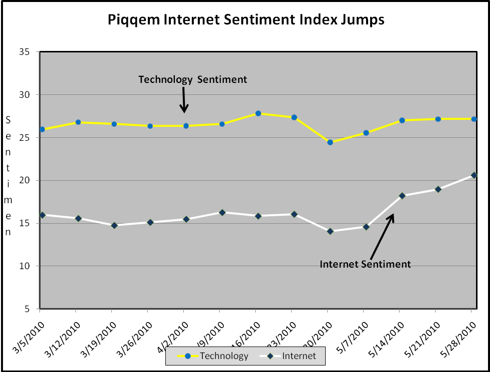

Piqqem released its weekly technology sentiment for the week ending May 28, 2010, and although the overall Piqqem technology sentiment index was flat, the internet and mobile sector showed a sharp increase. After another week of high volatility in the US equity markets, technology sentiment remained flat at 27.16. Within the technology sectors, hardware & networking was down 1.30 to end at 31.36, software and gaming was down .21 to end at 28.84, semiconductor was down .11 to end at 27.83, and finally internet and mobile rose 1.64 to finish at 20.61. A sentiment rating of 25 and above is considered positive.

Sentiment Winners & Losers

Within the technology index, Amazon (AMZN) and eBay (EBAY) led the internet sector higher, while Hewlett-Packard (HPQ), Intel (INTC), and Microsoft (MSFT) all headed lower.

About the Piqqem Technology Sentiment Index

Piqqem tracks sentiment on all securities including stocks, mutual funds, ETFs, and major market indices. The Piqqem sentiment scale runs from 100 on the high end to -100 on the low end. The actual Piqqem Technology Sentiment Index is proprietary blend of technology stocks covering the hardware, internet & mobile, software & gaming, and semiconductor sectors.

Disclosure: Disclosure: No Positions