The day began with much anticipation for the six of us. Most of the group had made several trips to Maui, but none had explored the southwest region of the island. Four of us piled into my Jeep. Len-my VP of National Sales-and his wife, Renee, took off ahead of us in their Buick.

As we traveled south from the large hotel complexes of Wailea, we saw the coastline, crowded with the homes of the rich and famous.

After a short while, the paved four-lane highway narrowed to a two-lane asphalt road. Second homes in little seaside subdivisions begin to appear. Winding streets branched off of the main highway. Suddenly we were in a maze of lanes and often stunning architecture and gardens.

As we casually took in the views and cruised the streets, we often saw the black Buick that carried our compatriots. We'd stop and exchange "wows" and "did you see that's?" as we slowly motored through the neighborhoods. But at some point, the sporty Buick pulled away, and we lost them in the labyrinth.

The neighborhoods slid passed. The road along the sea narrowed. Eventually, we were driving just feet from the shore, enjoying unrestricted views across the bay to the surrounding islands. Gorgeous!

Soon the road was down to a single bumpy lane. But the bumps and swerves of the winding coast could not distract us from one picturesque view after another.

The road of badly broken asphalt was soon replaced with a single-lane dirt road flanked by fields of black, jagged volcanic rock. In one direction was a distant volcano; in the other, the solidified lava marched to the sea. It was hard to comprehend how a road could have been carved through such desolation.

We parked on a tiny lot carved out of the ocean's edge. A lava beach reached into the sea, and the few sightseers who had made the trek (all in Jeeps like ours) were roaming the once-molten rock in search of the plentiful shellfish that inhabited the remote point of land.

The offshore islands looked so close. You felt you could reach out and touch them, though they remained far across the shimmering aqua blue Hawaiian sea.

When we returned to our lodging, we all hurried to find Len and Renee. They were luxuriating in the pool. "What happened to you?" we all wanted to know. "Did you see the picturesque harbor, swimming hole, and the magnificent view from the southernmost point?" "Did you leave before we got there and find an alternative route home?"

"We gave up after that little seaside church and graveyard," Len replied. "The road just kept getting worse, and the Buick was taking a lot of pounding. You're lucky you had the Jeep."

After many trips to Maui, I knew I would need an all-terrain vehicle to smooth the journey over its rough backroads and trails. For the same reason we, here at Flexible Plan Investing, introduced a new investment platform last week called "All-Terrain Investing."

This separately managed account service for mutual funds or ETFs offers six strategies. Each strategy is designed to carry investors through the bumpy financial roads of today's financial markets.

All-Terrain Investing finds its roots in the quest for a permanent portfolio allocation solution that could be used regardless of the ups and downs of the stock market. It is an outgrowth of the old 60% stock/40% bond, balanced portfolio that was once the favorite of institutional investors.

Later Harry Brown, a famous perma-bear of the '70s and '80s, updated it to The Permanent Portfolio. Today, Ray Dalio's Bridgewater Associates, the world's largest hedge fund, purportedly uses his variant, called the All-Weather strategy, to manage half of their billions under management. Tony Robbins came out with a book a year or so ago where he suggested an alternative version, the All-Season strategy.

From these differing, but similar, names, you probably get the picture of what each attempts to do. Historically, they seek to yield a solution that performs well in all markets. They start with asset classes that over the long run have seen their value grow. They also are asset classes that have tended to march to a different drummer. They are not very correlated in their price movements, as we say in "Quantland."

For example, when stocks go down, bonds, gold, and commodities often go up, and vice versa. In fact, we did a study of asset classes back to 1972 and found that bonds and gold were the least correlated of any asset class with the movements of the S&P 500 stock market index.

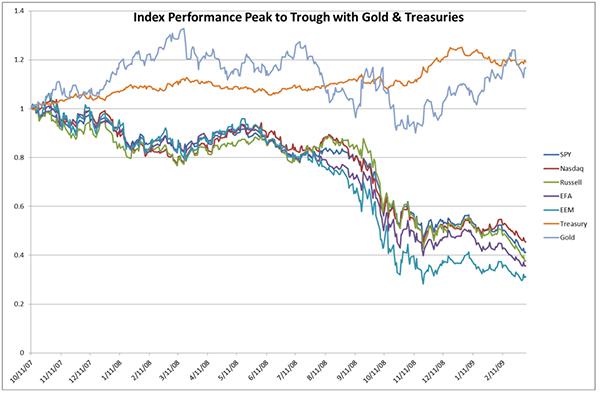

This is very different from the usual view of diversification on Wall Street. Most firms focus on portfolios diversified by many different equity types, like small versus large, and foreign versus domestic. But we know, from the 50%-plus S&P 500 crashes of the last decade that when the S&P 500 tumbles these equity diversifiers all tend to go down together. They provide no diversification when it's really needed, as this chart from the 2007-08 collapse demonstrates.

