Summary

- NOV has taken a beating since the oil market turned sour in the fall of 2014 due to softening demand paired with oversupply which has resulted in decreased capital expenditures. The pullback makes NOV an attractive cyclical value play, as it is down 54% over the TTM.

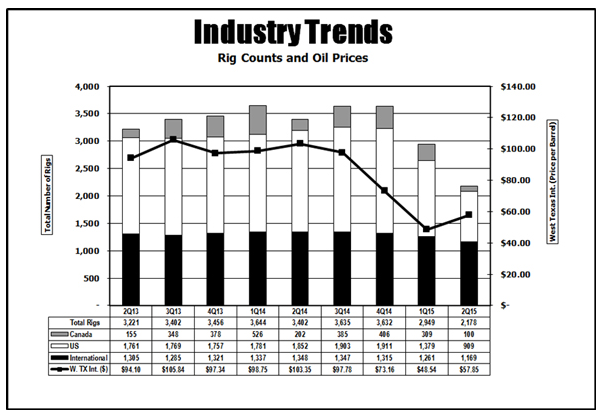

- Global rig count is down 40% over the last 12 months - although this will hurt NOV in the short term, rigs that are neglected and retired today will need to be refurbished and repaired tomorrow, which will allow NOV's highest margin businesses to prosper.

- An extremely diversified product portfolio paired with a global presence has earned NOV the nickname of "No Other Vendor" - exemplifying its foothold in an industry that will need NOV's products and services for years to come.

- NOV has put its money where its mouth is, returning value to shareholders by initiating a strategically timed $3B share buyback program in September 2014. The company has bought back over 45M shares the whole way down from $84.63 to current sub $40 levels. With share count reduced by 12.85%, every future dollar earned will generate 14.75% more value for shareholders.

- An expanded $4.5B revolving line of credit supplemented by $2.5B of cash on the balance sheet will give NOV the firepower it needs to take advantage of the downturn through low cost acquisitions, allowing it to emerge from the downturn stronger than ever.

State of the Industry (Macro Case)

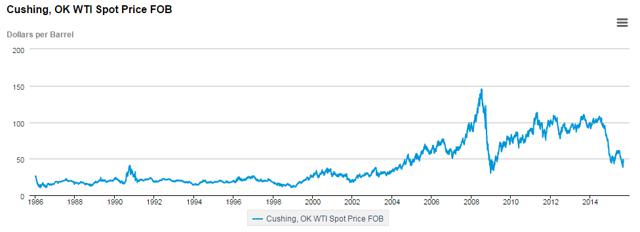

At this point it is no mystery that plummeting oil prices have reached just about every corner of the oil and gas world - upstream E&P, downstream refineries, and even OPEC are feeling the effects of the supply glut and softening demand. As of Tuesday September 8, 2015 the WTI spot price at Cushing is $45.92, down 57.46% since the June 2014 highs of $107.952 per barrel, and 51.94% off of the 52 week high of $95.55. The last time oil traded at these levels was in April 2009 when a barrel was priced at $48.82 after bottoming out at $33.17 a barrel in the midst of the Great Recession - in 2009, the collapse of the housing market decimated the entire global economy, so mid $30 lows in WTI crudeshould not be considered organic, as they weren't driven by supply and demand, but greater economic forces. Prior to the run-up in in 2007 and 2008 and the crash of 2008 and 2009, the last time WTI crude traded at today's prices was in January 2005 when a barrel was selling for $45.66.

Faltering prices have forced many E&P companies to slash their capital expenditure budgets to a fraction of what they were a year ago. Total capex spending has fallen in line with WTI prices, dragging the entire oilfield services and manufacturing industry down with it as global rig count has decreased 40% over the last 12 months from 3,635 in 3Q14 to 2,178 in 2Q154. Despite the carnage, OPEC shows no sign of pumping the brakes on their production, but with the next OPEC meeting taking place on December 4, 2015, the world anxiously awaits the Cartel's decision to continue producing at current, or even increasing rates, or to reduce supply in an effort to stabilize volatile oil prices.

