Introduction

RealD Inc. (RLD) is the world leader in 3D and other visual technologies. The company was founded in 2003 by Michael V. Lewis and went public in 2010. Its stock became very popular very quickly but within a couple years its price dropped. RLD data by YCharts

RLD data by YCharts

When RealD technology hit the markets people got extremely excited about not having to watch their 3D movies in red and blue. This created the huge spike in 2010 and 2011, but as time went on peoples' affinity to the new technology began to fade. The lack of interest from viewers and investors is what has lead to a decline over the last 3 years.

Troubling Financials

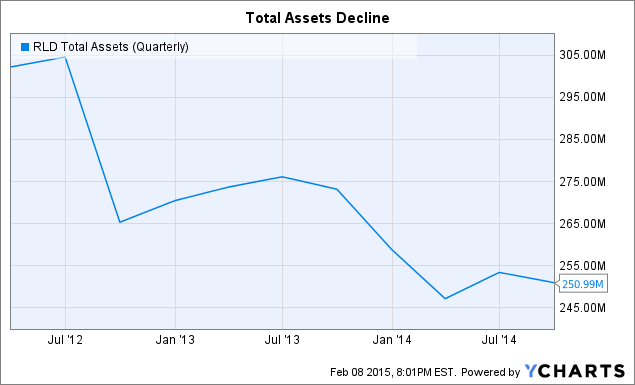

Over the last 3 years RealD has not shown any sign of getting back to its high from 2010 and 2011. In reference to the chart above you can see that instead of reaching new highs RealD always seems to find new lows. This is extremely troubling. Last quarter RealD had an net income of -11.41 million; almost 2 million worse than the previous quarter. This is a terrible trend that helps illustrate RealD's struggles. RealD has also seen a massive drop in their total assets since 2012. This is also a terrible trend which just further proves that RealD is on the decline. RLD Total Assets (Quarterly) data by YCharts

RLD Total Assets (Quarterly) data by YCharts

As bad as these financials are the worst thing about RealD has been their massive price drop since 2011. In 2011 RealD saw and incredible high of $34.02 per share. Since then it has all been downhill with the exception of a few minor blips due to popular movies that hit the theaters.

2015 Expected Ups and Downs

In 2015 RealD is set for quite the lineup. RealD has already seen some major ups and downs this year. The new Spongebob Squarepants movie Sponge Out of Water has already done better than expected. While this is a good thing RealD has also seen some major flops including Jupiter Ascending and Seventh Son which got an abysmal 10% on rotten tomatoes. These extreme lows counter the successes that RealD rarely sees. I can really only see a couple high points for RealD this year in The Hunger Games: Mockingjay Part 2 and The Avengers: Age of Ultron. These two films might help RealD see some small spikes, but sure busts similar to Jupiter Ascending and Seventh Son are bound to plague RealD in 2015.

Conclusion

Simply put 3D just isn't cool anymore. People often choose to view movies in 2D if given the option, and the shock value 3D once gave us is now expected. 3D is on the decline and there is little RealD can do about. If RealD wants to see spikes like it did after Avatar came out they are going to have to do something groundbreaking again. Given their recent history this seems unlikely. Think about it, when was the last time you saw a 3D movie that left you breathless?