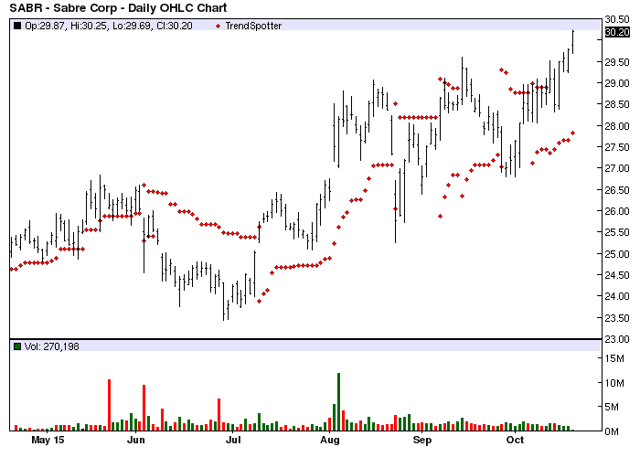

The Chart of the Day belongs to Sabre Corp (SABR). I found the Internet software stock by using Barchart to sort the Russell 3000 Indexstocks first for a Weighted Alpha of higher than 50.00+ then again for technical buy signals above 80%. Since the Trend Spotter signaled a buy on 10/7 the stock gained 4.72%.

Sabre Corporation engages in providing technology solutions to the global travel and tourism industry. The company operates four brands/businesses: Sabre Airline Solutions (R), Sabre Hospitality Solutions , Sabre Travel Network and Travelocity . Its software, data, mobile and distribution solutions are used by airlines hotel properties to manage critical operations, such as passenger and guest reservations, revenue management, and flight, network and crew management. Sabre Corporation is headquartered in Southlake, Texas.

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 100% Barchart technical buy signals

- 74.20+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 9 new highs and up 6.16% in the last month

- Relative Strength Index 67.63%

- Barchart computes a technical support level at 29.05

- Recently traded at 30.2 with a 50 day moving average of 28.19

Fundamental factors:

- Market Cap $8.20 billion

- P/E 31.14

- Dividend yield 1.22%

- Revenue expected to grow 14..40% this year and another 12.70% next year

- Earnings estimated to increase 1.40% this year, an additional 7.60% next year and continue to compound at an annual rate of 3.95% for the next 5 years

- Wall Street analysts issued 3 strong buy, 4 buy and 7 hold recommendations on the stock

The 20-100 Day MACD Oscillator has been a reliable technical trading strategy for this stock.