5

5

The industry-wide downturn that has occurred over the last 12 months has undoubtedly created opportunities for investors with longer time horizons - no one can predict when oil prices will rebound, but historically, supply and demand eventually realign, at which point oil always seems rally to new highs. Typically, when there is "blood in the streets", as there is now with WTI crude cut in half over the last year, the market becomes irrational, short term investors become fearful, and entry points are exposed for investors who aren't worried about what the market is going to look like next week, but what it will look like several years from now. There is one particular company in the oilfield services space that - if purchased during this cyclical downturn - will reward patient investors for years to come. That company is National Oilwell Varco.

National Oilwell Varco Overview

National Oilwell Varco (NOV) is in the business of designing and manufacturing the equipment and components used in oil and gas drilling, completion and production operations. The company also provides oilfield services to the upstream oil and gas industry. NOV is segmented into three distinct business units; Rig Systems, Wellbore Technologies, and Completion and Production solutions. An outline of these systems can be seen below:

National Oilwell Varco is primarily in the manufacturing business. The company manufacture both onshore and offshore rig systems, as well as the aftermarket parts that are used to service the installed rigs. The company also provides operational assistance for all aspects of production, from site prep to cleanup, through their Wellbore Technologies segment. The Completion and Production segment provides the technologies necessary to extract oil and gas from once the rig is in place. Through these three businesses, NOV has established themselves as a one stop shop for oil and gas production.

The Bull Case for NOV

Downturns Hurt

There is no arguing that near term business prospects are bad - very bad. But with NOV cut in half over the last year on global energy fears, the stock looks like a bargain compared to some of its peers. Before making the bull case for NOV at sub-$40 prices, investors need to have an idea of what they are getting themselves into over the months, and possibly years, to come.

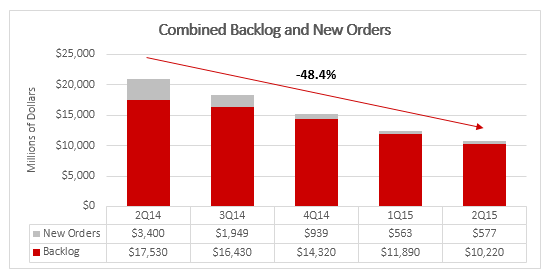

New orders have fallen off a cliff, down 83% from $3.4B to $577M since 2Q14 as capex budgets have dried up and vanished. Backlog is down from $17.5B in 2Q14 to $10.2B in 2Q15 - a drop of 41.7%. Combined, new orders and backlogs are down 48.4% over the year.

NOV has been eating away at its massive backlog since prices began to plummet, generating about $2.33B of revenue each quarter from the backlog alone while replacing less and less of it with new orders each quarter. The backlog is driven by the lead time associated with delivering rig systems and completion/production solutions to clients, and represents confirmed orders that typically take more than three months to manufacture and deliver.

However, at the current backlog depletion rate of $2.33B/quarter, NOV could maintain the output of its Rig Systems and Completion and Production Solutions segments for the next 4.38 quarters without drumming up any new business.

Decreasing oil prices tend put pressure on E&P companies, but the oilfield manufacturers and service companies are especially vulnerable to spending cuts. NOV management believes:

"Longer-term, in a low oil price environment, contractors become more hesitant to invest in older rigs which are far less productive and competitive. As a result, the industry expects to see a large number of rigs retired during this cyclical downturn, which could result in a newbuild order recovery when commodity prices recover and drilling activity responds. We expect sales of parts, repair work and service to decline year-over-year in the Rig Aftermarket segment as our customers defer expenditures in favor of cannibalizing idle rigs"6

If there is a silver lining to be found in the downturn, this is it: neglecting and retiring today's rig fleets will result in greater spending later on.

