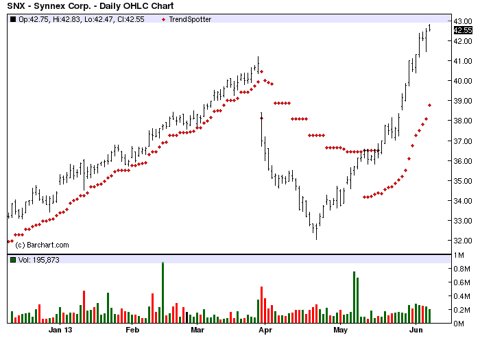

The Chart of the Day is Synnex (SNX). As always I go to the new high list and sort for frequency in the last month. Today a turnaround stock floated the top with a Trend Spotter buy and advances in 19 of the last 20 sessions for a gain of 19.22%.

The company is a global IT supply chain services company offering a comprehensive range of services to original equipment manufacturers and software publishers, or (OEMs), and reseller customers worldwide. They offer product distribution, related logistics services and contract assembly. SNX distributes IT systems, peripherals, system components, software and networking equipment for OEM suppliers such as HP, IBM, Intel, Microsoft Corporation and Seagate.

Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 80% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 19 new highs and up 19.22% in the last month

- Relative Strength Index 81.26%

- Barchart computes a technical support level at 41.01

- Recently traded at 42.57 with a 50 day moving average of 36.33

Fundamental factors:

- Market Cap $1.59 billion

- P/E 10.88

- Revenue projected to increase 1.20% this year and another 4.20% next year

- Earnings are estimated to be down 4.80% this year but grow by 11.10% next year and continue to increase at the annual rate of 10.55% for he next 5 years.

- Wall Street analysts issued 5 buy and 1 hold recommendation

- Financial Strength B+

Since this stock has been up and down over the year I suggest you adhere to a strict exit discipline of selling if the stock trades below its 50 day moving average.