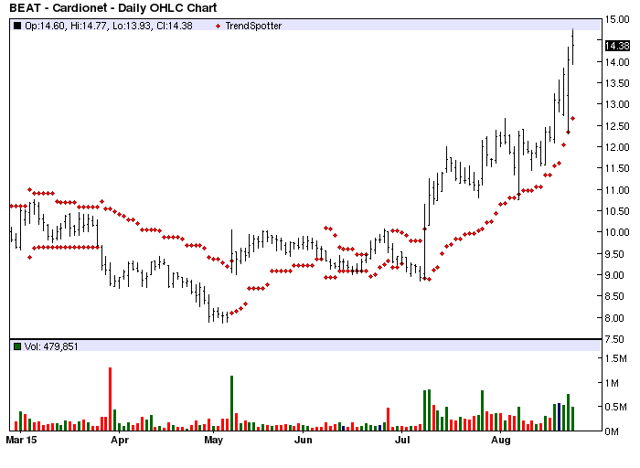

The Chart of the Day belongs to BioTelemetry (BEAT) formerly known as Cardionet. I found the medical services stock by sorting the Russell 3000 Index stocks first for the highest Weighted Alpha then for Barchart technical buy signals of 80% of better. Since the Trend Spotter signaled a buy on 7/9 the stock gained 42.30%.

BioTelemetry, Inc. provides ambulatory outpatient management solutions for monitoring clinical information regarding an individual's health. It is focused on the diagnosis and monitoring of cardiac arrhythmias, or heart rhythm disorders. BioTelemetry, Inc., formerly known as CardioNet, Inc., is headquartered in Conshohocken, Pennsylvania.

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 100% Barchart technical buy signals

- 106.10+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 10 new highs and up 29.67% in the last month

- Relative Strength Index 76.27

- Barchart computes a technical support level at 11.54

- Recently traded at 14.42 with a 50 day moving average of 11.10

Fundamental factors:

- Market Cap $389.52 million

- P/E 47.21

- Revenue expected to grow 9.30% this year and another 10.40% next year

- Earnings estimated to increase 310.00% this year, and an additional 34.10% next year

- Wall Street analysts issued 3 strong buy and 1 buy recommendation on the stock.

The 100 day moving average vs price has been the most effective technical trading strategy for this stock but has also resulted in an excessive number of traded. A moving stop loss 20% below the most recent high might work out better for most investors.

PLEASE NOTE: The Chart of the Day is not a buy recommendation. Even when the market is in turmoil if you screen 3000 stocks for positive momentum attributes you will always come up with a few stocks that fight even the most negative market momentum.