by Scott Murray & Mark Gomes

Back in June 2014, PTT cautioned subscribers that while the boom in energy production was bound to benefit parts of the US economy, it would be a destabilizing factor abroad, specifically in Russia. US shale oil and natural gas were taking market share from other producers, both at home (shrinking the export market for Saudi oil) and in Europe (putting pressure on Russia's economy).

Despite excess supply, many analysts were predicting $150 oil. While we are not energy experts, even PTT had to acknowledge the potential for a temporary energy shock due to deterioration of security in Iraq.

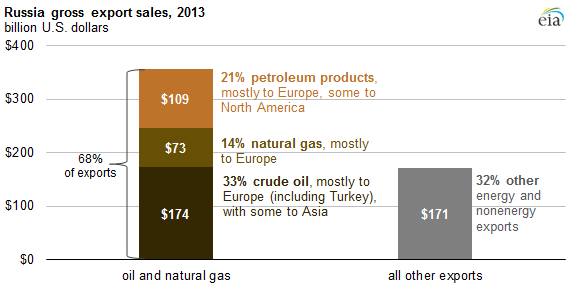

In keeping with our methodology, we declined to predict any short-term prices. Russia was nonetheless clearly at risk, with 10% of GDP accounted for by a single energy company (Gazprom) and 68% of exports consisting of oil and natural gas .(Source: EIA)

.(Source: EIA)

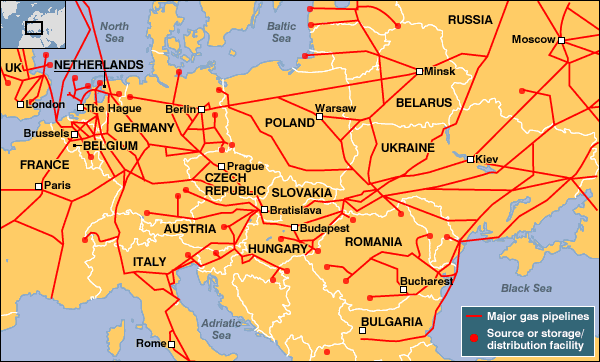

Up to 60% of Russia's natural gas exports to the EU flow through Ukraine. This helps explain why Vladimir Putin allowed Russian separatists to draw him into a conflict in the Western-leaning state:

As long as the price of oil remained elevated, Putin had at least a chance of negotiating a slow decline. Gradual loss of energy market share (in addition to sanctions over Ukraine) would probably have hampered the Russian economy over time. Instead, the Saudi Arabia crippled it in a matter of weeks.

Why did the Saudis say they refused to pull any levers at OPEC to keep the price of oil high? To protect market share.

When we identified the US energy boom as a source of risk and Russia as its most likely victim, we could not foresee that it would prompt an OPEC decision that would gut Russian GDP and crumple the ruble. The lesson? It is almost always impossible to predict exactly how things will play out. But it is possible to discern risk, to protect one's portfolio, and even to profit from market declines.

Not long after our first comments about Russia, we issued a Yellow Alert, suggesting hedges such as short positions in IWM (the small cap index) and HYG (high yield bonds). We chose US ETFs as hedges for two reasons. First, we are invested in US stocks. Second, the US economy was exposed to the risk it had created by taking market share from other countries.

Within four months, IWM tumbled 10%. HYG caught up in December. As plummeting oil created uncertainty and divergence in the market in early December, we issued a second Yellow Alert that netted more agile readers another 4% in as many days. (Both our hedges and our core long positions remain in place.)

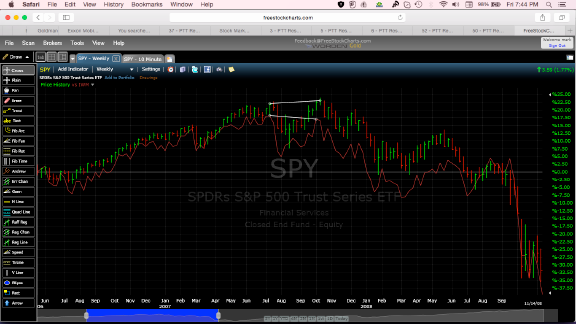

We have highlighted IWM and HYG as hedging vehicles several times since late 2013. Higher-yielding assets often express early symptoms of market risk, evidenced this year by the flat-to-down returns of the Russell 2000 and high-yield bonds. Investors who are watching the S&P and Dow continue to rise should take note of the dynamic that unfolded in 2007, when the Russell peaked 3 months before the S&P.

We are not there yet. We have not seen a clear peak in IWM, though it is up only marginally from a year ago. If there are improvements in housing, Ukraine, Europe or China, the indices may keep clawing higher for another year. As we say often, we are not market timers, but we do encourage you to protect your portfolio in times of elevated risk.