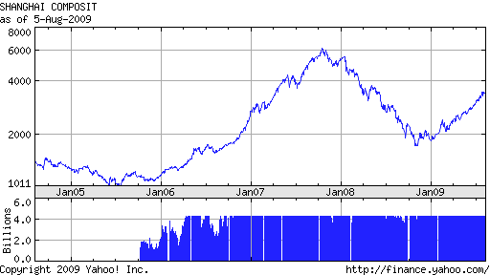

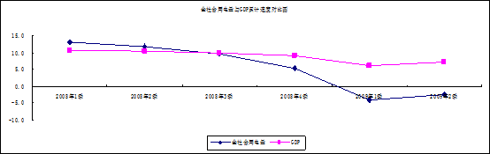

Sophisticated investors in china market were taught how to interpret various warning signs from the government correctly and act accordingly. When they study the historical china market patterns they can always find there are almost no exceptions that the correlation between various warning signs from the government and the following market performance are very strong as Figure 1 and Figure 2 illustrated. The latest and the most famous example is the one between 2006 and 2007 when the Shanghai Composite Index (000001.SS) rose from 998 to its all time high 6124 in two years. Over liquidity was blamed for the surge. The government rose ten times deposit reserve ratio within one year to reduce liquidity. The market reacted by a free fall from 6124 to 1706 in the following year. Then the government imposed four times rises on the same ratio since September 2008. The following market surge proved this correlation again.

Figure1. M1, M2 trends

Source: The People's Bank of China

Figure 2. Shanghai Composite Index since 2004.11

Source: Yahoo Finance

One simple explanation for this phenomenon is that china’s monetary policy is very effective because the stock market reacts to the monetary policy change fairly dramatically. But another more sophisticated explanation is that a significant proportion of bank loans and credits flooded into stock market directly rather than designated operation use. The concern is not unjustifiable.

Although bank loans increased by 34.4% this first half year, imports decreased by 21.8% and exports shrank by 25.4%. GDP was reportedly increased by 7.1% but the 2.24% decrease in electricity consumption couldn’t support the GDP report. As Figure 3 illustrated, the increasing divergence between the two figures since the 3rd quarter of last year further weakened the trustworthiness of the official GDP report.

Figure 3. GDP and electricity consumption

Source: Statistic China

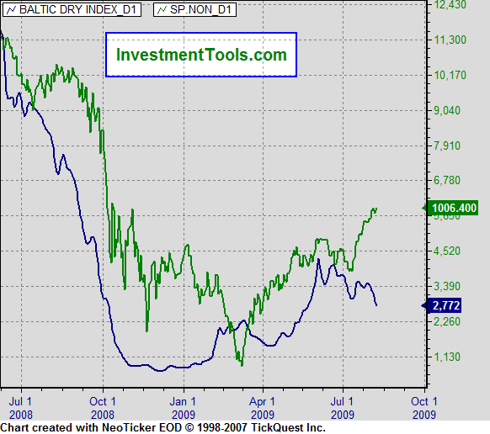

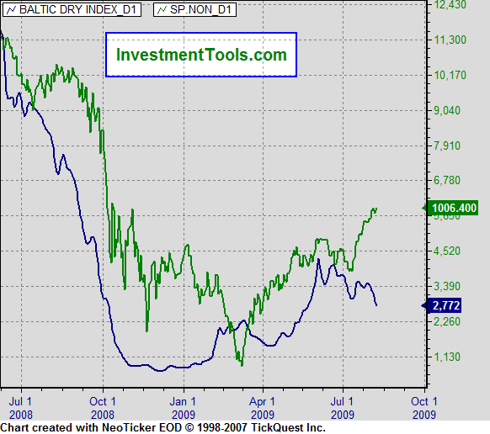

Considering there is no apparent evidence of domestic consumption increase, where has the additional money supply been going? One voice was that Chinese had been buying commodities. Despite the soaring commodity prices the falling Batic Dry Index ( Figure 4 ) doesn't support the conclusion that more commodities were consumed by the real economy. China’s stock market has doubled its index since last November. What role are the new bank loans playing in the stock market?

