The headlines for this week's earnings release from Starbucks (SBUX) may cause some confusion among investors as the company will disclose the final gain on acquisition for the remaining shares of Starbucks Japan. The gain is expected to be in the range of $325M to $375M, which will result in a non-GAAP EPS adjustment of $0.40 to $0.48. While this adjustment will cause some variation in the reported EPS for F1Q15, analysts will be removing the gain from their valuation models. Therefore, the primary focus will likely be operating margin performance given the pressure from holiday marketing costs and the expense associated with the company's leadership conference which took place in October.

Commodity prices are also likely to be a topic of discussion on the call, however, F1Q15 earnings are not expected to be impacted by variability in coffee prices as management has stated that the majority of the company's commodity needs have been hedged through 2015.

(Source: Company reports and F4Q14 earnings call)

Current Guidance and Consensus Estimates

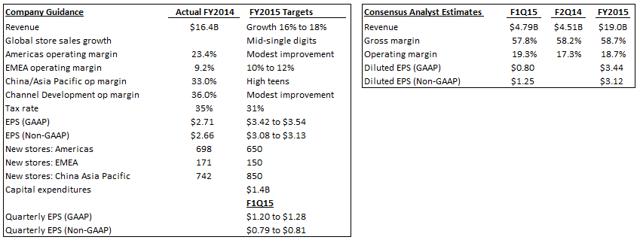

For F1Q15 the consensus analyst non-GAAP EPS estimate is in line with management's guidance at $0.80. For FY2015 the consensus estimate of $3.12 represents the high-end of management's $3.08 to $3.13 EPS guidance. This means the upside of management's forecast has already been priced into the stock's value, which poses some risk heading into the earnings release. The following chart highlights the key metrics to watch for in this quarter's press release:

(Source: Company reports, Bloomberg)

Valuation

Shares have traded at a Price Earnings (PE) ratio between 22.5 and 26.9 times the FY2015 EPS estimate over the last six months with an average PE of 25. Currently shares are trading above the average at a PE of 26, which reflects the current market optimism for management's growth strategy and the Starbucks Japan acquisition. The relatively high multiple could put pressure on shares if management is not able to execute on their FY2015 targets.

For additional details on consensus estimates including our full consensus-based earnings model, segment forecast, and valuation approach please click here.