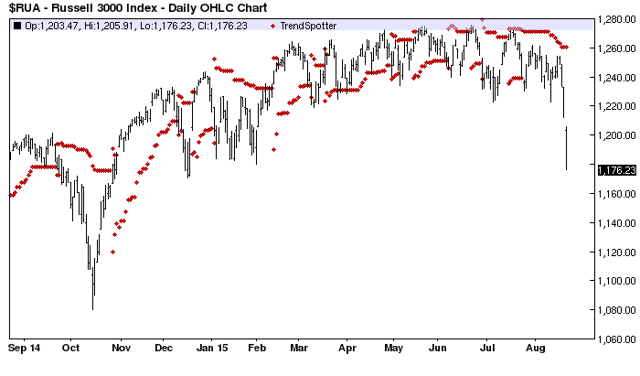

The Chart of the Day is the Russell 3000 Index ($RUA). In order to understand the market you should analyze the Index the way you would an individual stock. Since the Trend Spotter signaled a sell on 8/5 the Index lost 6.51%.

The Russell 3000 Index measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Russell 3000 Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad market and is completely reconstituted annually to ensure new and growing equities are reflected.

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 100% Barchart technical sell signals

- Trend Spotter sell signal

- Below its 20, 50 and 100 day moving averages

- 7.81% off its 52 week high

- Negative 4.23 Weighted Alpha

- Relative Strength Index 25.07%

- Recently traded at 1,176.23 which is below its 50 day moving average of 1,249.22

Note that at the close of the market today 62.42% of the 3000 stocks included in the Index were trading below their 200 day moving averages. The 50-100 Day MACD Oscillator has been a very effective technical trading strategy for this index. Conservative investors who are following a sell point discipline should consider staying in cash. Aggressive investors should consider shorting individual stocks or buying inverse ETFs