Figure 4. BDI and S&P500

Source: investmenttools.com

Bank loans from the main street investing in the stock market has long been a public secret within Chinese investors. By one way or another, industries redirected bank loans from designated operation use like raw material purchase to the stock market. There are motivations for these industries especially in the economic downturn like current global recession and a bull domestic stock market. The bull stock market can generate much higher profits than their own industries and more quickly. One good model role is Youngor (600177.SS), a garment manufacturer, whose stock investment income was publically reported as more than 75% of its total net income in 2007. Another motivation is to maintain the strategic relationship with banks. They have to help banks when banks are forced by the government stimulus plan with a lack of "cash for clunkers program" to issue more loans. They take loans even they don’t really need money to expand as they are still struggling to clear their own overstocks. At the end of 2008, more than one third of loans stayed unused in their bank accounts. Without a mature monitoring mechanism from authorities for the bank loan usage, managements often are free to transfer the excess money to wherever can bring them high and quick profits.

To what extent will the illegal use of bank loans affect the market? There is no statistical data for the proportion of new bank loans flooded into stock market because they are neither legal nor easily traceable. But we can make a safe assumption here. Suppose a conservative 5% of 7.4 trillion newly issued loans went into the stock market, they would account for as high as 82% of 450 billion new capital injections in the stock market in the same period. Even worse, as the main street industries usually don’t have professional asset management teams when the government requires banks to collect loans back, they have to liquidate their positions in a very short time, causing the market extremely volatile.

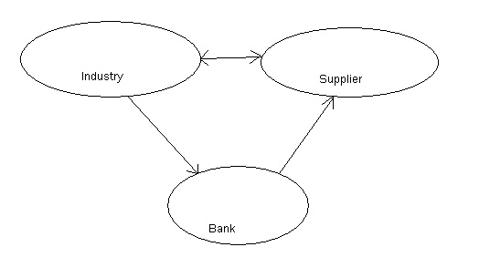

The government apparently realized the seriousness of this issue. China Banking Regulatory Commission issued “Fixed asset loan management regulation” in July 27th, sending out the first warning sign since the market rebounded. The main purpose of this regulation is to assure bank loans to be used in their designated ways. The key method is that unlike past, now it is banks than their clients that will control the loan spending transaction if an individual transaction is larger than 5% of the total loan or more than 5 million Yuan in amount. In another words, if a client wants to buy raw material, it has to ask its bank to approve the purchase. Banks are required to conduct due diligence and decide whether to transfer the money to the right accounts. Industry clients seem to lose power to banks on handling their loans. One day after the new regulation, the Shanghai Composite Index slumped more than 5%, the biggest in two years. Although the market rebounded immediately after a reassurance of the loose monetary policy from a centre bank official, the question for how much momentum left stays around the corner.

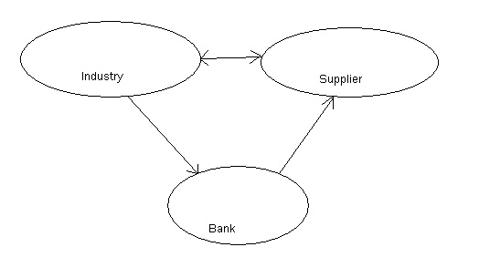

Figure 5. New bank role on handling loans

Actually the new regulation also gives the clue. The regulation was declared to take effect in three months. Why not now? The government seems to face a dilemma. They need to regulate the unhealthy use of loans but they are worrying about the disastrous consequence on the stock market caused by the expecting sudden capital outflow and the resulting bad loans. To smooth the effect on the market, three months not only gives the market a buffer to react but also gives the bank money already in the market enough time to cut positions without big losses otherwise.

No matter how cautious it is, however, the government started to send out warning signs. Yesterday, one week after the assurance of the loose monetary policy, not surprisingly, the central bank changed its tone. The first time since recession, it emphasized a future minor adjustment on its loose policy. Neglecting the adjective “minor”, we can now safely say if the history repeats the bull markets is near its end.