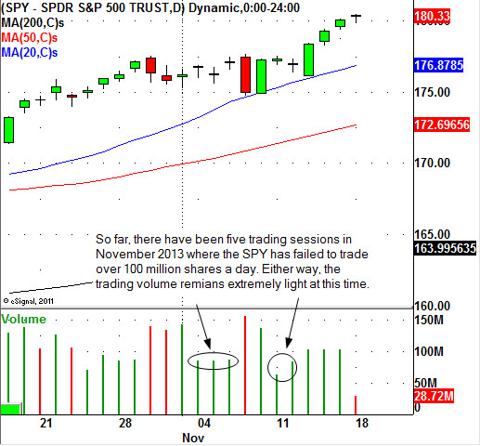

The Federal Reserve members must be shaking their heads when they look at the current trading volumes in the stock market. For example, today the SPDR S&P 500 Trust (NYSEARCA:SPY) is trading just 23 million shares as of 11:00 am EST. The average trading volume for the SPY in the month of November 2013 is just 104 million shares a day. Last year at this time the SPY averaged 144 million shares traded per day. Now in all fairness, last year the stock market came under some distribution in the first half of November. It should be noted that when the stock market declines the trading volume will usually increase, that did occur last year. But either way, when you consider all of the new issues in the stock market the trading volume is terrible for time of year.

Recently, reports from CNN have stated that investors have poured $277 billion into stock-based mutual funds and exchange traded funds through Oct. 25, 2013. This is supposedly the fastest inflow of capital into stocks since 2000, but why hasn't the trading volume picked up yet?

Many reports are calling QE-1, 2, and 3 the ultimate bank bailout. This is when the Federal Reserve prints money to buy U.S. Treasury bonds, and mortgage backed securities in order to keep interest rates artificially low. Currently, the central bank is buying $85 billion a month worth of these securities. Meanwhile, the fed funds rate is at zero to a quarter percent. The fed funds rate is the overnight lending rate to the large banks. You see, this is why you earn practically no interest in a savings account at the bank. This hurts everyone on a fixed income, or anyone that saves money.

Many investors can say that the easy money policies by the Federal Reserve saved the entire economic system from collapse in 2009. The easy money has certainly propped asset prices to new all time highs, so I suppose everyone should be happy, but many people worry that central bank is just doing more of the same that caused the crisis in the first place. That argument is still open for debate.

The one problem or concern with the stock market is the trading volume. It is often a warning that when equities continue to rally in a dull market (light volume market) it is on borrowed time before real downside volume comes in and takes every asset class lower. Only time will tell, but you can bet the Federal Reserve members are watching the dreadful trading volumes very closely. The light volume tells us that only a small group of financial institutions are moving the markets higher. Since the 2009 low, every increase in trading volume has resulted in a sharp decline in the stock markets. Everyone better watch out when the volume returns as the odds favor it will be another decline in stocks and that is not something that the central bank wants to see.

Nicholas Santiago

InTheMoneyStocks.com