I love earnings season!

As a fundamentalist, it's a time to go over the data and get a better picture of how these companies we invest in are doing. How each sector is performing gives us a clearer picture of the overall economy and, of course, there are tons of quick-trading opportunities as those crazy speculators are willing to pay us huge premiums on both sides of any bet we're willing to take. We just have to play the role of bookies.

Take AA, for example. It reports this afternoon. Although the stock is just $9.10, we can sell the Jan 2015 $7 puts for $0.80. That would, at worst case, put us into the stock at net $6.20, which is a 32% discount to the current price. In fact, if we're willing to risk owning AA at net $7.70 (still a 15% discount), we can buy the 2015 $7/10 bull call spread for $1.50 and now we're in a $3 spread that's already $2.10 in the money for net $0.70 (because we sold the Jan 2015 $7 put for $0.80 along with it). Our maximum gain with AA at $10 in Jan 2015 is $2.30 but that's a solid return on our money. (There is also a net $0.70 margin requirement according to ThinkorSwim). If you REALLY want to own AA for net $7.70 as a long-term investment - there's not much downside.

I love trades like this on blue-chip companies. Earnings tends to pump up the prices you can sell puts and calls for, so it's a great time to take advantage and, as I'm reviewing the Income Portfolio for our Members, we're actually finding quite a few new long-term entries just like AA, which I've highlighted in blue under each relevant review.

I love trades like this on blue-chip companies. Earnings tends to pump up the prices you can sell puts and calls for, so it's a great time to take advantage and, as I'm reviewing the Income Portfolio for our Members, we're actually finding quite a few new long-term entries just like AA, which I've highlighted in blue under each relevant review.

On ALU, for example, although we've already made 166% off our initial entry, we still have another 38% to go through the end of the year. While 38% sounds very dull compared to 166% - it's so deep in the money now that it's attractive as a new trade - even with the lower rate of return. I had mentioned our ALU play in our Morning post, on October 18, when the stock was still $1.10 (now $1.73) yet there are still people who don't think it's worth less than $2 a day to have our morning posts delivered to their Inbox every morning before the market opens…

We're actually going to do an experiment this year and set up a virtual portfolio for the picks I make in the morning posts. It will be tracked on an independent site that people can follow so, hopefully, we can get the great and powerful Mark Hulbert to rank us, as we'd be right near the top if he did. That would be great exposure for our newsletters (try here).

We have asked to be ranked before, but no luck, so we'll do a little self-promotion this year for the PSW Report (our twice daily Emails with site access), Stock World Weekly (our weekly, executive review of the markets) and Market Shadows, which is a new report we send out to Report and SWW subscribers, sort of weekly.

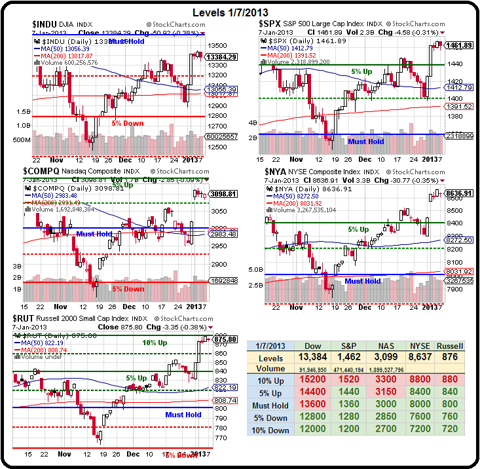

Our indexes are still wriggling around between the 4 and 5% lines we laid out last week at:

- Dow: 13,319 & 13,447 (finished 13,384)

- S&P: 1,442 & 1,456 (1,461)

- Nas: 3,028 & 3,056 (3,098)

- NYSE: 8,580 & 8,660 (8,636)

- RUT: 858 & 866 (875)

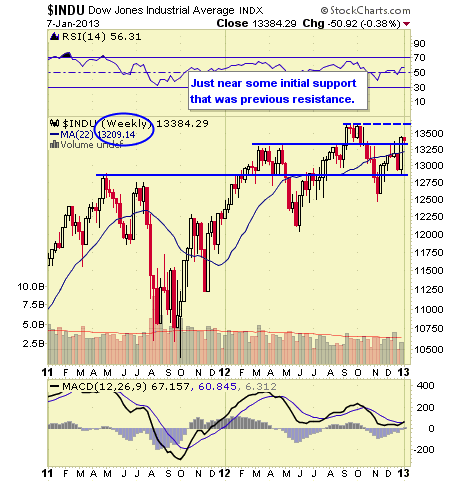

So we still have 3 of 5 of our indexes over the 5% lines but those are previous spike lows, not our longer-term 5% lines, where we're waiting for the Nasdaq to confirm a move up. The Dow is still seriously lagging and has yet to cross over its Must Hold line at 13,600 (see Dave Fry chart), which was our problem all of last year. It at least signaled the big drop in October when the Dow failed right at that line. That means we're going to have to take it very seriously but we're currently hoping the 3rd time will be a charm. The RUT topped out at 868 in September and now made it over that line, giving us hope.

So we still have 3 of 5 of our indexes over the 5% lines but those are previous spike lows, not our longer-term 5% lines, where we're waiting for the Nasdaq to confirm a move up. The Dow is still seriously lagging and has yet to cross over its Must Hold line at 13,600 (see Dave Fry chart), which was our problem all of last year. It at least signaled the big drop in October when the Dow failed right at that line. That means we're going to have to take it very seriously but we're currently hoping the 3rd time will be a charm. The RUT topped out at 868 in September and now made it over that line, giving us hope.

We finished off our day uncovered on our AAPL longs as we got a dip right to our $513 target (again, the 5% Rule rules!) and finished right at our $523 target so now we're looking for $531 this morning. Another failure there is going to lead to at least some partial covers on both AAPL and the Qs. (For more on Apple, read here >)

Treasury has some short-term notes to pawn off today and we're not expecting any trouble there but tomorrow is a 10-year auction and Thursday is a 30-year auction and they are going to be tough sells, so expect a bumpy ride. There's also an ECB meeting this weekend so more madness from across the pond.

MON had earnings this morning and knocked them out of the park with a .25 beat at .62 (67%) and a 10% beat on revenue, just shy of $3Bn. MON also raised guidance to $4.40 per $96 share for 2013 and that's got a good chance to push it over $100 this morning, where it will probably make a nice short. It's a bit stretched with a forward p/e of 22.7. If you want a real bargain - BA had an fire on a 787 and should be down around $75 again, where we can look to sell 2014 $55 puts for $5 for a ridiculous net $50 entry. Maybe we can get $10 for the $70 puts and risk a net $60 entry in the Income Portfolio - we'll decide later.

YUM is also getting crushed after serving contaminated chicken. It issued a warning that same-store sales will be off by 6% this Q, but it had already forecast a 4% hit and has held $62 on several occasions. This could be a good time to take advantage of a cheap entry, selling July $62.50 puts for $4 or maybe $5 if there's a good dip - just taking advantage of bad news ahead of earnings. The 2015 $50 puts can be sold for $5 for a net $45 entry (30% off current price which is already 15% off the pre-news top at $75). TOS says the net margin on that is just $5 so you either make a 100% gain on margin in 24 months or you own YUM at it's lowest price since 2010.

*****