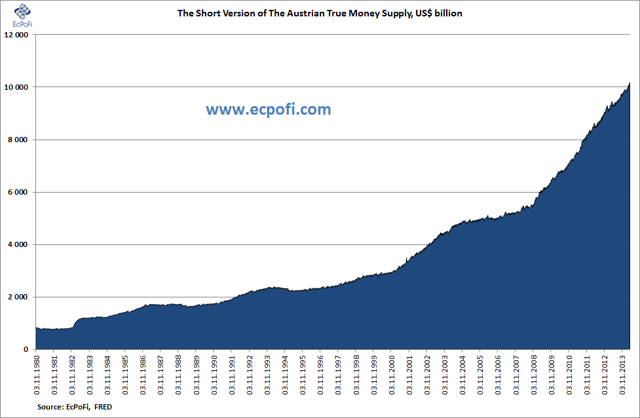

The short version of the Austrian True Money Supply (SVTMS) for the U.S. increased by 0.29% (16.11% annualised) during the most recent week ending 14 April 2014 to reach $10.1784 trillion calculated from the latest data published by the Federal Reserve.

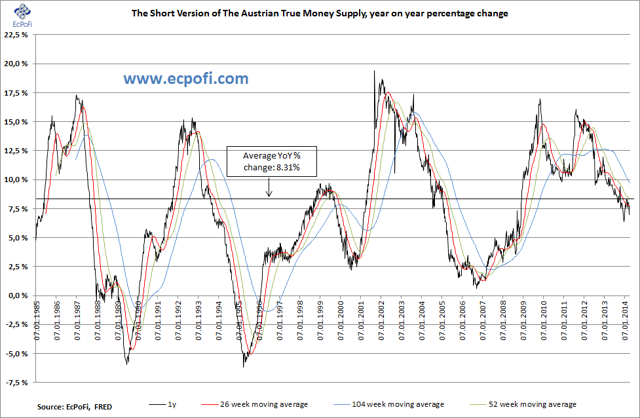

As has been customary for more than 30 years, the money supply keep on expanding steadily and surely hitting new all-time highs on a regular basis. Since 1980, the money supply has only shrunk four times on an annual basis: 1981, 1989, 1994 and 1995 (here's a detailed overview). The relevant question is hence by how much it expands. This is one reason why the focus in this report is on percentage changes in the money supply instead of the absolute level. The other reason is that changes in the growth rate in the money supply is a crucial factor for the

Austrian Business Cycle Theory (ABCT).Compared to last week, the 1-year growth rate in the money supply was unchanged this week coming in at 7.74%. This remains lower than the long term average of 8.31% since 1985 and is also lower than the most recent 52-week moving average year on year growth rate of 8.30%.

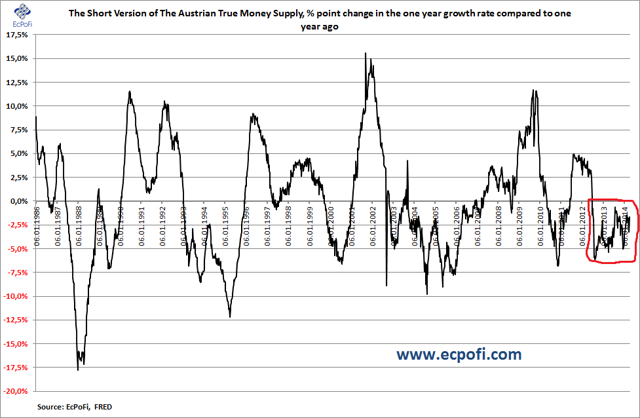

This growth rate was 1.88 percentage point lower than the same week last year and represented the 94th week in a row that the 1-year growth rate was lower compared to previous year.

The 5-year annualised growth rate in the money supply has increased slightly during the last couple of weeks and currently stand on 10.97%. This was 60 basis points lower than at the same stage last year and was the 20th week in a row it posted a declining growth rate. Both the 1-year and the 5-year growth rates hence continue to decline.

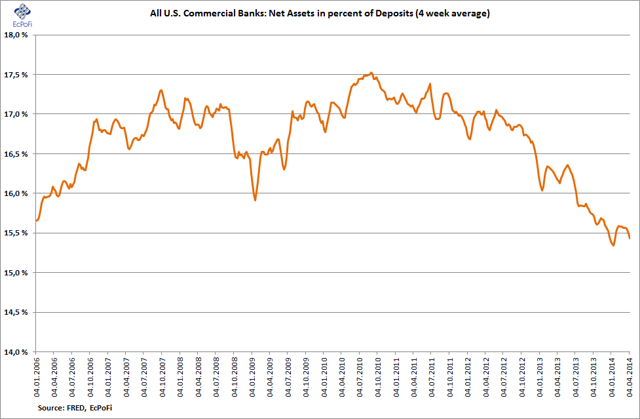

Though many factors are at work and the fact that it is impossible to make timely predictions, a declining money supply growth rate is nevertheless incompatible with the U.S. stock market bubble. With the Fed tapering and U.S. bank balance sheets no more solid than just before Lehman Brothers collapsed, the stock market in my opinion has perhaps not discounted the unlikely scenario of rapid money supply growth going forward and certainly not a further fall in the growth rate. Yes, the banks are much more liquid now than some five and a half years ago. This is however a trivial matter in the big scheme of things for two reasons: 1) whether banks hold cash balances or treasuries does not really make a difference as the latter can rapidly be turned into cash at crunch times as the Fed buys them and 2) banks are by definition illiquid anyway as not only do they lend long and finance short, but also as they always create a large portion of unbacked deposits (a liability) - the act of "creating money out of thin air". Combined these two factors lead to a maturity mismatch on bank balance sheets. Modern banks can therefore never be liquid (to meet all liabilities in full and on time) and must be content with having solvency (assets are sufficient to satisfy all creditors in a liquidation) as their goal. Effectively, depositors confidence in banks is what allow the banks to run as going concerns.

As economist Ludwig von Mises once said about confidence in banks: "...either it is shared by everybody or it does not exist at all". If they don't, the house of cards will crumble and the Fed will come to the aid once again creating yet bigger problems further down the line. But it will arrive late as usual and not in time to counter the confidence long gone.

Visit the short version of the Austrian True Money Supply archive here (published weekly).

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.