By Poly

This is an excerpt from this week's premium update from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly. Now offering monthly & quarterly subscriptions with 30 day refund. Promo code ZEN saves 10%.

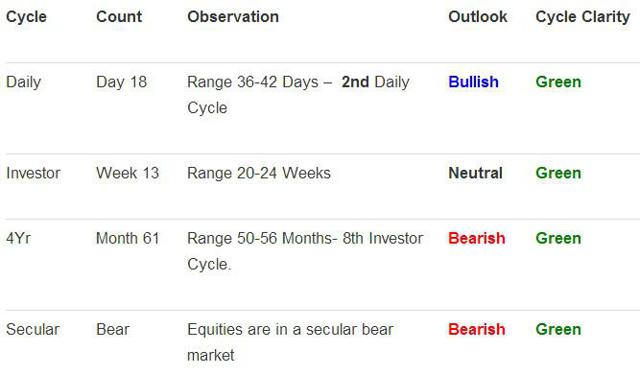

This really is a difficult environment for both traders and Investors; there is just too much uncertainty on both the short and longer term time-frames. Traders who are playing the swings are getting crushed; the moves are too sudden and never fully resolve themselves far enough to where traders can take profit. On the longer term, for the investor, the cyclical bull market is showing signs of topping, as wide divergences between the indices have clearly developed.

This is why I like to take somewhat of a "back seat" approach to the action, let the price prove me wrong and allow these Cycles to keep rolling along. For the S&P 500, it has struggled to break out of this consolidation zone, so that remains a concern. And just as the bears are obligated to sell down equities to break the long term trend, at some point soon, the bulls too need push the S&P up into new high territory to keep the rally alive.

If the past Cycles action is indicative, then that's what the S&P is about to do here. They have been sold down these past few days, but still the S&P has managed to test and bounce off the 50-daymoving average today. When we ignore the glaring divergence with the Nasdaq and Russell indices, the S&P looks bullish and poised to resume its cyclical rally into record territory.

Even the technology stocks reversed off deep losses today, while more notably, the Russell closed green after a big reversal and another successful retest of the April Lows. I believe the markets are fast approaching a cyclical market peak, but until we see Cycle failures, I continue to "run with the bulls".

Related Posts: