In this article I am going to take a detailed look at AAPL to determine if an investment in Apple is a good choice for a dividend growth investor. I'll start with an analysis of the last 10 years of financial data and then try to answer a few simple questions about the company, its products and its customers.

Perhaps surprisingly I am not going to make any comparison between Apple, Samsung and Blackberry products because this has been done to death in other articles already. Instead I will only look at Apple's financial history and the strengths and weaknesses of their current management team.

So: should we go long Apple? Let's find out.

Ten years of financial data

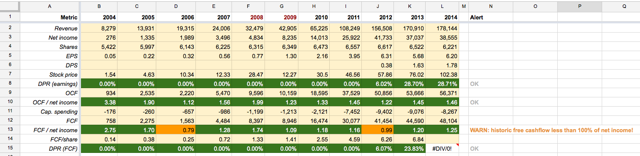

Let's start with the last 10 years of financial data. At first glance everything looks fine. Revenue and income are steadily rising over the years and both operating cashflow and free cashflow are very healthy. There are only two warnings for 2006 and 2012 (the two yellow spreadsheet cells) when free cashflow drops below 100% of net income, and we can safely ignore the 2012 warning because an FCF of 99% of net income is nothing to worry about.

Steve Jobs hated borrowing money and preferred to build up a large reserve of free cash instead. We can clearly see this in the financial history: FCF is smooth as butter in the last 10 years with not a single year with a negative value.

Also clearly visible is Tim Cook's decision to start paying out dividend in 2012, something Steve Jobs was always dead set against. FCF / net income dips briefly to 99% in 2012 and then jumps back to 120%. This suggests that Tim Cook continues to set aside roughly 120% of net income as free cash and uses the remaining earnings to pay out dividend.

During the great recession of 2008-2009 both revenue and earnings continue to rise as if the recession never happened. Notice that EPS keeps rising without Apple have to resort to a share buyback program. Steve Jobs did a truly remarkable job guiding Apple through the recession.

Debt

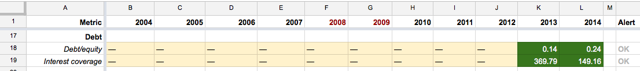

As I mentioned before Steve Jobs hated borrowing money and preferred to build up a large reserve of free cash instead. Tim Cook is more open to borrowing money when needed. Our only datapoint for debt is 2013 which shows a very healthy debt/equity ratio of 0.14 and a whopping interest coverage of 369.

Everything looks good, but with only two years of data we cannot really derive any meaningful conclusion about how Apple handles its debt. Time will tell.

Performance

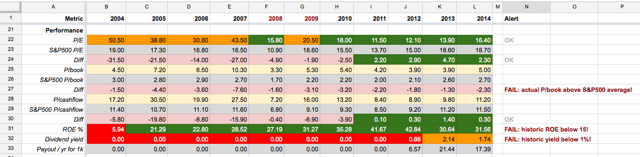

Apple's performance is nothing to worry about. Both the P/E and the P/cashflow are lower than the S&P500 average with only the P/book slightly above. The current P/E value suggests that Apple is underpriced.

My spreadsheet shows an alert for the ROE but on closer inspection the faulty value turns out to be from 2004. Warren Buffet once mentioned in a Forbes interview that exceptional companies always have an ROE of over 20, and Apple qualifies if we start counting from 2005. I give them a pass on this one.

The dividend yield in 2013 is 2.14 which is not spectacular. And with only three years of data it is very hard to calculate a trend over a longer period of time. Time will tell how Apple handles its dividend payments in the future.

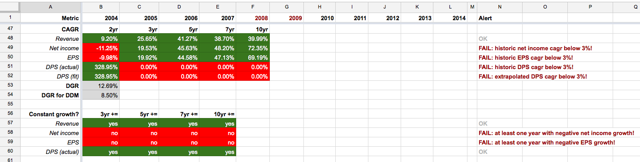

Dividend growth

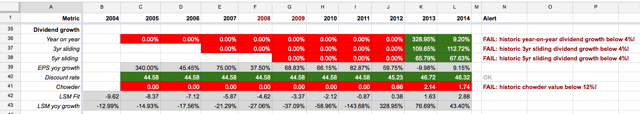

Dividend growth investors usually pick their stocks from the Dividend Aristocrats list. Each company on the list has at least 30 years of continuous rising dividends. Apple has thee years of rising dividends and so most of the dividend growth values in my spreadsheet are zero and highlighted in red. I have three alerts complaining about 1-, 3- and 5- year sliding dividend growth averages being below my minimum healthy growth value of 4%.

The Chowder value calculation also breaks down because it uses the 5-year compound annual DPS growth rate and we have less than 5 years of dividend data.

Then again the discount rate (dividend yield + 5-year EPS compound annual growth) is at a super impressive 46.32, way over the minimum value of 10 I consider healthy. Apple really has spectacular earnings growth.

The bottom line? The discount rate looks good but there just isn't enough data to say anything meaningful about dividend growth.

Annual growth rates

Apple has enjoyed an unbroken 10-year period of revenue growth with a 5-year compound annual growth rate of 41.27% and a 10-year rate of 39.99%. EPS growth is also spectacular with rates of 44.58% and 69.19% respectively.

Slightly worrying is a net income drop in 2013 of -11.25% and a corresponding EPS drop of -9.98%. This is the only time net income and earnings dropped in the last 10 years, but the recency of the event (last year!) is cause for worry.

With only three years of dividend data I get an absurd DPS growth rate of 328.95%. The corresponding 20-year forward dividend growth rate is an equally absurd 12.69%. I have to use an adjusted DGR of 8.5% to prevent the DDM calculation (in the next section) from breaking down.

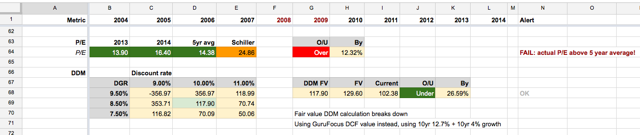

Fair value

Apple's P/E is lower than the S&P500 average but 12.32% higher than the 5-year average P/E. This is not a bad result and suggests that the stock might be undervalued.

I did a DDM fair value calculation, but the dividend growth rate from the previous section is way too high and causes the DDM calculation to break down. So I use an adjusted DGR of 8.5% instead and this gives a fair value of $117.90 per share.

But notice the share prices in the DDM matrix. There are huge differences between neighboring cells and the top-left value is negative. This is an indication that we're pushing the DDM algorithm to its limit. The dividend discount model works best with long smooth dividend payout histories and it simply cannot handle Apple's short three year history with extreme dividend growth.

To get a better fair value estimate I use the DCF model instead. Again I need to adjust the EPS growth rate down to a more realistic value. I decided to use my 20-year forward DGR value of 12.7% with a terminal 10-year 4% growth and get a fair value of $129.60, which seems more or less in line with what analysts are saying.

Based on this highly off-the-cuff calculation Apple is underpriced by 26.59%.

I made arbitrary changes to the DGR value and fed the dividend growth into the DCF model instead of the earnings growth. This should tell you one thing: because of Apple's extremely large earnings growth it is extremely hard to calculate a fair value. The company seems to defy analysis.

Financial summary

So to sum up: Apple's 10-year financial metrics are great and the earnings growth is truly spectacular. But:

- EPS shrunk by almost 10% in 2013.

- There is only 3 years of dividend data.

- It's very hard to calculate the fair value.

Q&A

For a qualitative analysis I like to ask a few simple questions about Apple, its products and its customers. By trying to answer my own questions I discover if I actually understand the company and its business model.

The great Warren Buffett once told shareholders in 1977 that his company would only invest in a business that the directors could understand. This is sound advice that I intend to follow.

Do I understand Apple's products and market?