NOV will undoubtedly take a major hit to revenue and earnings in the short term as E&P companies learn to act more frugally by refurbishing certain rigs, retiring others and delaying the big ticket purchases of new rigs. But each rig that is neglected or retired today will eventually need to be replaced as commodity prices rebound and drilling for oil becomes lucrative once again. Companies will need oil to sell to take advantage of higher prices, and that oil will be extracted from the ground using brand new NOV rigs and parts.

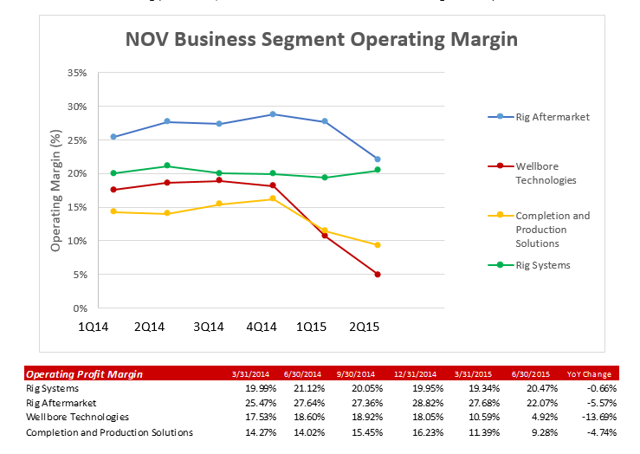

Rig systems have historically been NOV's main source of revenue, resulting in $9.85B in sales which made up 46% of the business in 2014. The Rig systems segment consistently maintains operating margins over 20%, second only to the 25-30% margins of the Rig Aftermarket business. Although Rig System operating profits have remained flat over the last 12 months, hovering around the usual 20% due to the lead time associated with new rig purchases, all other business lines have faltered significantly.

Once prices rebound, a shortage of rigs will force customers to purchase new systems if they want to drill, and NOV will be handsomely rewarded when that time comes.

NOV is Undervalued Relative to Its Competitors

I have often seen NOV compared primarily to Halliburton, Baker Hughes and Schlumberger, but these associations are not entirely accurate - NOV only competes with those companies in their Wellbore Technologies business, not the other two manufacturing segments. Cameron (recently purchased by Schlumgerger) and Weatherford, however, are two of the biggest competitors in the manufacturing space.

NOV's expansive business model is perfectly exemplified through its relationship with Schlumberger. Although Schlumberger is one of NOV's biggest competitors in the Wellbore Technologies business, it is also a customer of the products that NOV manufactures. This relationship highlights the staying power and necessity of NOV's business. And even though Schlumberger recently purchased Cameron, it will still need to rely on NOV for a significant number of products.

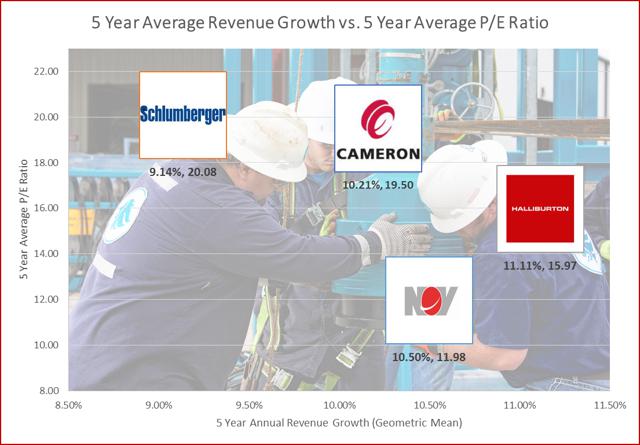

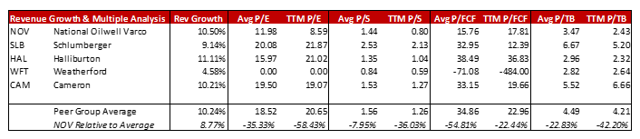

When compared to Cameron, Weatherford, Schlumberger and Haliburtion, NOV's P/E multiple traded 30% below the peer group from 2010 to 2014, on average. NOV's 5 year average P/E is 12.65 vs. 18.09 for the peer group7. This discount is rather shocking considering that NOV's revenue has grown at a faster rate than all but one company in the peer group - Halliburton8. The chart below shows this very comparison, and indicates that NOV has been historically undervalued compared to its peers when considering revenue growth and earnings multiples.

