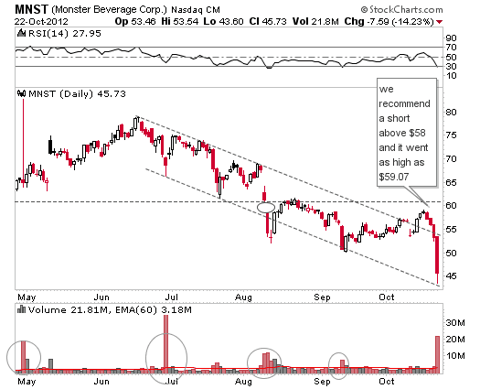

The following is an excerpt from the Sept 23rd premium update by Karen Starich. There are two particular points of interest regarding time and price worth noting after Monster's massive sell off today. At the time the update was release to subscribers MNST was trading between $54-$55 and we recommended a short near $58. The high of the counter-trend rally was $59.07.

The other is time, as Karen said this "there could be more bearish sentiment near October 20th", and that happens to be on a Saturday so the next trading day was today and I think the news coming out for Monster was decidedly bearish. Judging from the other dates she's indicated below there's more bad news coming for this stock although booking profits is always top priority for me so I would be covering some into today's sell off.

She's also written public articles on Zentrader here that go all the way back to August 12 and August 23rd detailing a bearish outlook. This was a great example of where the Astrology and Technicals lined up for a home run trade.

Financial Astrology: Monster Beverage Corp

One testimonial I received from a subscriber yesterday.

I sent a note congratulating Karen on her MNST call. This was high conviction + timing and it was great. But I wanted to thank you also - when you talked technicals on it on the previous sell off in September. It kept me in the trade for this event. Thanks pal ! I appreciate it very much and am very grateful.

Here is the actual excerpt: MNST (Monster Beverage Corp.)

MNST could be a take over target, however there are other potential setbacks for the company that could rattle investors tolerance to continue to hold their stock. The recent pullback in June was related to concerns over health risks to younger consumers that are the target in company advertising. The astrology for the IPO suggests there could be more bearish sentiment near October 20th and particularly critical on October 24th-November 29th.

Currently a Jupiter t-square in the IPO chart suggests over optimism regarding a buyout may not materialize and Neptune square Venus suggests the beverage maker could be swamped with negative media and lose consumer loyalty. As I mentioned above Neptune transits are very 'slippery' and the aspect to Venus could mean the hopes of a buyout never materialize. Consider a short position near $58.

Karen uses astrology to forecast events in the financial markets and Jeff Pierce adds in the technical picture for the stocks in focus. Astrology Traders provides specific dates and in-depth analysis of future events for the financial markets through weekly updates, trade alerts, and educational webinars.