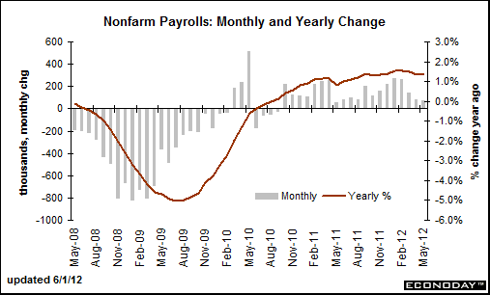

The lousy job report of 69,000 was very disappointing as for the past 4 months job growth has been declining. This decline came after a 3 month period of over 200k jobs being made each month. It lowered to just below 200k then went to the low 100k then came May with a consensus of a gain with 150k but when the job report came out on Friday it came out with a very disappointing 69k.

The lousy job report of 69,000 was very disappointing as for the past 4 months job growth has been declining. This decline came after a 3 month period of over 200k jobs being made each month. It lowered to just below 200k then went to the low 100k then came May with a consensus of a gain with 150k but when the job report came out on Friday it came out with a very disappointing 69k.

This decline is showing in ever single industry and ratio, including the market. But some of this decline is good for the market but bad at the same time. A good thing that is declining with the economy is inflation which is at an usually low rate of 2.3% as of April. This data is only good for the economy but a barrel of oil fell below $90. This might seem good as gas prices will be lower but this also hurts the economy as oil producers and exporters don't get the same income as before. Also home sales were 10% in April then a year ago and now in May home prices are up 5% from this time last year. This is a stat that economist tend to like lower, so forth making this a bad number. So this might seem bad for the buyer but good for the seller but most likely the buyer will be selling their house getting the extra 5% but the seller is almost always going to be buying a house to move into having to pay 5% more than last year. So this equals out for both individual making it a very stable ratio. These numbers would all be thought of as bad results and shows what is going in the stock market.

The stock market after Friday is now in a decrease in price from a Year to Date stats. This has come from 6 months ago when the stock market was at its peek 10% above its Year to Date. Now don't you see a trend between the jobs and market. The stock market was at its peek 6 months ago same with the jobs. It had 3 months in a row of the same good results like the jobs report. Then starting March it started a large decline of over 10% just like the jobs report. Now the reason these two trends are so similar is because the amount of jobs added is increased or decreased by the amount of money the company contains. Now if the market is in a bull state and companies are gaining unusual amounts of money then the jobs added goes up. But Europe and its debt caused investors to fear causing investors to pull out of the market. This brought prices down or the companies worth went down. This made companies have to either lower the amount of hiring or cut jobs. Now this is shown by many banks like Wells Fargo (WFC), JPMorgan Chase (JPM), Morgan Stanley (MS), Goldman Sachs (GS), and Bank of America (BAC). These bank promised to cut over 100,000 jobs combined! And Yahoo (YHOO) but 30,000 jobs. Now they probably during this firing they weren't hiring many employees were they. So if the companies have less money than they hire less people, and companies have less money if products to sell are worth less and the market goes down. Then if you link the cause to the decrease in the stock market, Europe, which has scared investors out of the market making it decline. So now just think if Greece leaves the Euro zone. What will happen then, the job report might go into the negative! This is important to remember and is why it is important to watch Europe, because if it has another problem then there's the reason why the job report will be so low.