Today I wanted to find the 5 large cap stocks that had the most consistent upward momentum this past month. I used Barchart to sort theS&P 500 Large Cap stock index to find the stocks that had the most frequent new highs in the last month.

The stocks making the cut are: Sherwin-Williams (SHW), Lowe's (LOW), Omnicom Group (OMC), Red Hat (RHT) and Archer Daniels Midland(ADM):

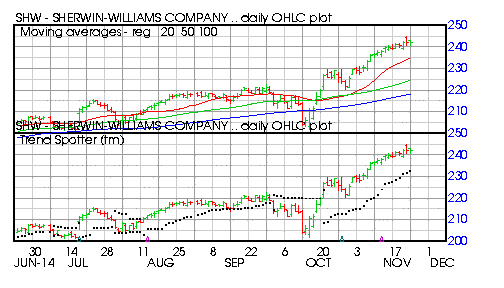

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 18 new highs and up 5.79% in the last month

- Relative Strength Index 73.31%

- Barchart computes a technical support level at 238.34

- Recently traded at 242.05 with a 50 day moving average of 224.54

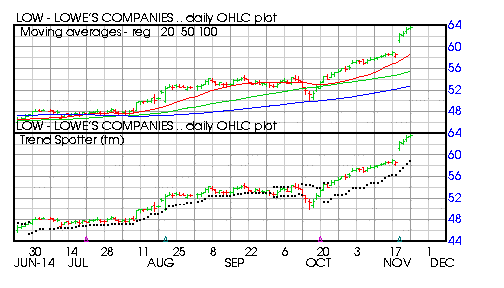

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 18 new highs and up 15.13% in the last month

- Relative Strength Index 85.76%

- Barchatt computes a technical support level at 62.00

- Recently traded at 63.62 with a 50 day moving average of 55.53

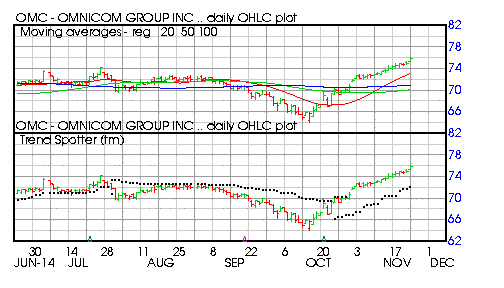

Barchart technical indicators:

- 80% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 18 new highs and up 8.29% in the last month

- Relative Strength Index 76.35%

- Barchart computes a technical support level at 74.49

- Recently traded at 76.13 with a 50 day moving average of 70.12

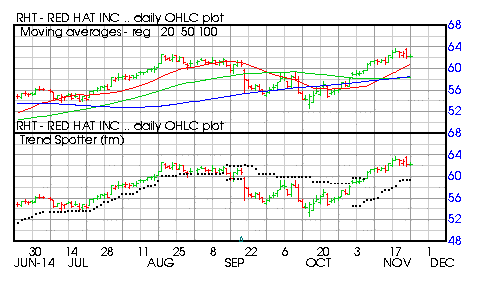

Red Hat (RHT)

Barchart technical indicators:

- 48% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 11.19% in the last month

- Relative Strength Index 64.55%

- Barchart computes a technical support level at 60.76

- Recently traded at 62.30 with a 50 day moving average of 58.35

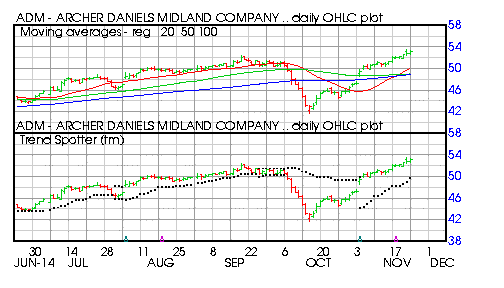

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 16.50% in the last month

- Barchart computes a technical support level at 51.76

- Recently traded at 53.06 with a 50 day moving average of 49.01