Yes, I do. Apple produces aesthetically pleasing and elegantly designed consumer devices that adhere to Dieter Rams' 10 principles of good design (source). In this regard Apple resembles a fashion brand, and this is why comparisons between Apple, Samsung and Blackberry miss the point. Apple customers don't really care about point-by-point feature and price comparisons between Apple products and competitors, but instead care more about the elegance, aesthetics and fashionableness of Apple products.

Apple's biggest threat is not that a competitor manages to match its product features at a lower price point, but rather that the Apple brand itself goes out of fashion.

Apple customers are anybody who appreciate aesthetics and elegance and who is willing to pay a premium for it. This includes "hipsters", graphic designers, artists, musicians, but also anyone who appreciates the reliability and trustworthiness of Apple products.

20 years in the future we will still have people around who appreciate aesthetics and elegance and are willing to pay a premium for it, so if Apple can remain fashionable their business model and market will be future-proof.

How wide is Apple's moat?

Apple's moat is fairly wide because Apple is large and can put devices into the hands of millions of customers, but especially because in the market segment of aesthetically pleasing and elegantly designed consumer devices Apple is operating virtually alone without strong competition.

Several device makers are trying to compete with Apple including Samsung, Blackberry, and Microsoft. But no company has ever fully replicated the business model of providing a fashionable premium product with an outstanding end-to-end design elegance.

There have been close calls. Blackberry did a really good job with their e-mail friendly keyboard and Microsoft's Metro user interface is very original and a joy to use. But neither Microsoft or Blackberry made design a core company value and it shows.

For now I'd say Apple has no real competition in their market segment and that gives them a wide moat.

Could an idiot run Apple?

This might seem like a weird question but if you're going long with a specific company chances are that eventually your favorite management team will leave and less qualified people will take over. The question is how big of a problem this is going to be.

If a less competent management team ever takes over at Apple I would say the party is over. In the past Apple's lead came entirely from Steve Jobs driving his vision of design excellence through the entire company. After his death Tim Cook took over. Tim Cook lacks Job's instinct for design but he is aware of this and has delegated this responsibility to Jonathan Ive and Craig Federighi (source)

Right now Apple's finances and operations are in safe hands with Tim Cook, and Jonathan Ive is doing a fine job maintaining Apple's lead in design. But if Ive ever decides to leave the company Apple will have a big problem.

Conclusion

In conclusion I have to admit that Apple is not an outstanding choice for dividend growth investors (or anyone else going long for 10-20 years). There are many possible threats:

- The dividend might be cut at any time. We know Jobs disliked dividends and Tim Cook is more open to the idea. But what happens when Apple gets into rough weather? How committed is Cook to this new policy? We simply don't know.

- Steve Jobs was a genius with an instinctive understanding of good design and elegance. Tim Cook lacks this skill and depends on Jonathan Ive to keep running the show. Is Ive going to continue his work for the next 10-20 years? Who will take over if he does not?

- In the past a less competent management team brought Apple to the brink of bankruptcy. The current team is doing a fine job but will they stick together for the next 10-20 years?

- The media loves to bash Apple (see "Bendgate" for example - source) and the stock price is sometimes affected by this hype. Could a manufactured scandal sometime in the next 20 years wipe out all of the capital gains?

There is also a lot to like about Apple:

- Apple has loads of available free cash that they can use to pay out dividend. If dividend ever stops it probably will not be because of lack of cash.

- Apple's earnings growth has been absolutely spectacular. It has been so large that it is very hard to calculate fair value.

- If we ignore 2013 Apple has had 9-years of continuous revenue and income growth.

- Apple is a market leader without strong competition in its niche.

- The current management team seems very competent and is friendly to shareholders.

These facts make me confident that Apple is going to pay out a steadily increasing dividend year after year, and made me decide to go long.

But the threats are worrying and so I'm keeping Apple on watch and I remain ready to sell if anything bad happens down the road.

I like Apple but the company needs to prove themselves to me first before I let down my guard.