On September 9, 2014, Apple (APPL) introduced Apple Pay, a mobile payment and digital wallet service. The premise is simple. Using near field communication (NFC) technology in its iPhone 6, iPhone 6 Plus, and the upcoming Apple Watch, Apple Pay offers a more convenient, secure and private way of paying for your purchases at retailers.

Partnered with American Express (AMEX), Visa (V), Mastercard (MA) and a number of banks including , Apply Pay launched on October 20, 2014. Already, many retailers are reporting high adoption rates. Chase reported seven times more issuances of cards for the Apple wallet than traditional plastic cards on launch day (Source).

There are numerous competitors in the mobile payments field, including unsuccessful attempts by Google (Google Wallet) and Paypal.

Aside from Apple Pay, one of the only mobile payments systems gaining traction among retailers is CurrentC. The service has not launched and is still in pilot mode. Yet, it has already prompted two members of the consortium developing CurrentC, Rite Aid and CVS, to disable Apple Pay at their terminals, implying an agreement to exclusively use CurrentC for mobile payments.

Both systems require willing adoption by consumers. Thus, let's examine the incentives for consumers to switch to either Apple Pay or CurrentC.

Convenience

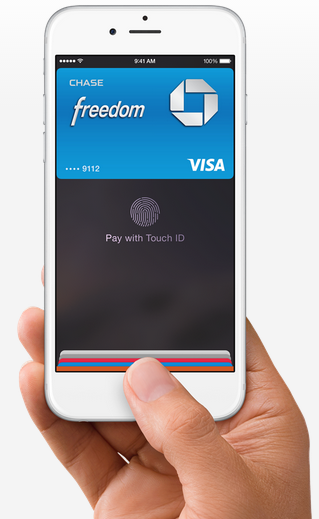

One of the major selling points of Apple Pay is its convenience over traditional credit cards. It eliminates the need to search through your wallet for the right card. With NFC technology and Touch ID, you can simply hold your iPhone near the contactless reader, scan your fingerprint on the home button and then the payment is complete.

(Source)

In contrast, CurrentC uses QR codes. You must unlock your phone, open the CurrentC app, open the code scanner and scan the QR code on the cashier's screen.

(Source)

Advantage: Apple

Security

Apple Pay also promises more secure payments. Rather than allow everyone nearby to see your credit card number, Apple Pay uses a unique Device Account Number stored only on your iPhone of Apple Watch to transact. Each transaction generates a specific dynamic security code sent to the merchant. Thus, your credit card numbers are never sent to the merchant or to Apple.

Similarly, CurrentC uses an encrypted token to transact. This token is decrypted and translated by the financial institution to process your payment. Therefore, it also protects your financial information from wandering eyes and from being sent to the merchant.

Advantage: Neither

Privacy

Apple's motive is clear. It wants to profit from your transactions by extracting a fee from credit card companies and financial institutions while encouraging the sale of its hardware products. They don't want to know the details of your transactions. They don't save the information and offer you complete privacy.

On the other hand, CurrentC collects a variety of transaction data which may be valuable to the merchants who control the system, including location, spending habits, and health data.

Advantage: Apple Pay

Loyalty Programs

One area which favours CurrentC over Apple Pay is loyalty rewards programs. As CurrentC gathers transactional data, it is able to integrate loyalty rewards programs into the app to offer superior value to consumers.

Advantage: CurrentC

However, considering the ultimate goal of CurrentC is to reduce credit card fees and increase margins for its consortium of retailers, it is unlikely that consumers will be reap significant additional value from these rewards programs.

There is a disconnect between what MCX hopes to achieve with CurrentC and the value that consumers can derive from the platform, offering little to no incentive to switch. In contrast, Apple strives to extract profits while offering a superior value to consumers. Ultimately, this will lead to the success of Apple Pay over CurrentC. ACCUMULATE APPLE.