Today I used Barchart to sort the S&P 500 Large Cap Index to find the stocks hitting the most frequent new highs in the last month. I then skipped the stocks that didn't have positive returns in the last week and month and used the Flipchart feature to review the charts.

Today's list includes Pentair (PNR), Kroger (KR), Abbott Laboratories (ABT), Eastman Chemical (EMN) and Leggett and Platt (LEG):

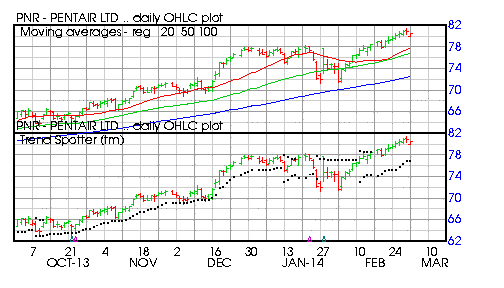

Barchart technical indicators:

- 88% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 11.99% in the last month

- Relative Strength Index 62.66%

- Barchart computes a technical support level at 79.80%

- Recently traded at 80.11 with a 50 day moving average of 76.77

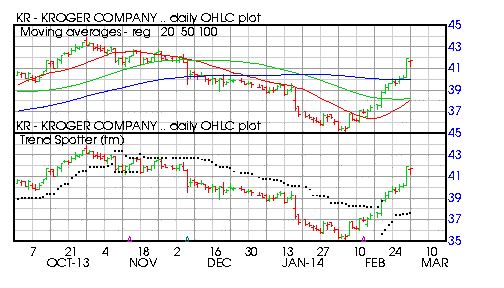

Barchart technical indicators:

- 48% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 17.61% in the last month

- Relative Strength Index 74.55%

- Barchart computes a technical support level at 39.53

- Recently traded 41.57 with a 50 day moving average of 38.24

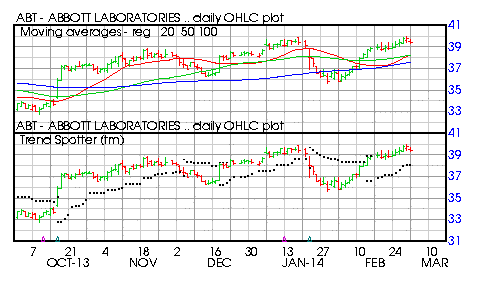

Barchart technical indicators:

- 56% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 9.12% in the last month

- Relative Strength Index 58.27%

- Barchart computes a technical support level at 39.17

- Recently traded at 39.04 with a 50 day moving average of 38.24

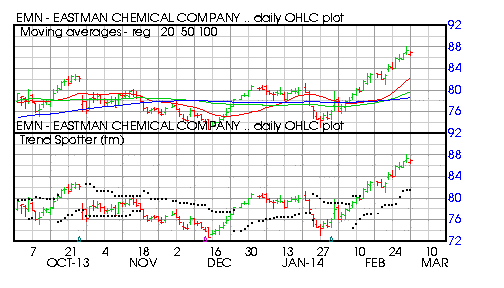

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 14.31% in the last month

- Relative Strength Index 73.77%

- Barchart computes a technical support level at 85.96

- Recently traded at 86.58 iwht a 50 day moving average of 79.70

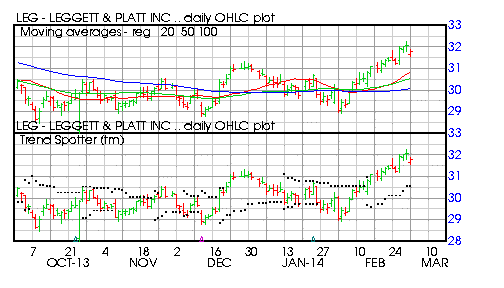

Barchart technical indicators:

- 88% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 9.05% in the last month

- Relative Strength Index 62.56%

- Barchart computes a support level at 31.56

- Recently traded at 31.56 with a 50 day moving average of 30.54