Source: Flexible Plan Research

These Wall Street diversifiers often do use bonds to reduce risk. But they apportion the portfolios as if bonds and stocks have about the same degree of risk. They suggest that the portfolio should have about a 60%-40% equity tilt versus bonds, seemingly blind to the fact that stocks are two to three times as volatile as bonds, leaving these portfolios more stock market heavy in their exposure to risk than most investors realize.

Flexible Plan's All-Terrain Investing follows in the footsteps of its All Weather predecessors. However, while they are all static, passive allocation structures, only one of our six follows this model. As active managers since 1981, we offer five dynamic, risk-managed versions as well.

Joining All Weather Static is a leveraged and unleveraged rotational style called All Weather Dynamic. In addition, we have a tactical, market-timed-if you will-variety called Trivantage, available with and without leverage.

Finally, we brought out a fundamentally based version called Smarter Beta. Smarter Beta invests exclusively in smart beta ETFs-those ETFs created with a fundamental tilt away from market-cap-based indexes like the S&P 500. Research has shown that these often have outperformed the traditional indexes.

However, with close to 400 of these ETFs now available, it is difficult for any investor or advisor to analyze them and create a realistic portfolio solely of them. Smarter Beta is the first effort that we are aware of to do so, and, of course, we have done so while adding our dynamic risk management to its operation.

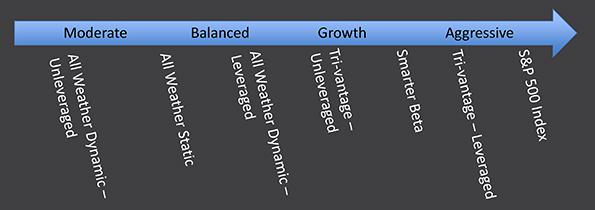

As the chart below demonstrates, these All-Terrain methodologies span a wide range of client suitability. Yet, they all seek a single goal: to protect investment dollars and deliver a smoother investment road through financial market volatility. Check out their recent performance in the strategy section of the Hotline.

Certainly, the last two months have demonstrated just how volatile the financial markets can be. Stocks and bonds have fluctuated up and down in large moves throughout this period. We saw the depths of the August plunge both preceded and followed by stock market near-all-time highs. And bonds have risen and fallen with every opinion uttered by a Federal Reserve Board member or media talking head. Today, we wait yet again on an announcement of an expected rise in their discount rate.

To combat this run of volatility lately, I've been looking ahead only a week or so in trying to divine the stock market's future course. It is just that fraught with uncertainty. Two weeks ago I was bearish for the week, and then switched to bullish last week.

This week I'd have to come down on the side of the bears, although I think it is a closer case than in the other two weeks. After last week's 3%-plus climb in stock prices, the market has returned to short-term overbought territory.

Earnings reporting for the third quarter came to an end with Walmart's report last week. It has been one of the weakest sessions in some time. Earnings provided fewer positive surprises than any quarter in the last year. Reported revenues had the least positive results versus expectations since the bull market began in 2009.

Interest rates continue to trend higher. While this is a negative, it is also true that most of the anticipation of a rate hike seems to already have been baked into stock and bond pricing. Of course, the problem is that the day after a rate hike is finally announced, the market will begin speculating about the next increase and the cycle of uncertainty will just repeat itself.

The only indicator that seems supportive of higher stock prices in the very short term is seasonality. Thanksgiving week is normally a period of rising prices, especially on Wednesday and Friday. Still, the first two days of the week tend to be directionless, and the Monday afterward is downright bearish. Add in that Thanksgiving positive seasonality is weakest in the year before presidential election years and it is difficult to see the lone indicator carrying the day. Again, this is very short term in outlook.

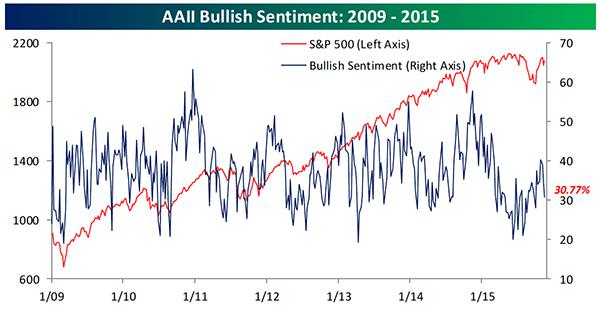

Looking at the chart below of ACII small investor bullish sentiment, it is easy to see why investors need an all-terrain vehicle to navigate the ups and downs of financial market emotion.

Source: Bespoke Investment Group

To that end, we hope that our new All-Terrain Investing strategies can find a place in investor portfolios to help them traverse the bumpy and winding roads that are likely just around the corner, to reach their sought after destination farther down the investment highway.

All the best,

Jerry