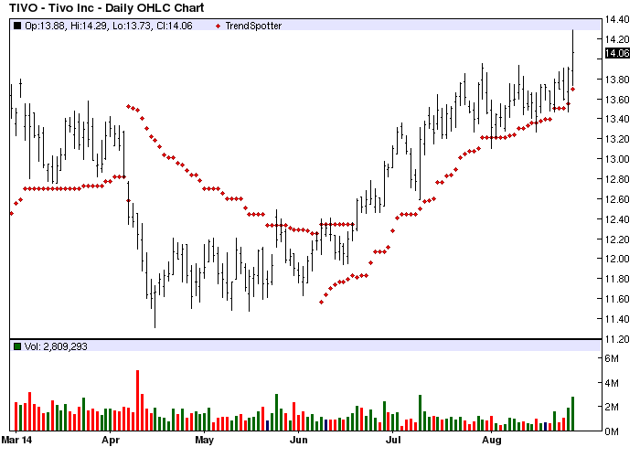

The Chart of the Day belongs to TiVo (TIVO). I fond the stock by sorting the New High List for the highest technical buy signals then used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 6/9 the stock gained 14.22%.

TiVo pioneered a brand new category of products with the development of the first commercially available digital video recorder. Sold through leading consumer electronic retailers, TiVo has developed a brand which resonates boldly with consumers as providing a superior television experience. Through agreements with leading satellite and cable providers, TiVo also integrates its DVR service features into the set-top boxes of mass distributors. TiVo's DVR functionality and ease of use, with such features as Season Pass recordings and WishList searches and TiVo KidZone, have elevated its popularity among consumers and have created a whole new way for viewers to watch television. With a continued investment in its patented technologies, TiVo is revolutionizing the way consumers watch and access home entertainment. Rapidly becoming the focal point of the digital living room, TiVo's DVR is at the center of experiencing new forms of content on the TV, such as broadband delivered video, music and photos.

Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 4 new highs and up 4.31% in the last month

- Relative Strength Index 63.07%

- Barchart computes a technical support level at 13.31

- Recently traded at 14.06 with a 50 day moving average of 13.32

Fundamental factors:

- Market Cap $1.70 billion

- P/E 97.14

- Revenue expected to grow 16.80% this year and another 11.50% next year

- Earnings estimated to decrease 86.00% this year but increase again next year about 46.40% and continue to increase at an annual rate of 11.10% for the next 5 years

- Wall Street analysts issued 3 strong buy, 9 buy and 8 hold recommendations on the stock.

Closely watch the 50 day moving average for weakness and exit at the 100 day moving average.