This morning I used Barchart to screen a list of stock analysts think have the best chance of continuing to rise in the next year to find the 3 with the best technical indicators and found Select MedicalHoldings (SEM), Canadian National Railway (CNI) and CF Industries(CF)

Select Medical Holdings (SEM)

Barchart technical indicators:

- 100% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 9 new highs and up 41.60% in the last month

- Relative Strength Index 83.44%

- Barchart computes a technical support level at 11.65

- Recently traded at 14.77 with a 50 day moving average of 10.43

Canadian National Railway (CNI)

Barchart technical indicators:

- 100% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 6.66% in the last month

- Relative strength Index 67.43%

- Barchart computes a technical support level at 88.31

- Recently traded at 90.24 with a 50 day moving average of 84..48

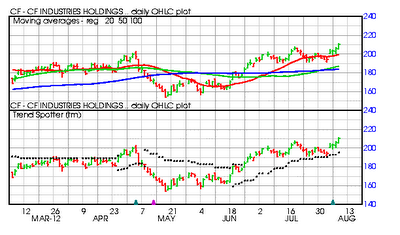

CF Industries (CF)

Barchart technical indicators:

- 100% Barchart technical buy signal

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 5 new highs and up 6.65% in the last month

- Relative Strength Index 66.72%

- Barchart computes a technical support level at 196.88

- Recently traded at 208.57 with a 50 day moving average of 187.12

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in SEM, CNI, CF over the next 72 hours.