Taken From Connecting The Dots...Provectus Pharmaceuticals (January 25, 2013).

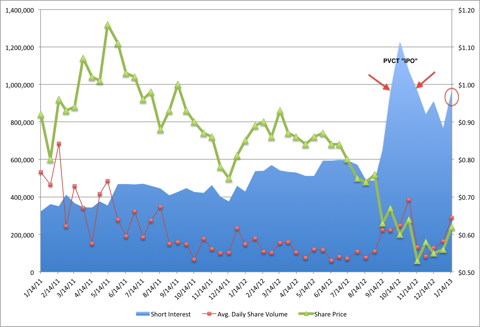

Short interest at 1/15/13 (964K) increased by ~26% over 12/31/12 (766K), and was last seen two months ago at 11/15/13 (966K), the aftermath of the now terminated PVCTP "IPO," and three-and-half months ago at 9/28/12 (959K), the beginning of the "IPO" chaos.

I am a little surprised, yet perhaps not surprised, by the uptick in short interest. I can understand why it is happening. There probably is some modest shorting of the stock (why one would short a penny stock mystifies me at a very low level; it's like rubber necking in some regard), say a couple of hundred thousand shares, because of the share price run-up through January 11. It also could be the balance of the short interest, above the historically innocuous 400-500K level, is related to the continued conversion of the preferred shares (hundreds of thousands of shares?) by funds like Revelation and others.

These funds probably have sold more of their since-converted-into-common shares earlier in the month and late last month (as they look to complete their departure from the stock) when buyers from two locales (one domestic, one international) bought shares. They probably also further knocked the share price down to current levels, which were of course last seen before the late-December/early-January share price run-up.

Despite management's efforts to bring so-called "serious" life sciences investors into the stock, these folks remain firmly on the sidelines. I appreciate Peter's tenacity and persistence.

What will it take to bring the life sciences folks in and the generalist funds in and/or back? A little more time: say, a month or two.

For the former, it is looking more and more like what is necessary is the revelation of the highly anticipated Moffitt data (combined with profound statements like "…the nearest thing to a cure for cancer we've seen.") A China regional oncology deal and the SPA will of course help a lot, too. Ironically, both of these should arrive [very] roughly around the same time as Moffitt's data, conclusions and declarative statements begin to be and are fully unveiled.

For the latter, it will take more mass awareness and an upward moving share price whose momentum-based vortex subsequently draws these investor types into and back into the stock.

Disclosure: I am long OTC:PVCT.

Additional disclosure: I am a large shareholder of Provectus Pharmaceuticals. I have not sold any shares as of this Instablog submission.