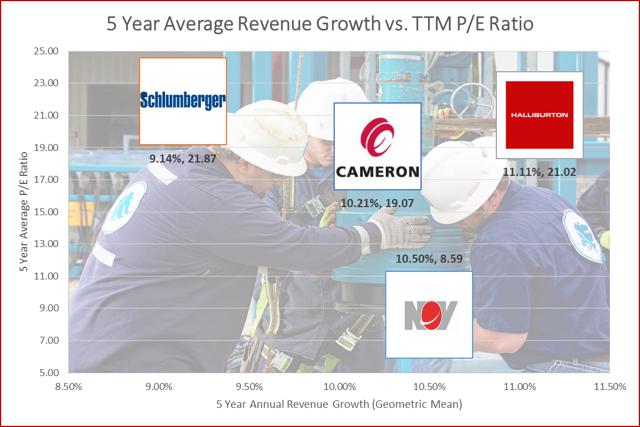

Over the last 12 months, NOV has been punished more severely than its peers, and its P/E multiple now trades 58% below the peer group average, indicating NOV is considerably undervalued.

NOV's current earnings multiple is 28% lower than it has been for the past 5 years, while its peer group is trading in line with historical ratios.

It should be noted that for every metric above, excluding P/FCF, NOV is currently trading at a cheaper multiple than it has for the last 5 years when compared to its peers, and compared to its own historical valuation. However, NOV's 10.5% revenue growth over the last 5 years is 8.77% more than the peer group grew. It would be expected that NOV should trade in line, or even at a premium, to its competitors, but the market currently says otherwise. This ratio disconnect gives long term investors yet another reason to feel comfortable buying in to NOV at these levels.

With NOV trading at such steep discounts to the peer group, many analysts and investors clearly expect depressed revenue, earnings, and cash flow well into the future. Whether the discounted share price is warranted or not, the oilfield services space presents opportunities for the patient investor who believes that oil prices will rebound and E&P capex spending will increase within their time horizon. NOV is currently one of the best value plays in the peer group.

No Other Vendor

The oilfield industry is hurting - there is no hiding that - and NOV is no exception. Revenue is down 25.6% compared to the same quarter a year ago, and down 18.9% between the first and second quarter of 2015. But despite the reduction in E&P capex that has hurt NOV over the last 12 months, there is still plenty to love about the business model.

What I like most about NOV is that they are primarily a manufacturing company. NOV designs, manufactures and sells proprietary products which differentiates the company from the Schlumbergers and Halliburtons of the world, who primarily provide oilfield services. Ironically, Schlumberger is one of NOV's biggest clients, but SLB is also a competitor.

Despite the high barriers to entry, there is a good amount of competition in the industry which will only increase with the looming Schlumberger/Cameron and Haliburton/Baker Hughes mergers. Regardless of industry consolidation, NOV still has an incredibly diversified product portfolio that will continue to be needed throughout the entire oil production process; from rig construction to site cleanup.

NOV's primary competitive advantage is its expansive product line, which is complimented by a global footprint - customers can buy nearly anything they would ever need from one supplier, and they can get it delivered to their sites all over the world quickly. This is a convenience and a service that only a global player can provide, and has earned NOV the nickname "No Other Vendor".

NOV's success is also a product of its own technological improvements in drilling and extraction - cutting edge equipment unlocks formations that were previously unproduceable, increasing oilfield activity and driving demand for new products. When NOV creates value for customers by allowing them to extract oil from new locations, they are rewarded for it.

