One of the many impacts of last year’s market meltdown was the huge shakeup to stocks’ style box classifications. With most stocks losing a quarter to half of their value — and some of the largest companies being decimated — definitions for “large-cap”, “mid-cap”, and “small-cap” were turned on their heads. And, writes Investment News’ Jeff Benjamin, that appears to have given smaller money managers and individual investors an advantage over big investment firms.

Benjamin says the market plunge “had a unique impact on managers of small-cap stocks because it pushed those stocks that are generally expected to lead a market recovery beyond the range of some big fund managers. … Although smaller-company stocks have led the way in performance since the March 9 stock market low, many of those stocks are only now moving into a market capitalization range that meets the size and liquidity requirements of most large institutional money managers.”

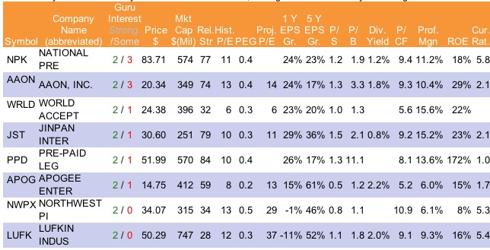

While some managers have revised their definitions for large-, mid-, andsmall-cap stocks in response to the shakeup, others have not. With that in mind, Ithought it would be a good time to see which small stocks my Validea.com GuruStrategies are highest on right now. The eight stocks below all have market capsbetween $250 million and $750 million, and all get approval from two of my guru-based approaches:

Disclosure: I'm long all eight of the stocks listed above.