Today I used Barchart to sort the S&P 600 Small Cap Index to find the stocks with the most frequent New Highs in the last month, then eliminated those that did not have positive gains for the last week and month. I then used the Flipchart feature to review the charts.

Today's list includes Abaxis (ABAX), Anixter International (AXE), Matrix Service Co (MTRX), Tangoe (TNGO), and Stewart Information Services(STC):

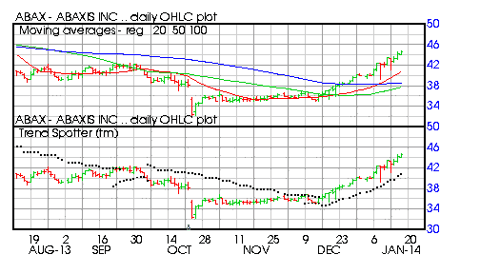

Abaxis (ABAX)

Barchart technical indicators:

- 80% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 22.24% in the last month

- Relative Strength Index 81.83%

- Barchart computes a technical support level at 43.67

- Recently traded at 44.58 with a 50 day moving average of 37.71

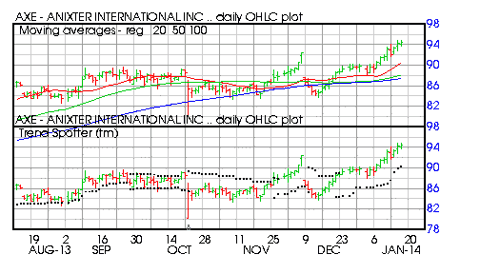

Anixter International (AXE)

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 10.36% in the last month

- Relative Strength Index 70.65%

- Barchart computes a technical support level at 93.14

- Recently traded at 94.48 with a 50 day moving average of 88.07

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 21.89% in the last month

- Relative Strength Index 78.39%

- Barchart computes a technical support level at 26.06

- Recently traded at 26.56 with a 50 day moving average of 22.63

Tangoe (TNGO)

Barchart technical indicators:

- 40% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20 and 50 day moving averages

- 15 new highs and up 21.88% in the last month

- Relative Strength Index 71.25%

- Barchart computes a technical support level at 18.98

- Recently traded at 19.72 with a 50 day moving average of 16.89

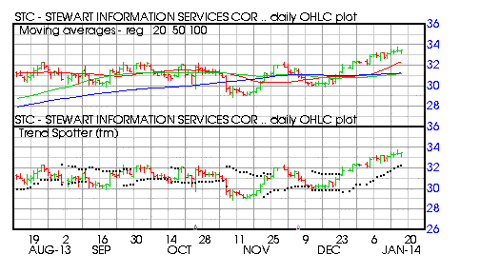

Stewart Information Services (STC)

Barchart technical indicators:

- 80% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 10.73% in the last month

- Relative Strength Index 69.83%

- Barchart computes a technical support level at 33.05

- Recently traded at 33.44 with a 50 day moving average of 31.19