Perfectly Timed Share Buybacks

When NOV initiated its $3B share buyback program there were 431 million shares outstanding. Over the last 12 months the Company repurchased 44.7 million shares through the end of the second quarter, or 10.4 percent of its shares outstanding, at an average price of $57.12 per share.

It seems as though NOV timed this buyback perfectly, repurchasing shares the entire time their stock price was falling, which has allowed them to repurchase a larger quantity of shares and get the most bang for their buck.

Considering the average closing stock price since July 1, 2015 has been $41.73, and there is approximately $447M of the $3B remaining, NOV will repurchase an estimated 10.7M shares in the third quarter of 2015. This will result in an approximate total of 375.6M shares outstanding, resulting in a total reduction of 12.85%.

Putting this into perspective, the $22.869B in revenue that NOV generated in FY14 was worth $49.74 per share. After the buyback, that same $22.869B would be worth $57.08 - and increase of 14.75%. Now, to be fair, NOV has only generated $20.025B in revenue over the last 12 months. But when CapEx budgets increase and oilfield spending resumes, each additional dollar earned will be worth nearly 15% more for investors.

Seasoned CEO, Clay Williams, Knows How to Navigate a Downturn

Williams grew up in Texas and has spent most of his life in the oil and gas field - and entered the industry at one of the worst times possible - about 6 months before the price collapse of 1986. He went to work for Shell, eventually returned to school to get an MBA, joined private equity firm SCF Partners, and ended up joining one of the firm's portfolio companies which ultimately merged into what is now National Oilwell Varco.

Regarding the current oil downturn, Williams had this to say:

"This one may last a little longer than the previous couple. In 2009, we didn't really stay down for too long, and the industry came back relatively quickly. In 2002, there was a slower ramp-up. And in 1998, it was a slower bleed-down. They're all different, I guess, but they're all painful. I think the good news is we don't believe the over-supply of oil today is nearly of the order of magnitude of the oversupply that we had in the 1980s. We probably have a few million barrels a day of excess capacity today versus a demand level of about 93 million barrels per day. You go back to the 1980s, and the Saudis were keeping six or seven million barrels a day off the market through OPEC quotas. Worldwide, there was probably an 11 or 12 million barrel overhang against a demand level of 60 million barrels. So it's a completely different set of numbers. Recovery is out there. It's just taking a little longer than we had hoped or expected." 9

NOV also expanded their revolving credit facility to $4.5B, which is supplemented by $2.5B in cash, resulting in a "strong balance sheet with lots of firepower".10 Williams plans to make additional acquisitions while the market is beaten down, and invest in his company's products and technologies. While E&P companies are struggling to make interest payments on their debt, Williams has positioned NOV to be an opportunistic buyer rather than a desperate seller. Ultimately, Williams believes "the level of activity today is not sustainable to fuel a world that's going to demand more oil", and it's tough not to agree with him.

