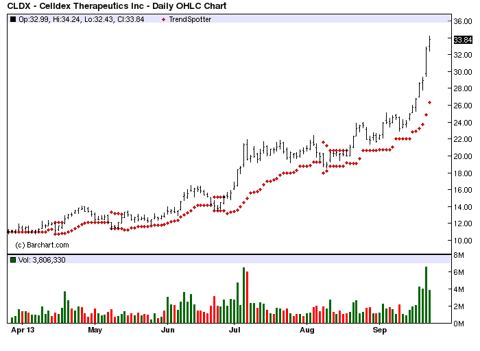

Celldex Therapeutics (CLDX) is the Chart of the Day. The stock has both a Trend Spotter buy and 100% Barchart technical buy signals. I found the stock by sorting the New High List for Weighted Alpha and the stocks was 437.10+

It is an integrated biopharmaceutical company that applies its comprehensive Precision Targeted Immunotherapy Platform to generate a pipeline of candidates to treat cancer and other difficult-to-treat diseases. Celldex's immunotherapy platform includes a complementary portfolio of monoclonal antibodies, antibody-targeted vaccines and immunomodulators to create novel disease-specific drug candidates.

Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 9 new highs and up 43.54% in the last month

- Relative strength Index 85.67%

- Barchart computes a technical support level at 28.17

- Recently traded at 33.87 with a 50 day moving average of 22.54

Fundamental factors:

- I'm totally perplexed on the fundamentals

- Revenue is predicted to have negative growth

- Earnings are not only estimated to be negative but analysts expect the deficit to increase

- In spite of that Wall Street analysts issued 7 Strong buy and 2 Buy recommendations

- Financial Strength is B+

My take is this is an interesting situation. The price is rising and analysts like it but at the same time they predict shrinking revenue and continuing losses. Monitor this but keep your powder dry.