Bullion traditionally refers to gold, silver and other precious metal bars and is one of the oldest stores of values worldwide. Over time gold bullion has gone through a number of iterations in terms of its role in society; to begin it was and continues to be a sign of wealth and opulence, it then became a form of currency through the Gold Standard, and today two of its principal functions are as a store of value and as a "safe haven" investment within an investment portfolio. In addition, gold bullion has a community of buyers through the jewelry and technology (used for its conductive qualities) channels, as well as among many central banks, which tend to buy gold in an effort to diversify reserves. Though demand and supply for gold bullion have ebbed and flowed over time, it wasn't until gold futures contracts hit the scene in 1975 that gold's popularity within the investing community grew, while with the introduction of gold ETFs its prevalence became mainstream.

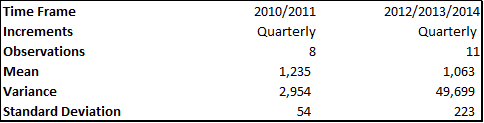

In recent years, as investors have increased their focus on portfolio diversification and investment options meant to reduce risk during times of market turmoil, the distinct market influences (i.e. currency movement) that typically motivate gold prices, drove many to integrate a gold allocation into their portfolio, which they did through options or physical ownership. It wasn't until the exchange traded fund (ETF) SPDR Gold Shares (GLD) was launch by State Street Global Advisors, in November, 2004, that investing in gold became a household norm. Though there is no doubt the gold futures market made trading the metal much easier, since futures contracts are not backed by an actual asset, futures tended to attract a more sophisticated investor base (i.e. CTAs, hedge funds), while with the introduction of the GLD ETF, which provides interest in a gold trust, gold shares become available through the NYSE. Much of the recent gold price volatility can be traced to ETF activity, which includes both speculative and emotion based trading. The below table provides standard deviation calculations for gold tons held by the popular ETF GLD. Over the last 11 quarters, the standard deviation of gold tons held in the ETF was 223, while over the prior two years (2010 and 2011), it was significantly lower at 54. What this might suggest is that the heightened volatility in the bullion market is associated with the ETF holdings.

Data: spdrgoldshares.com

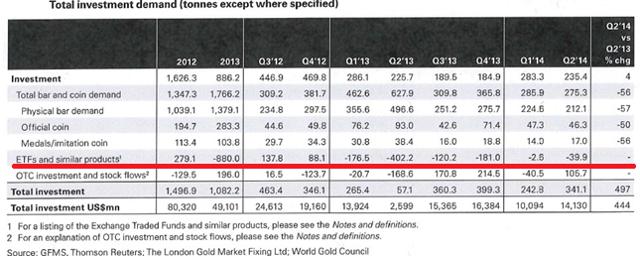

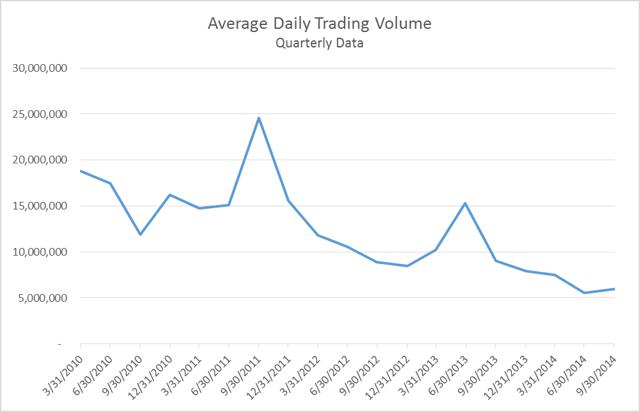

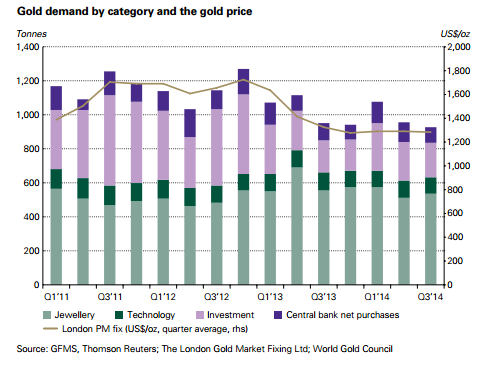

As you can see from chart 1, purchases made by central banks, jewelry and technology buyers have remained relatively consistent, while demand from investors has been variable. To further highlight this point, chart 2 breaks down the investment category into bars/coins and ETF demand. In general, investments have experienced the largest swing quarter-over-quarter, but most striking is the negative demand within the ETF universe in Q2 2013. For 2013 in its entirety, ETFs sold 880 tons of gold in response to investor redemptions, while a year earlier, positive sentiment dictated an environment of solid demand. We believe that today and going forward, much of the selling pressure within the gold market has come from ETFs and we are of the opinion that at this point, the majority of those sellers have removed themselves. To further highlight this idea, please refer to chart 3, which provides average daily trading volume for GLD from 2010 through Q3 2014. Volume has been on a downward trajectory as owners of GLD reduce or sell out of their gold position.

Chart 1

Chart 2

Chart 3

Data: spdrgoldshares.com

For this reason, we would not expect to see the same level of price volatility as we have in recent quarters. Given that the price is nearing (and for some miners has fallen below) the cost of production, signaling a potential price floor, while gold bullion is actually quite attractive for most international (non-USD investors) buyers, we are comfortable holding and potentially increasing our allocation to the metal. We have and continue to be long-term investors in gold bullion, believing that the finite amount of supply and growing demand will favor investors like ourselves. In the short-term it is imperative to remain cognizant of the sentiment within the gold investor community, as this will very likely play-out through ETFs, which for better or for worse, have become a major part of the gold market. We should not lose sight of the main reasons people invest in gold, as a safe haven and an inflation hedge. As of this writing, the TIPS market expects inflation to average approximately 1.8% per year for the next ten years. Might this be an opportunity to add protection from a higher inflationary environment few are expecting in the form of gold?