For Every Bust, There is a Boom

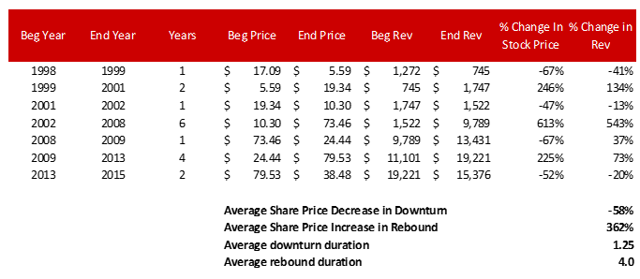

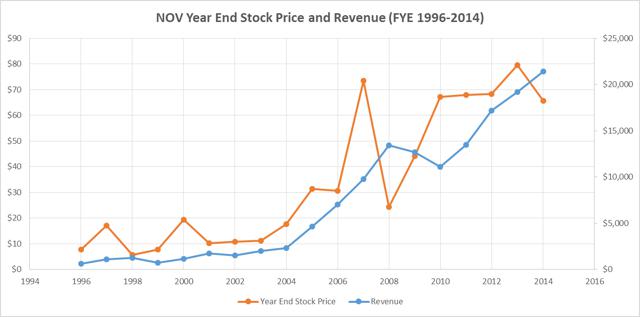

Historically, the share price and revenue numbers also prove that for every bust, there is, in fact, a boom. NOV has been publically traded since 1996, providing 20 years of historical data for analysis. There have been 3 cycles over the duration of NOV's tenure, 1998, 2001, and 2008, and the company is currently in its 4th. The average historical share price decrease in a downturn is (58%), with the smallest being (47%) in 2008 and largest being (67%) in 1998 and 2008. The average rebound is 362%, with the smallest being 225% from 2009 to 2013 and the largest being 613% from 2002 to 2008. The average length of a downturn is only 1.25 years while the average duration of a rebound is 4 years.

History does not necessarily repeat itself, and there is no reason to believe that this downturn won't be the worst yet, but analyzing the prior 3 allows us to understand how NOV's business is affected by macroeconomic factors. Below is a chart of the aforementioned cycles - all price data is from the year end, and all revenue data is from NOV's full fiscal year:

If NOV's share price trades down 67% off the high, like it did in 1998 and 2008, the share price during this cycle will bottom out around $26 a share, slightly above where it bottomed in 2009. If the stock is reduced by the average, (58%), it leaves the price about $5 below where it is today - around $33.50 a share.

If the rebound follows the trend of NOV's previous rebounds, and the price does bottom out around $26, shares would trade around $94 prior to the next downturn. This is about 15% above where the stock was trading a year ago (September 2014) at its peak.

If the stock only drops 58% off of its September 2014 highs, which is the average price decrease during a downturn, and the stock rallies 362% as it has over the last 3 rebounds, NOV will be trading around $120 per share before the next downturn.

These two scenarios give an investor at today's prices tremendous upside if they are willing to remain patient during the turbulent decline.

Final Thoughts

NOV is an incredibly diversified global manufacturing company, with plants and facilities all over the world. The industry in which the company operates in is cyclical by nature, just as it has been for the last 30 years since the EIA began recording WTI crude data. For every boom, there is a bust, and NOV has been around for a whole lot of them. National Oilwel Varco's two main predecessors, Oilwell Supply and National Supply, were founded in 1862 and 1893, respectively so the company has had plenty of experience surviving downturns. NOV's rig business, which made up 46% of the company in 2014, earns healthy operating margins north of 20%. The company has a veteran CEO with 30 years of experience in Clay Williams who understands how to be greedy when others are fearful. With $4.5B of revolving credit and $2.5B in cash, Williams has already purchased 45M shares and will have purchased approximately 55M when the program ends.

Investing in an uncertain market can be tough - but right now the market is selling a great company for a great price. Historically, investors who have invested in NOV during a downturn have been handsomely rewarded. Regardless of where oil trades for the next week, month, year and decade, NOV will be there every step of the way, generating returns for shareholders.

2 eia.gov, Cushing, OK WTI Spot Price FOB (Dollars per Barrel)

3 www.eia.gov, U.S Energy Information Administration, Cushing OK WTI Spot Price FOB

4 Baker Hughes, International Rig Count

5 Baker Hughes, International Rig Count

6 National Oilwell Varco, 2014 10-K

7 The peer group is defined as Cameron (CAM), Weatherford (WFT), Schlumberger (SLB) and Halliburton (HAL). WFT was not included in the P/E analysis due to negative earnings in 4 of the 5 years.

8 Revenue growth was determined using the 5 year geometric mean.

9 www.rigzone.com, NOV's Williams: Energy Industry Will Barrel On

10 www.rigzone.com, NOV's Williams: Energy Industry Will Barrel On

11 Price data is from Google Finance, all prices are from calendar year end

12 Revenue data from SEC.gov, Edgar, all revenues are full year

Connor Donovan September 10, 2015