Although the S&P 500 has hit another all time high today (February 13 2015), the financial landscape and collective psyche of equity market investors will be much different at the end of the year.

As a preamble, Central banks have realized that general market psyche can be controlled by asset price management and underlying fundamentals may take a back seat for long periods of time. Especially in the United States, the Federal Reserve has witnessed the positive response system that takes place when it steps in to prop up markets. Over the last year and a half when the numerous small S&P 500 equity market corrections have occurred, they happened due to worries regarding economic fundamentals. However, these very real economic fundamentals which are worsening at the margin, are swept under the rug of asset price appreciation as institutional traders and algorithms follow through with buying support under the premise of the backings of omnipotent central banks. After all, most market participants are amoral and simply want to make money, and for that reason they follow the path of least resistance. An investors job is to "understand the world we live in a and turn that into capital gains". Principals and reasons for gains do not come into the mental equation.

Presently global economic growth and corporate profits are stagnating. Furthermore, the fire power of some of the most influential central banks is waning due to diminishing amount of assets which they can purchase and ballooning balance sheets. Moreover, market participants are coming around to the fact that central banks implementing liquidity solutions for structural problems have not helped economic growth achieve "escape velocity" in target countries. It is at this juncture that market participants are close to realizing that the PE multiples of the S&P 500 companies are unsustainable. The market is close to a point of narrative change.

It is the diminished flow (not stock) of financial market liquidity that has led to the resurgence of global deflationary forces over the past year and half. Central banks in the U.S., China, and Japan are collectively running into challenges increasing stimulus. Furthermore, rate cuts initiated by other global central banks are having difficulty moving the needle as their nations are already heavily indebted and rates have been low for so long. Adding fuel to the fire has been the large correction in the price of oil which will decrease the flow of petrol dollars being recycled back into financial system from surplus nations. Tightening financial flows set the stage for a triggered market correction. These could be any of the following:

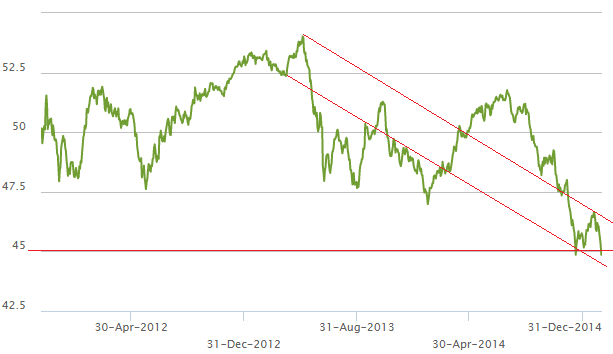

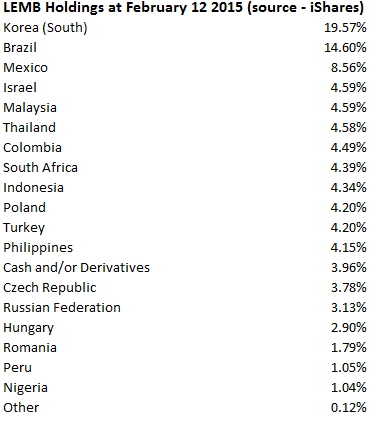

1) Diminished flow of U.S. dollars to emerging market countries because of lower U.S. trade deficit, higher $USD exchange rate, and deflated commodity prices trigger the next leg of an emerging market debt sell off. Very likely to be reignited by one of the Latin American countries like Brazil which are struggling with exploding indebtedness without an amelioration of the tightening financial conditions in site. Some important ETFs to monitor for emerging market debt distress including the LEMB (iShares Emerging Markets Local Currency Bond ETF) which is trading near all time lows and has been in correction since the infamous Fed Taper announcement in May 2013:

As this is an ETF which holds bonds denominated in local currencies, a continued fall below $45 per unit for LEMB signifies stress in in emerging market currencies and credit spreads.

2) The follow through from low oil prices begins to show through more greatly in the U.S., Canadian, and other global economies with a lag in Q2 2015. Market does not appreciate the knock on effects of the drop in one of the most important commodities for financial flows and collateral until the effects are directly in front of them. One early way to monitor whether the market is waking up to risks of lower oil prices will be in the price of oil stocks. The U.S. oil sector is now trading at its highest PE multiple since the tech bubble and this is largely because investors have bid up the stocks in anticipation of oil prices rising into the end of 2015. A correction in oil sector stocks would signify capitulation among investors that oil prices will remain lower for longer. This would be due to market participants admitting weak global demand will not buoy prices into the end of 2015 and supply is too high. An ETF to watch here is XLE - Energy Select SPDR ETF - the most actively traded U.S. energy sector ETF on the NYSE. Its lowest closing price during the energy market correction was $72.86 on January 15 2015. A future ETF price close around or below this level would signify a further breakdown in investor outlooks. XLE price chart over the last 6 months (source: Yahoo Finance):

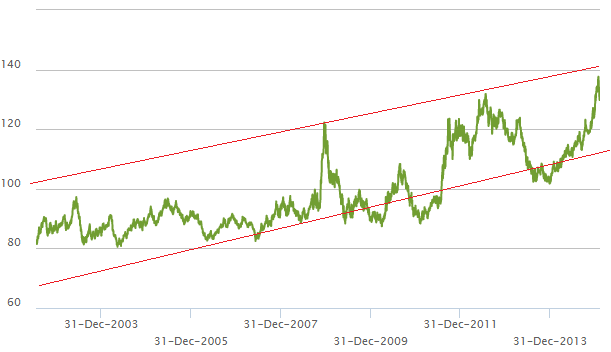

3) Market participants who played along with central banks jump ship and bite the hand that feeds. Narrative broadly changes to one where central banks can no longer be effective at improving economic conditions. Central Banks, Wall Street's one time partner in crime, are rejected as they are of diminished help for realizing capital gains. This corresponds with exploding yield spreads in the Eurozone as this is an area where confidence in central banks have been the most important in stabilizing financial conditions. Financial contagion comes back strongly in the Eurozone and makes its way to American financial institutions. A continued rise in U.S. treasury prices would result from the capital flight created by Eurozone contagion. Also, bond yields will react to the markets sentiment regarding central bank ability to create inflation. The higher U.S. bond prices go, the lower the market's confidence in the Federal Reserve's ability to create an inflationary environment. Therefore, TLT - iShares 20 + year treasury bond ETF is a good one to watch for financial markets participants overall sentiment on taking risk. A new all time high for TLTabove $140 per share would signify growing deflationary and low growth expectations among investors:

4) As posted by David Stockman in his article on Contra Corner blog a few weeks ago, S&P 500 EPS improvement since 2008 largely due to backing out "one time" hits to earnings, eking profit margin gains out by underpaying employees, and using share buy backs funded with cheap debt to decrease share float, will prove unsustainable. Profit margins cannot be sustained at these high levels in perpetuity, nor can share buy back programs, which create a large headwind for the U.S. financial markets going forward.

Some combination of all of the above could create financial market contagion prior to the ECB beginning its own round of QE in mid March. From now until mid march is a crucial period for global markets as financial conditions are tightening without flow of new QE from the ECB. Given that the market has broken through technical levels and is close to all time highs, the market could stay aloft for a few more weeks. However, the headwinds stated above have not abated, and the market faces a tough battle to continue advancing this year.

Low risk investment recommendation for the stated conditions:

1) iShares 20 Plus Year Treasury Bond (TLT) - with a sell trigger on the downside if the ETF price breaks below $116 per share. This would be a 10% loss from current prices.