Today I used Barchart to sort the S&P 600 Small Cap Index stocks for the most frequent new highs in the last month then I used the Flipchart feature to review the charts for consistency. The watch list additions are:

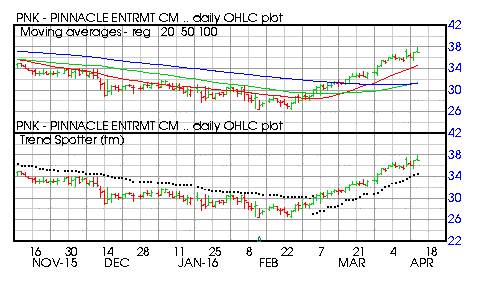

Pinnacle Entertainment (PNK), SPX Corp (SPXC), TREX Company (TREX), Government Properties Income Trust (GOV) and Surgical Care Affiliates (SCAI)

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above ts 20, 50 and 100 day moving averages

- 15 new highs and up 17.54% in the last month

- Relative Strength Index 76.79%

- Technical support level at 35.03

- Recently traded at 36.98 with a 50 day moving average of 31.33

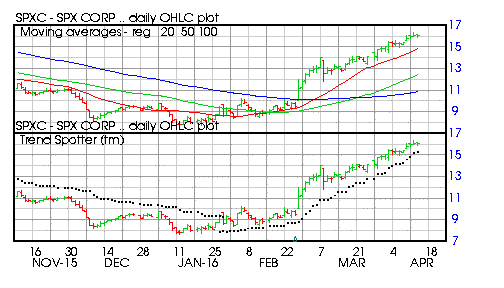

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above ts 20, 50 and 100 day moving averages

- 15 new highs and up 21.83% in the last month

- Relative Strength Index 77.27%

- Technical support level at 15.77

- Recently traded at 16.16 with a 50 day moving average of 12.41

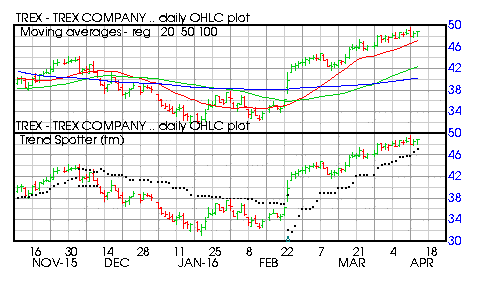

Barchart technical indicators:

- 72% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 13.92% in the last month

- Relative Strength Index 67.50%

- Technical support level at 47.29

- Recently traded at 48.90 with a 50 day moving average of 42.33

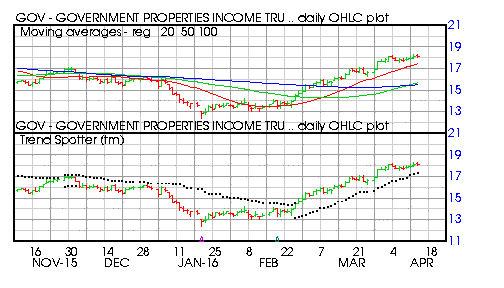

Government Properties Income Trust (GOV)

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 12.47% in the last month

- Relative Strength Index 72.57%

- Technical support level at 17.82

- Recently traded at 18.17 with a 50 day moving average of 15.68

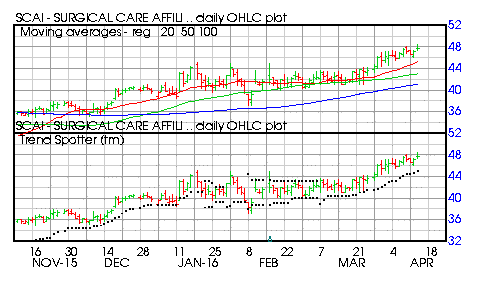

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 12.32% in the last month

- Relative Strength Index 66.56%

- Technical support level at 45.59

- Recently traded at 47.69 with a 50 day moving average of 43.01