I have screened the U.S. market and selected 3 companies to put on my watchlist. I will provide couple reasons for my decision to shortlist the stocks, however, thorough analysis is to be done be each investor individually. Hopefully this can provide some interesting investment ideas for some of you. The criteria I set when screen for the ideas were following: high revenue and earnings growth in the past years, appealing margins, strong balance sheet and last but not least: reasonable valuation. Out of the list of companies that I was left with, I decided to include ones with a potential catalyst for share price growth in the near future.

Michael Kors (KORS)

Global luxury lifestyle Brand Michael Kors is one, which is actually already in my portfolio. The stock has declined by over 40% this year and currently trades at forward P/E of 9.72. Michael Kors is a good company, with consistently high revenue and earnings growth, consistent operational margin, very strong balance sheet and high return on equity. Total liabilities of the company represent $450.93m. With retained earnings at $2,168.76m, this is a very low number.

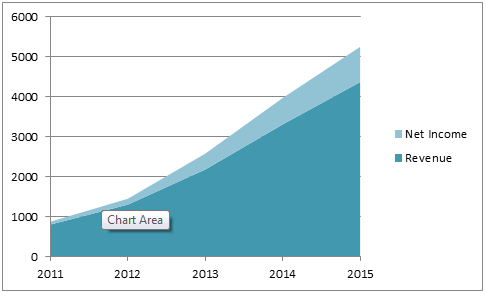

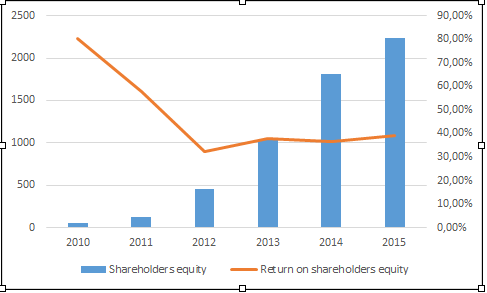

The revenue, net income and profit margin has been increasing rapidly over the past three years, as you can see in the graph bellow. The net profit margin has been at 20% for the past two fiscal years. Furthermore, the ROE is at 39.35% and the company had increased shareholders equity from $49 million in 2010 to $2,241 million in FY2015.

Source: company financial data

Source: company financial data

Revenues grew by 7.3% YoY in Q1FY2016 and the company looks for further growth. The plan is to introduce new products with innovative design in the FY 2016. Furthermore, the company looks to expand into new geographic markets as well, adding two new locations in North America, five in Europe and two in Japan this year. The above mentioned expansion could provide a catalyst for the depressed price, currently trading at 66% discount to fair price, according to Jitta.com. Another strong catalyst could be the ongoing share repurchase program. 7m shares for total of $350million have already been repurchased and $650million worth of repurchases are to be completed in the following quarters.

To conclude, I believe this is an unusual investment opportunity you should not miss. I am not going to go to much more detail, as there is already plenty of analysis on KORS here on SA, which I could only agree on.

Gilead Sciences, Inc.

Another stock recently added to my portfolio is Gilead Sciences (GILD). Gilead is a research-based biopharmaceutical company that discovers, develops and commercializes innovative medicines. GILD is currently trading at 11.7 times ttm P/E, with good financial strength, high growth of revenue and earnings and high profitability.

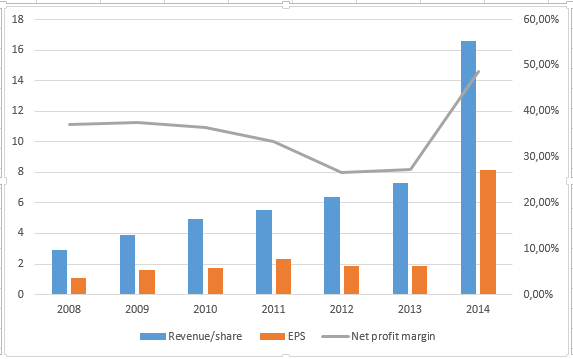

Company's revenue grew at CAGR of 25.65% in the past 5 years, from $7.95B in FY 2010 to $24.9B in FY2014. Net profit margins are at very high levels, currently at 48.6%, operating margin over 60%. GILD ended FY 2014 with ROE of 76.4%! These numbers show just how profitable the company is and was in the past.

Trading at the current multiples, there clearly is shareholders value to unlock. What's going to be the catalyst? It seems we will find out shortly. The company announced a bond issuance in amount of $10 billion at low interest rates. This is viewed as an wise decision of the management and was well received by the Street. There are basically two opinions on how the money will be used: share repurchase or acquisition, with the latter being viewed as more probable. The company has experience with successful acquisitions and is probably looking for another one, in order to enhance growth. Good article on possible acquisition targets can be found here.

Whichever possibility shows to be the actual intent of the management, it should have a positive effect on the share price. The company currently held a Q&A session, where questions about the expected acquisition, as well as about current product portfolio, development of market shares of major medications and intentions for expansion were answered. You can read the transcript of the whole session here, or summary here.

T. Row Price Group Inc

T. Rowe Price Group (TROW) is a financial services holding company. The Company provides global investment management services to individual and institutional investors in the sponsored T. Rowe Price mutual funds distributed in the United States and other investment portfolios.

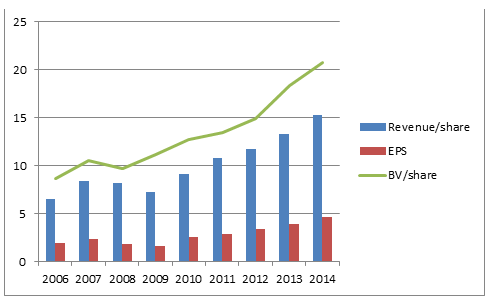

T. Rowe shows consistent growth in revenues and earnings, operational margin at 47%, net profit margin at 30.9% and consistently high return on equity (22.8%). Furthermore, the company has been raising its dividend consistently, with current dividend yield at 2.9%. With current payout ratio below 40%, there is space for further dividend growth. The company operates with strong balance sheet, with total liabilities at $448.4 million and equity at $4,967 million.

Source: company financials

The share price of TROW has declined 17% this year, currently trading at 15.3 PE. The company is rated as second out of 95 rated companies in the Investment Services segment and 8/887 in the financial sector by the Jitta.com. Having that said, the trailing PE of 15 looks very low in comparison to the broad market at 20 x PE. For the stated reasons, I believe T. Rowe Price Group Inc is definitely a stock to put on your watchlist.