Today I screened the S&P 500 Large Cap Index to find the 5 with the best Barchart technical indicators and charts. Near the top of the list were

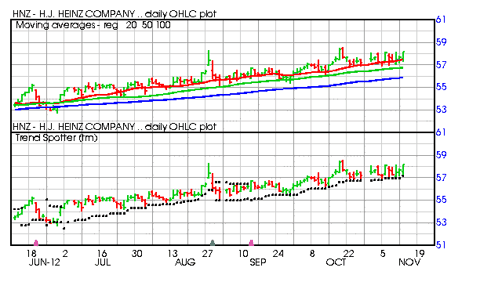

H J Heinz (HNZ), Home Depot (HD), Gilead Sciences (GILD), Equifax (EFX) andCampbell Soup (CPB):H J Heinz (HNZ)

Barchart technical indicators:

- 100% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 5 new highs and up 3.48% in the last month

- Relative Strength Index 61.20%

- Barchart computes a technical support level at 56.91

- Recently traded at 58.32 with a 50 day moving average of 56.77

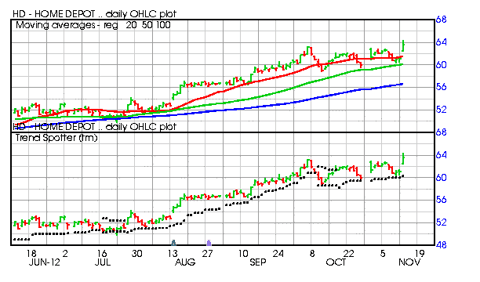

Home Depot (HD)

Barchart technical indicators:

- 100% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 6 new highs and up 7.27% in the last month

- Relative Strength Index 64.98%

- Barchart computes a technical support level at 60.10

- Recently traded at 63.94 with a 50 day moving average of 60.17

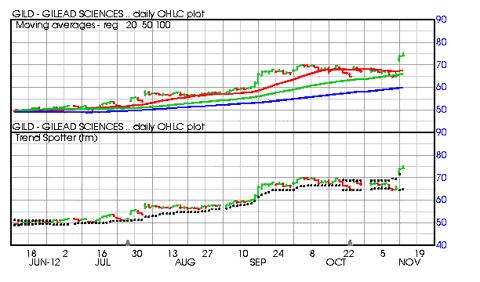

Gilead Sciences (GILD)

Barchart technical indicators:

- 100% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving average

- 4 new highs and up 9.56% in the last month

- Relative Strength Index 70.46%

- Barchart computes a technical support level at 70.52

- Recently traded at 74.42 with a 50 day moving average of 66.08

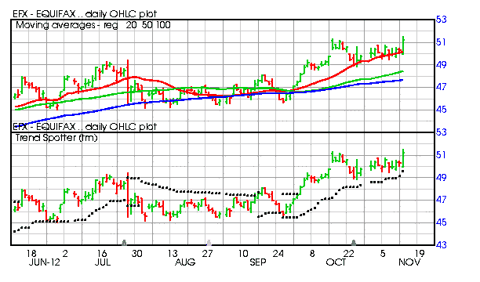

Equifax (EFX)

Barchart technical indicators:

- 100% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 3 new highs and up 4.30% in the last month

- Relative Strength Index 65.99%

- Barchart computes a technical support level at 49.80

- Recently traded at 51.38 with a 50 day moving average of 48.48

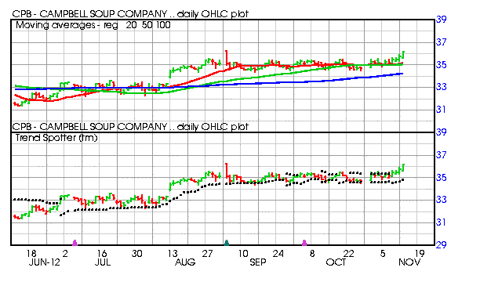

Campbell Soup (CPB)

Barchart technical indicators:

- 100% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving average

- 10 new highs and up 5.51% in the last month

- Relative Strength Index 73.38%

- Barchart computes a technical support level at 34.97

- Recently traded at 36.58/ with a 50 day moving average of 35.06