EUR/USD

The Asian session was a period of consolidation for the European majors & the equities rose at the back of oil gain which surged to new year highs. Both Asian and the European markets are strong for the day. EUR/USD was considered as the funding currency for the year collectively with Gold and Jap's Yen, this common currency is now under pressure and is trading in a 80 pip range from 1.1208 and 1.1120 for the day, while it remains under the magnitude of yesterday's close.

Germany's data was positive and according to the IFO survey the sentiment side of the business was better than expected for the month of May. We have few readings scheduled in the US session and if these data points are positive then the EUR/USD may break below the 1.1100 area.

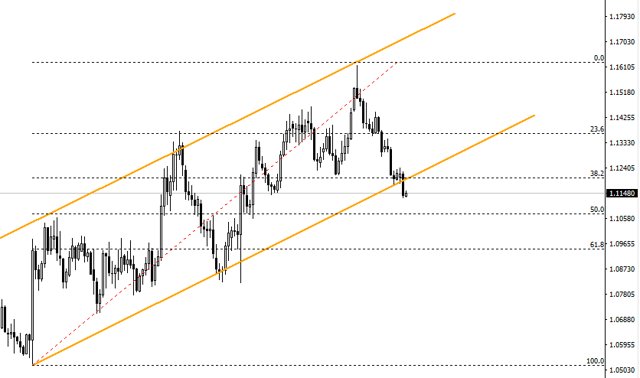

4 hour indicators continue to point south while the 20 SMA remains as a strong barrier for recovery. There is a strong support at 1.11205 and a break below this level will quickly push the pair near 1.1100 level.

On the daily chart the price has broken below the ascending channel and is heading towards 1.1069.

XAU/USD

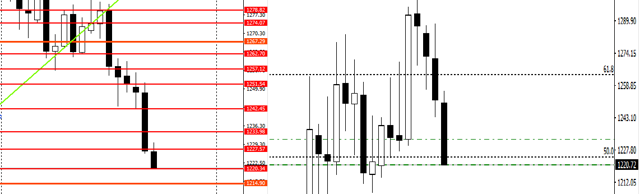

Gold is knocking off all supports and is largely bearish across charts. We have hedged our orders that were triggered at these support zones. One of the major sentiment surrounding the Gold is the US Interest rate decision. The next support is at 1214 followed by 1207 and 1197/1. The weekly candle poses a strong bearish slide and could close the week at 1214 level.

We will continue to hold our hedge till 1197/1 before removing the sell entry for a retracement.

For more daily Forex signals, visit NoaFX Knowledge Center.