HCI Group (HCI) has already been written about extensively here on Seeking Alpha. I'm not going to repeat all the gory details however the synopsis is:

- HCI is just one big catastrophe away from going BK:

seekingalpha.com/article/4003630-hurrica...

- It's insider dealings make a mockery of the term re-insurance:

seekingalpha.com/article/3989214-hcis-ca...

- It primarily owns takeout policies most reputable insurance companies won't touch:

seekingalpha.com/pro/checkout/3948256?no...

-And even this core takeout business is eroding:

seekingalpha.com/article/3956383-hci-gro...

This company is just one big Florida hurricane away from bankruptcy and Matthew could be that hurricane. Here is Accuweather's current best guess estimate of Matthew impacts:

Notice how much of the eastern Florida seaboard is in the High impact zone. This is an area HCI has written or taken-out a lot of wind and hurricane policies in. The liability inherent in the policies and their lack of adequate third party re-insurance is by far the main risk; however, it is not the only risk. HCI tends to "re-insure" via another division, Claddaugh, which is part of the same HCI group. It also tends to invest in real estate in the very locations, Florida, that it insures. So a big hurricane not only delivers a big punch to their Homeowners Choice Insurance division (primarily uneconomic take-out policies), but also potentially delivers a second punch to their Claddaugh re-insurance division (criminal that they can even call it re-insurance when in fact they are buying from another division of the same company), and a third punch to their investments in Florida real estate.

As just one example, that Sorrento shopping center investment they just touted less than a month ago (finance.yahoo.com/news/hci-group-real-es...), yeah that's just north of Orlando approximately 50 miles inland, at 69' elevation, and surrounded by a number of natural lakes. That puts it somewhere right around the border between the area labeled high impact and moderate impact on the map above.

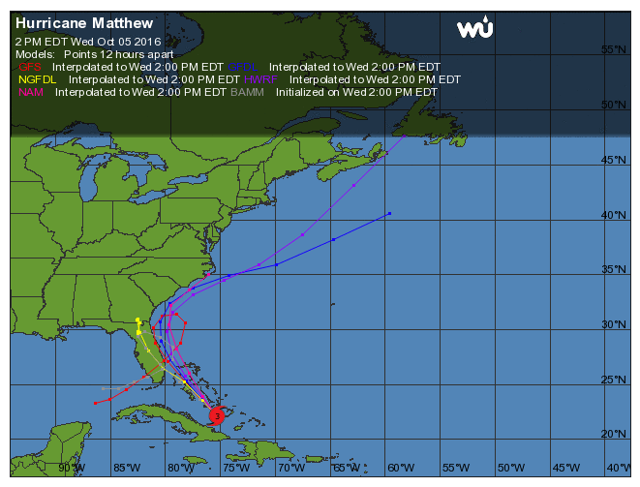

Now understand while slowly meandering along just off the eastern Florida seaboard is currently Accuweather's most likely path depicted above, they put the chances of it hitting landfall in Florida as high as 30%. If instead of skipping along 50 miles off the eastern coast of Florida, the hurricanes eye ends up moving up the middle of the state 50+ miles inland, as the yellow NGFDL track below shows, the impact to Florida is unfortunately going to be devastating.

The red GFS track above is also potentially devastating as this monster not only skips right along the coast making landfall numerous times, but actually swings around again hitting the area just north of West Palm Beach near Lake Okeechobee a second time.

So I'm handicapping HCI's chances of being knocked out (going BK) from the devastating one, two, three punch of Hurricane Matthew currently at about 20 - 30%. We will know more each day as the hurricane gets closer to the Florida coast, the models get updated, and the potential track get more defined.

What is truly a shame is the Homeowners insurance policies Florida residents think are protecting them may in fact not offer quite the level of protection they thought.