in China, as you can see on their homepage banner:

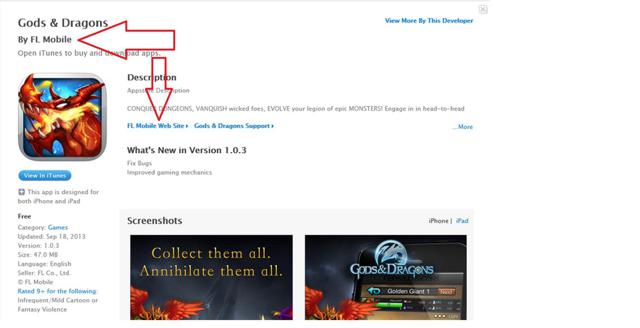

But wait, at last check today, FL Mobile is not available on iTunes and has not been available on iTunes for almost 9 months. I covered this story in a previous blogpost which shows a screenshot of FL Mobile on iTunes back then:

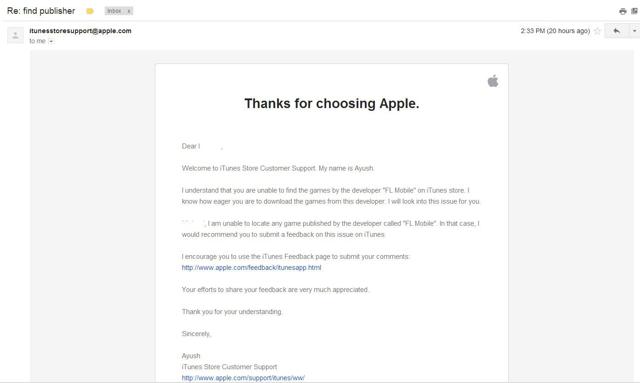

As of June 5, 2014, FL Mobile is still dubiously absent on iTunes. And then just yesterday, an iTunes representative replied to an inquiry of FL Mobile's whereabouts as follows:

So we have the "top iOS publisher in China without an iTunes publisher ID and everything's kosher?

Just curious why NQ management has never addressed this corporate absence from the iTunes store, expecially for a company and founders who have an extreme regard for brand equity.

In closing, I remind everyone of what NQ stated in their last 20-F report. Page 14 states:

"We are highly reliant on the Apple platform for a significant portion of our mobile games revenues. If Apple changes its standard terms and conditions for developers or operators and the mobile game approval process in a way that is detrimental to us, our mobile games and advertising business could be materially and adversely affected. Apple is currently the primary distribution, marketing, promotion and payment platform for Beijing Feiliu's mobile games."