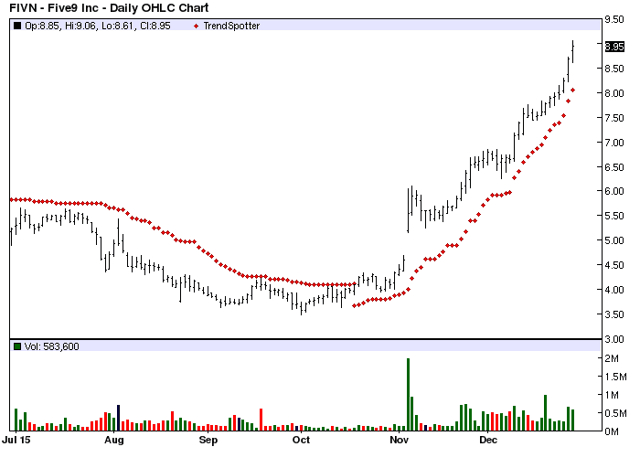

The Chart of the Day belongs to Five9 (FIVN). I found the cloud software stock by using Barchart to sort the Russell 3000 Index stocks first for a Weighted Alpha of 50.00+ or more then again for technical buy signals of 80% or better. I always review the charts by using he Flipchart feature.

Five9 provides cloud software for contact centers. The Company offers software products such as workforce management, speech recognition, predictive dialer, and voice applications. It offers virtual contact center cloud platform that acts as the hub for interactions between its clients and their customers, enabling contact center operations focused on inbound or outbound customer interactions in a single unified architecture. The Company serves customers in various industries, including banking and financial services, business process outsourcers, consumer, healthcare, and technology. Five9, Inc. is headquartered in San Ramon, California.

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 35.61% in the last month

- Relative Strength Index 90.27%

- Technical support level at 8.42

- Recently traded at 8.95 with a 50 day moving average of 6.14

Fundamental factors:

- Market Cap $449.74 million

- Revenue expected to grow 22.20% this year and another 17.20% next year

- Earnings estimated to increase 55.80% this year, an additional 31.60% next year and continue to increase at an annual rate of 77.30% for the next 5 years

- Wall Street analysts issued 1 strong buy, 3 buy and 2 hold recommendations on the stock

The 100 day moving average vs price has been a reliable technical trading strategy for this stock.