Today I used Barchart to sort the S & P 500 Large Cap Index for the stocks hitting the most frequent new highs. My list includes Micron Technology (MU), Boeing (BA), Delphi Automotive (DEPH), CME Group (CME) and Precision Castparts (PCP):

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 23.52% in the last month

- Relative strength Index 78.85%

- Barchart computes a technical support level at 13.16

- Recenlty traded at 13.97 with a 50 day moving average of 10.93

Barchart technical indicators:

- 88% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 3.37% in the last month

- Relative Strength Index 60.04%

- Barchart computes a technical support level at 102.13

- Recently traded at 102.35 with a 50 day moving average of 95.58

Delphi Automotive (DLPH)

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 7.36% in the last month

- Relative Strength Index 72.18%

- Barchart computes a technical support level at 51.10

- Recently traded at 52.09 with a 50 day moving average of 46.94

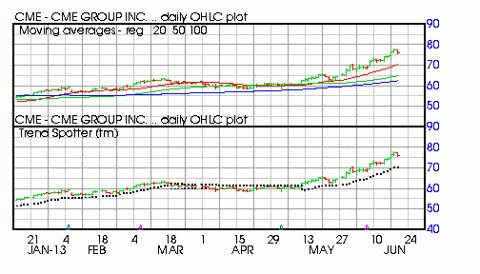

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 16.56% in the last month

- Relative strength Index 74.38%

- Barchart computes a technical support level at 74.38

- Recently traded at 75.96 with a 50 day moving average of 64.85

Precision Automotive (PCP)

Barchart technical indicators:

- 32% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 1.72% in the last month

- Relative Strength Index 55.57%

- Barchart computes a technical support level at 217.47

- Recently traded at 216.66 with a 50 day moving average of 203.27