This morning I used Barchart to screen the NASDAQ 100 stocks to find the 3 with the best upward momentum and found O'Reilly Automotive (ORLY), Verisign (VRSN) and Dollar Tree (DLTR)

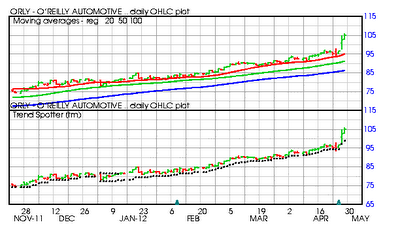

O'Reilly Automotive (ORLY)

Barchart technical indicators:

- 100% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 15.31% in the last month

- Relative Strength Index 81.72%

- Barchart computes a technical support level at 94.35

- Recently traded at 105.25 with a 50 day moving average of 91.28

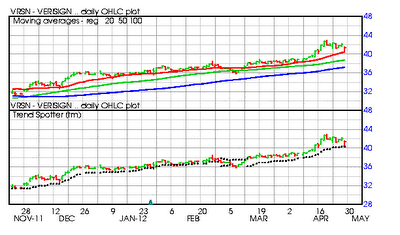

Verisign (VRSN)

Barchart technical indicators:

- 48% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 7.88% in the last month

- Relative Strength Index 59.42%

- Barchart computes a technical support level at 41.20

- Recently traded at 41.32 with a 50 day moving average of 38.74

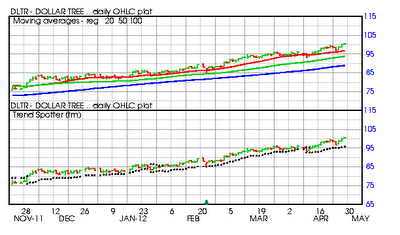

Dollar Tree (DLTR)

Barchart technical indicators:

- 100% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving average

- 11 new highs and up 5.33% in the last month

- Relative Strength Index 67.37%

- Barchart computes a technical support level at 97.56

- Recently traded at 100.73 with a 50 day moving average of 93.80

The stocks mentioned above may be held in either personal or family member accounts and/or mutual funds and separately managed accounts at Marketocracy Capital Management from whom I receive compensation as a financial analyst